Pay-Versus-Performance Disclosure: A Guide to Compliance in Year 1

Highlights

- The U.S. Securities and Exchange Commission in August 2022 released its long-awaited final rules for pay-versus-performance disclosure as mandated in the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010.

- The new rules require public companies – aside from Emerging Growth Companies, foreign private issues and registered investment companies – to add a new Pay-versus-Performance Table to their compensation disclosure and additional explanatory details regarding the relationship between executive pay, as disclosed in the new table, and company performance.

- Because of the volume and detail of what is required, companies should begin collecting information now to include in the Pay-versus-Performance Table and related disclosure.

The U.S. Securities and Exchange Commission (SEC) in August 2022 released the long-awaited final rules for pay-versus-performance disclosure that was mandated as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010. The new rules require public companies (other than Emerging Growth Companies, foreign private issues and registered investment companies) to add a new Pay-versus-Performance Table to their compensation disclosure and additional explanatory details as to the relationship between executive pay, as disclosed in the new table, and company performance. (See previous Holland & Knight Info Flash, "SEC Adopts Final Pay vs. Performance Disclosure Rules," Aug. 30, 2022.) Companies are required to include this disclosure in proxy and information statements for fiscal years ending on or after Dec. 16, 2022.

Companies should begin collecting information now to include in the new Pay-versus-Performance Table and related disclosure. Many of the data points are not currently calculated by most companies and are not generally used in other compensation disclosure, including an ongoing valuation of outstanding equity awards as of the last day of each fiscal year and company and peer group total shareholder return (TSR) over the disclosure period. This alert summarizes the requirements of the new rules, as well as key issues that should be considered by companies when developing this disclosure.

Pay-Versus-Performance Table

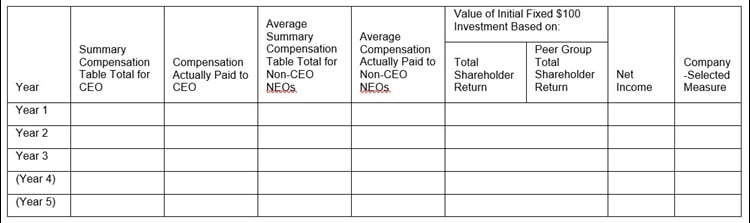

The new rules add Section (v) to Item 402 of Regulation S-K, which sets out the new pay-versus-performance disclosure rules, including the Pay-versus-Performance Table, which must be included in the format illustrated below.

Years Covered

- Eventually, the Pay-versus-Performance Table will be required to include five years of information (three years for smaller reporting companies), but companies are required to include only three years of information in the first year of compliance (two years for smaller reporting companies) and to add one additional year of disclosure during the following two years.

- For newly public companies, the information in the Pay-versus-Performance Table is not required to include information for fiscal years in which the company was not a reporting company.

|

Compensation disclosure in the Summary Compensation Table covers only the prior three fiscal years (two years for smaller reporting companies). The addition of compensation and performance data for additional years will require additional record keeping by the company. In addition, Compensation Committees will need to ensure that they examine pay and performance data over a five-year period when making compensation decisions in order to understanding how those decisions will affect the pay-versus-performance disclosure. |

Compensation Disclosure

Individuals Covered

- If there has been more than one CEO during a reported year, compensation for each of the CEOs must be included for that year – an additional column should be added for the additional CEO.

- The identity of the other named executive officers (NEOs) included is likely to change from year to year, and there may also be years where there is a larger number of NEOs reported as a result of one or more individuals being amongst the three most highly compensated executives, but no longer being employed on the last day of the fiscal year. In such a situation, all of the additional NEOs are included when determining the average total compensation for the non-CEO NEOs. Companies must include the identity of the non-CEO NEOs in a footnote for each year disclosed.

Summary Compensation Table Total

- The amounts disclosed in the "Summary Compensation Table Total" columns for the CEO and other NEOs are simply the totals disclosed in the Summary Compensation Table for each of the years included, without adjustments. For the non-CEO NEOs, this is an average of the Summary Compensation Table total for each year.

|

The payment of retention awards, discretionary performance bonuses, sign-on awards, and severance may skew the totals included in this column, particularly with respect to the average Summary Compensation Table total for the non-CEO NEOs. Companies should consider whether these types of one-time payments should be noted in a footnote to the appropriate data point. |

Compensation Actually Paid

For purposes of the Pay-versus-Performance Table, "Compensation Actually Paid" is equal to the Summary Compensation Table Total for the year:

- MINUS the change in actuarial present value of the individual's accumulated benefit under all defined benefit pension plans

