CMS Issues Final Rule on Medical Loss Ratio for Medicare Advantage and Part D

On May 23, 2013, CMS issued its Final Rule on Medical Loss Ratio (MLR) requirements for Medicare Advantage (MA) and Medicare Part D programs.1 MLR calculates the percentage of revenue used by MA organizations and Part D sponsors for patient care, rather than for other items such as administrative and marketing costs or profit. The higher the MLR, the more the MA organization or Part D sponsor is spending on prescription drugs, clinical services and other quality improving activities as opposed to other expenses. Under the Patient Protection and Affordable Care Act, both MA organizations and Part D sponsors must maintain an MLR of at least 85 percent for the contract year or be subject to penalties, including remittance of payments to CMS, enrollment sanctions and contract termination.

How does MLR apply to Medicare Advantage?

MLR minimum requirements apply to both Medicare Advantage plans and Medicare Advantage Prescription Drug (MA-PD) plans. MA organizations report one combined MLR for MA only and MA-PD contracts.

How does MLR apply to Medicare Part D?

MLR requirements apply to all Part D plans, including the Medicare-funded portion of Employer Group Waiver Plans (EGWP) and the Part D portion of benefits offered by Cost Health Maintenance Organizations or Competitive Medical Plans (Cost HMO/CMP), as well as Health Care Prepayment Plans (HCPP) offered by employers or unions. MLR does not apply to the Part D segment of Program of All-Inclusive Care for the Elderly (PACE) plans. MLR must be calculated and reported at the contract level.

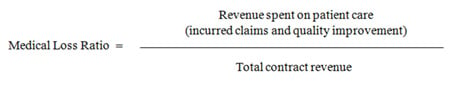

How is MLR calculated?

MLR takes expenses for incurred claims and quality improvement and divides that amount by the total revenue for the plan under the plan contract.

For MA incurred claims, only direct claims that the MA organization pays to providers for covered services provided to beneficiaries are included. For MA-PD and Part D incurred claims, MLR includes only drug costs that are "actually paid" by the MA organization or Part D sponsor, net of direct or indirect remuneration from any source. However, CMS has highlighted several technical distinctions as to what may or may not be included in calculating MLR. For instance, low-income cost-sharing subsidies and brand drug discounts through the Coverage Gap Discount Program are not included in the calculation of a Part D plan's MLR, while low-income premium subsidies and certain bonus and incentive payments are included. In addition, CMS will be issuing future guidance on how to report costs and revenue for the Medicare-funded portions of EGWPs.

What are the penalties for failing to meet the minimum MLR?

MA organizations and Part D sponsors failing to meet the 85 percent minimum MLR requirement in a contract year must remit payment of the difference to CMS. Remittance will be the total revenue under the contract year multiplied by the difference between 85 percent and the contract's actual MLR. If an MA organization or Part D sponsor fails to meet the 85 percent threshold for three consecutive years, the enrollment of new beneficiaries will be prohibited for the subsequent contract year. Any MA organization or Part D sponsor that fails to meet minimum MLR requirements for five consecutive years is subject to contract termination.

We will continue to monitor the impact of CMS's newly issued MLR guidance for Medicare Advantage and Medicare Part D as well as other upcoming regulatory developments concerning MLR requirements.

Notes

1 78 Fed. Reg. 100, 31284 (May 23, 2013).

To ensure compliance with Treasury Regulations (31 CFR Part 10, §10.35), we inform you that any tax advice contained in this correspondence was not intended or written by us to be used, and cannot be used by you or anyone else, for the purpose of avoiding penalties imposed by the Internal Revenue Code.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem. Moreover, the laws of each jurisdiction are different and are constantly changing. If you have specific questions regarding a particular fact situation, we urge you to consult competent legal counsel.