Increasing Financial Costs Associated With Foreign Compliance

United States law requires taxpayers who own foreign assets, have a connection to foreign entities and who engage in foreign activities to report such assets, entities and activities to the IRS. Taxpayers who fail to file the appropriate informational forms risk being subjected to significant monetary penalties. The Foreign Account Tax Compliance Act (FATCA) increases by two the number of required informational forms. Section 521 of FATCA amended Section 1298 of the Code to require shareholders in a Passive Foreign Investment Company (PFIC) to file an annual information return disclosing their ownership of the PFIC (Section 1298(f)). Additionally, Section 511 of FATCA created a new annual filing, Form 8938, for U.S. taxpayers with specified foreign financial assets.

On October 3, 2011, the IRS released draft instructions for Form 8938. The instructions are newsworthy in that they come 18 months after FATCA was implemented and two different draft Forms 8938 were released without instructions. Comments are requested and regulations are expected prior to the end of 2011.

The filing obligation, which is referenced in Section 6038D, applies to assets held during taxable years beginning after March 18, 2010. Taxpayers and practitioners alike should note that the reporting requirement is much broader than the Foreign Bank Account Report (FBAR), so it is possible that individuals who do not have an FBAR filing obligation may be subject to the FATCA reporting requirement. For example, the FATCA reporting requires taxpayers with investments in foreign entities, such as foreign hedge funds and private equity funds to report the existence of these investments. The recent FBAR regulations issued by the Financial Crimes Enforcement Network (FinCen) on February 26, 2010, exempt these assets from FBAR reporting. Notwithstanding, many taxpayers may find that they are required to file both an FBAR and Form 8938.

As a reminder, the FBAR is generally required to be filed by a U.S. person with a financial interest, signature authority or other authority over foreign financial accounts if at any point during the calendar year the aggregate value of all such foreign accounts equaled or exceeded $10,000, even if for one day. This contrasts with the Section 6038D disclosure, which is required to report “specified foreign financial assets” when the aggregate value exceeds $50,000 “(or such higher dollar amount as the Secretary may prescribe).”

Why Are There Duplicative Filings?

The reason for duplicative filings lies in the source of the filing obligation. The FBAR is mandated by Title 31, whereas the FATCA filing is mandated by Title 26. Title 31 relates to “Money and Finance” and its purpose (as stated in Section 5311) is “to require certain reports or records where they have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings, or in the conduct of intelligence or counterintelligence activities, including analysis, to protect against international terrorism.” As such, the information contained in FBARs is not confidential and federal officials are able to access the computer database in which FBAR information is entered. This contrasts with the information contained on Form 8938, which will be subject to the same confidentiality rules in Section 6103 governing tax returns.

The disclosure under new Section 6038D includes: (i) the name and address of the financial institution in which the account is maintained; (ii) the account number; (iii) in the case of any stock or security, the name and address of the issuer and other information necessary to determine the ownership; (iv) in the case of an instrument, the names and addresses of all issuers and counterparties; and (v) the maximum value of the asset during the taxable year. While this information is quite similar to that required on an FBAR, this disclosure is not required by persons who have signature authority or other authority over a foreign financial account.

Form 8938 History

The IRS initially released a draft version of Form 8938 in July 2010, but there were no instructions associated with the form. Then a revised draft Form 8938 was released in June 2011, again without instructions. About the same time that the revised June 2011 draft Form 8938 was released, the IRS issued Notice 2011-55 relieving taxpayers of the filing requirement until such time as the Form 8938 was released. The Notice also indicates that the IRS intends to issue regulations Section 6038D. Then on October 3, 2011, the IRS finally posted draft instructions. The instructions provide transitional rules that essentially relieve taxpayers of the requirement to file Forms 8938 until 2012. If a taxpayer had a 2011 filing obligation, the form for such year would be filed in 2012, along with any required 2012 form.