- MINUS the value of equity awards (stock awards or options) granted in the year

- PLUS an amount to represent the value "actually received" as it relates to pension benefits and equity compensation, calculated as set forth below:

- Pension Benefits added back is equal to the aggregate of the service cost, which is the actuarial present value of the CEO or NEO's benefit under all defined benefit pension plans that is attributable to services rendered during the fiscal year, and the prior service cost, which is the additional cost of defined benefit pension plan benefits for prior years that is attributed to a change in benefit formula during the fiscal year. These calculations must use the same methodology used for the issuer's financial statements under GAAP. Companies that maintain defined benefit pension plans in which the CEO or other NEOs participate will need to get actuaries involved to determine these calculations. Smaller reporting companies are not required to add back an amount related to pension benefits.

- Equity Compensation added back is equal to the value of awards granted during the fiscal year, valued as of the last day of the fiscal year (or, if they vested during the year, on the date that they vested):

- PLUS (OR MINUS) the change in value during the fiscal year of awards granted in prior years that are outstanding and unvested, as of the last day of the fiscal year

- PLUS (OR MINUS) the change in value during the fiscal year of awards granted in prior years that vested during the fiscal year, as of the date of vesting

- MINUS the value, as of the end of the prior fiscal year, of any performance awards that failed to meet the applicable vesting conditions (performance-based awards that are granted and determined not to vest in the same fiscal year are excluded from the calculation)

- PLUS the dollar value of dividends and earnings paid on stock or option awards during the year, unless this is otherwise reflected in the fair value of the award or is included in the All Other Compensation column of the Summary Compensation Table for the applicable year

- PLUS the excess fair value of any option or SAR award that was materially modified during the fiscal year.

- Valuing Equity Compensation

- Value of Time-Based Stock Awards. For time-based stock awards, the fair value is simply based on the price of the company's stock on the specified date.

- Value of Performance-Based Awards. The fair value of performance-based awards is calculated based probable outcome of the performance metrics on the specified date.

- Value of Options. For option awards, the fair value as of a specified date is determined under FASB ASC Topic 718 and is generally the Black-Scholes value of the award on that date.

|

"Compensation Actually Paid" does not correlate to the total amount of cash or equity compensation that the executive realized during the fiscal year, and is different from what many companies have been voluntarily reporting as "realizable" or "realized" compensation. Instead, it is a nuanced calculation that includes the increase (or decrease) in value of certain elements of compensation (i.e. equity compensation and pension valuation) over the fiscal year, even if granted in a prior year. The amount that the executive will ultimately receive with respect to these types of compensation (i.e. when the share awards vest or the options are exercised) may, in fact, be different from the amounts disclosed in this column of the Pay-versus-Performance Table. Companies should begin preparing for this disclosure as soon as possible, since it requires gathering information regarding fair value of awards on several different dates, which is not information that companies generally collect or use. Companies should engage their actuaries to calculate the service cost and prior service cost of pension benefits for the last fiscal year and the other years of required disclosure. |

Performance Disclosure

Company TSR

The company must disclose its TSR over the period that is covered in the Pay-versus-Performance Table. This will eventually mean a five-year TSR measurement (three-year TSR for smaller reporting companies), but for most issuers this will be just a three-year TSR measurement in the initial disclosure (two-year TSR for smaller reporting companies).

- Calculation of TSR. TSR is based on a hypothetical $100 investment beginning at the market close on the last trading day before the earliest fiscal year included. The TSR for Year 1 would represent the value of that investment as of the last day of that fiscal year, and TSR is then calculated, on a cumulative basis, for the other reported fiscal years.

|

This calculation of TSR is identical to how TSR is calculated in a company's performance graph, which is included in the annual registration statement on Form 10-K under Item 201(e) of Regulation S-K. However, smaller reporting companies have not previously been required to do this calculation, as they are not required to prepare the performance graph included under Item 201(e). Smaller reporting companies will need to begin to calculate TSR over the period of disclosure. |

Peer Group TSR

Companies (other than smaller reporting companies) must also disclose the TSR of a peer group over the same period.

- Identification of Peer Group. The company may choose whether it uses its compensation peer group, as disclosed in its CD&A, or the index or issuers that it uses in the "Performance Graph" that is disclosed (usually on a Form 10-K) pursuant to Item 201(e) of Regulation S-K.

- If the peer group used is not an index or a published industry group, the identity of companies that make up the peer group must be included in a footnote.

- If the company's peer group has changed from the peer group it used in its Pay-versus-Performance Table in the prior year, the company must disclose in a footnote the reason for the change and must compare its own TSR with both the TSR of the prior peer group and the new peer group.

- Calculation of TSR. Similar to the calculation of company TSR, peer group TSR is based on a hypothetical $100 investment beginning at the market close on the last trading day before the earliest fiscal year included. The returns of each company in the peer group must be weighted based on the company's stock market capitalization at the beginning of each period for which a return is indicated (i.e. for each year that the peer group's TSR is calculated).

|

The calculation of peer group TSR is identical to how peer group TSR is calculated for the performance graph under Item 201(e) of Regulation S-K. Companies should consider whether to use the peer group used for the performance graph, or whether it is a better illustration of pay-versus-performance to use the compensation peer group. Once a peer group is selected for use in the Pay-versus-Performance Table, any changes to the peer group used will require additional disclosure. Compensation committees should carefully consider each year whether to change the companies in the compensation peer group, if that peer group is used for the Pay-versus-Performance Table, since the company will still be required to disclose the TSR of the prior peer group. |

Company Net Income

Since TSR is not always the best way to measure performance of a company, particularly when there are other market conditions that may impact stock performance, the new rules also require companies to disclose their net income for each year reported in the Pay-versus-Performance Table. There is no requirement to include the net income of any other company or peer group.

|

Net income may not be a performance metric considered by a company when setting executive compensation, but the SEC has stated that it believes net income is related to other profitability measures that may be used to set compensation, and it is a standard financial performance measure that is well understood by shareholders. |

Company-Selected Performance Metric

The new rules also require companies (other than smaller reporting companies) to disclose one additional financial performance measurement for each year reported in the Pay-versus-Performance Table.

- Selection of Additional Performance Measurement. The financial performance measurement selected must be the measure that represents, in the company's assessment, the most important financial performance measurement (other than TSR and net income) that the company used to link executive pay and company performance during the last fiscal year. The financial performance measurement may be different for different years in which the pay-versus-performance disclosure is included, but the Pay-versus-Performance Table must include a calculation of that year's selected financial performance measurement for all years being disclosed.

- Calculation of Additional Performance Measurement. The financial performance measurement selected is not required to be a GAAP financial measure, but if the measurement is a non-GAAP financial measure, then the company will be required to disclose how the measurement is calculated based on its audited financial statements (in the same way that non-GAAP financial measures are disclosed in the company's CD&A).

- Additional Company-Selected Performance Metrics. Companies are permitted to include additional financial performance metrics that they have used to link executive pay and company performance in the Pay-versus-Performance Table, but the company will then be required to include a description (as discussed below) of the relationship between compensation actually paid to the CEO and other NEOs and each additional company-selected performance metric.

|

Since the company-selected performance metric is the metric that the company has determined is the most important to link pay and performance, it is likely to be the metric that also most closely correlates to compensation paid to the executives. Companies should consider whether the disclosure in its CD&A is consistent with the performance metric selected for the Pay-versus-Performance Table. |

Description of Relationship Between Pay and Performance

In addition to the Pay-versus-Performance Table, the new rules require companies to describe the relationship between executive pay and company performance, in a graphic or narrative form, or as a combination of the two. This disclosure must cover each of the following items:

- Relationship Between Pay and Company TSR. This description must be based on "compensation actually paid" over the period to the CEO and other NEOs and the Company TSR over the period.

- Relationship Between Pay and Net Income. This description must be based on "compensation actually paid" over the period to the CEO and other NEOs and the company's net income over the period.

- Relationship Between Pay and Company-Selected Performance Measure. This description must be based on "compensation actually paid" over the period to the CEO and other NEOs and the company-selected performance measure(s) over the period. This is not required for smaller reporting companies.

- Comparison of Company TSR and Peer Group TSR. This description relates only to the TSR of the company and the selected peer group, and compensation paid to the CEO and other NEOs is not required to be included in this description. This is not required for smaller reporting companies.

- Graphic or Narrative Disclosure. The new rules do not specify how the description of pay-versus-performance must be disclosed. Companies can choose to show the relationship with a graph, plotting the performance metric on one line and compensation paid to the CEO and NEOs on separate lines. Companies can, alternatively or in addition to graphic disclosure, include a narrative that compares the performance metric and compensation paid to the CEO and NEOs. The new rules do not require any specific form for this disclosure, so that companies have the flexibility to tailor the disclosure as necessary to most clearly provide shareholders about the relationships and how each performance metric is associated with compensation actually paid.

|

It is likely that a graphic illustration of the relationship between pay and performance will be used by many companies, given that it is a straightforward way to demonstrate this relationship and easy for shareholders to understand and that many professional compensation consultants already provide similar graphic illustrations to the compensation committee. However, additional narrative should be included where there is an apparent disconnect between the particular performance metric and the compensation paid to executives, in order to explain the reasons for the apparent disconnect. |

Tabular List of Most Important Financial Performance Metrics

The new rules also require companies (other than smaller reporting companies) to include a list of at least three and up to seven financial performance measures that the company considered to be the most important financial performance measures used to link compensation actually paid to company performance during the last fiscal year.

- Format of Tabular List. The tabular list can be a single list that applies to the CEO and other NEOs, or separate lists for the CEO and the other NEOs (in the aggregate or separately). The performance metrics in the list do not need to be ranked in order of importance.

- Performance Metrics Included. The tabular list must include the company-selected performance measure that is included in the Pay-versus-Performance Table. The company can include non-financial performance metrics in the tabular list, so long as it has provided at least three financial performance metrics. There is no requirement that the company describe how each performance metric is calculated, but companies may include this information if it would be helpful to shareholders.

|

The performance metrics included in this tabular list are likely to be the metrics used for short-term and long-term incentives. Companies should consider whether there are additional non-financial metrics that the Compensation Committee considers when it determines executive pay levels, as listing such non-financial metrics will help to show that pay and financial performance are not always directly correlated and that there are qualitative performance metrics that are also important in making compensation decisions. |

Location of Pay-Versus-Performance Disclosure

The new rules do not specify where the pay-versus-performance disclosure must be located in the proxy or information statement. Companies can include the disclosure in the CD&A and compensation tables that are otherwise included in the proxy or information statement or can choose to include the pay-versus-performance information in a different location of the document.

|

Companies should consider whether the disclosure would assist shareholders in an understanding of its compensation decisions, as described in the CD&A, or whether the information that is included in the pay-versus-performance disclosure is not consistent with the CD&A disclosure and otherwise would be confusing to shareholders. If the performance metrics disclosed in the Pay-versus-Performance Table (such as TSR and net income) are not used by the Compensation Committee when it makes decisions to link pay and performance, it may be advantageous to locate the pay-versus-performance disclosure later in the document than the CD&A. |

Recommended Action Items

For most companies, the pay-versus-performance disclosure will be required in the proxy or information statement filed in 2023. In order to be ready to make timely disclosure, companies should begin gathering data now and mocking up drafts of the disclosure, as the rules require a great deal of new information to be assembled and analyzed. Below is a list of action steps that companies should begin to take now in order to be ready for the new disclosure:

- Equity Compensation Valuation: Start assembling data on equity awards granted to the CEO and likely NEOs in prior years and value of those awards on the last day of the year. For stock options, this will mean determining a Black-Scholes value of options granted in prior years as of the last day of each year required to be disclosed.

- Pension Benefits Valuation: Engage actuaries to determine the service cost and prior service cost of pension plans for prior years and to prepare to determine the service cost and prior service cost as od the end of this fiscal year

- Historic TSR: TSR for the company over the prior three years can be calculated prior to the end of the current fiscal year and then updated with performance as of the last day of the fiscal year. For smaller reporting companies, this will be a new calculation, since the company TSR is not included in the Section 201(e) performance graph.

- Peer Group: Companies should begin an analysis of its compensation peer group and its performance graph peer group to determine which would better illustrate the company's performance versus peers over the initial three years of reporting. Companies should take into consideration whether the performance graph peer group or the compensation peer group is likely to change in subsequent years.

- Mock-Up Pay-Versus-Performance Table: Once the identity of the NEOs for the current fiscal year becomes clear, a general mock-up of the Pay-versus-Performance Table should be constructed, including the information for the prior years with respect to Summary Compensation Total, Compensation Actually Paid, Company and Peer Group TSR, and Net Income. Putting together a draft of this table early will assist the company in determining whether disclosure describing the relationship of pay to performance should be graphic, narrative, or a combination of the two.

- Selection of Additional Financial Performance Metric for Table and 3-7 for Tabular List. Companies should begin to consider which financial performance metric is the most important to link pay and performance, so that the financial data can be pulled for the initial three years of reporting. Other performance metrics that are considered important, but that are not included in the Pay-versus-Performance Table, should be included in the company's tabular list of performance metrics.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem, and it should not be substituted for legal advice, which relies on a specific factual analysis. Moreover, the laws of each jurisdiction are different and are constantly changing. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. If you have specific questions regarding a particular fact situation, we urge you to consult the authors of this publication, your Holland & Knight representative or other competent legal counsel.