Reportable Assets

Taxpayers who own specified foreign financial assets are obligated to file a Form 8938 if the total value of those assets exceeds a threshold. The amount of the threshold varies depending upon the filing status of the taxpayer. Regardless of the value of the asset, if the taxpayer is not obligated to file an income tax return, then the taxpayer is relieved of the obligation to file Form 8938.

Specified foreign financial assets include any financial account maintained by a foreign financial institution. It also includes the following assets held for investment outside of a financial institution: (i) stock or securities issued by a non-U.S. person; (ii) any interest in a foreign entity; and (iii) any financial interest or contract held for investment that has a non-U.S. issuer or counterparty. Consequently, any taxpayer who forms a foreign entity to hold assets, such as real estate, would have a reporting obligation. Notwithstanding, a taxpayer does not have to report an interest in a foreign estate or foreign trust unless the taxpayer has reason to know of their interest. If the taxpayer receives a distribution from the trust or estate, knowledge is attributable to them.

The instructions provide the following examples of other specified foreign financial assets if they are held for investment: (i) stock issued by a foreign corporation; (ii) a capital or profits interest in a foreign partnership; (iii) a note, bond, debenture, or other form of indebtedness issues by a foreign person, an interest in a foreign trust or estate; (iv) an interest rate swap, currency swap, basis swap, interest rate cap, interest rate floor, commodity swap, equity swap, equity index swap, credit default swap, or similar agreement with a foreign counterparty; and (v) an option or other derivative instrument with respect to any of these examples or with respect to any currency or commodity that is entered into with a foreign counterparty or issuer. An asset is deemed to be held for investment regardless as to whether the taxpayer uses it or holds it in the conduct of any trade or business.

Taxpayers With a Filing Obligation

The following individuals with ownership in a specified foreign financial asset must file a Form 8938: (i) U.S. citizens; (ii) permanent residents (i.e., green card holders); (iii) individuals satisfying the substantial presence test; (iv) a nonresident alien making an election to file a joint income tax return with a U.S. spouse; and (v) a nonresident alien who is a bona fide resident of Puerto Rico or American Samoa. There is an inconsistency as the category Specified Individual does not contain a broad reference to bona fide residents of a U.S. possession or territory. As a result, bona fide residents of Guam, the U.S. Virgin Islands and the Northern Mariana Islands would appear not to be subject to the Form 8938 filing. However, later in the instructions it states that any bona fide resident of a possession or territory is exempt from filing a Form 8938 if the specified foreign financial asset is:

- A financial account maintained by a U.S. institution in the possession where the taxpayer is a resident;

- A financial account maintained by a branch of a foreign institution in the possession where the taxpayer is a resident provided the branch is subject to the same tax and information reporting requirements that apply to U.S. financial institutions;

- Stock or securities issued by an entity organized in the possession where the taxpayer is a resident;

- An interest in an entity organized under the laws of the possession where the taxpayer is a resident; and

- A financial instrument or contract held for investment provided each issuer or counterparty that is not a U.S. person is either an entity organized under the laws of the possession where the taxpayer is a resident or is a bona fide resident of such possession.

Additionally, even if a permanent resident or substantially present resident elects to be treated as a foreign resident under an income tax treaty, the Form 8938 must be filed. Unresolved is whether the Form 8938 must be filed if the individual taxpayer is able to qualify as a nonresident alien under the closer connection test.

Section 6038D (f) states that the IRS may apply the reporting requirement to domestic entities formed or availed of for purposes of holding, directly or indirectly, specified foreign financial assets. Presently, however, there is no requirement for a domestic entity to file a Form 8938. The IRS expects to issue regulations indicating when such entities will have a filing obligation. Similarly, a taxpayer is not deemed to have an interest in a specified foreign financial asset held by a partnership, corporation, trust or estate, solely as a result of the taxpayer’s being a partner, shareholder, or beneficiary.

Notwithstanding the foregoing, taxpayers who own a disregarded entity must file Form 8938 if the entity owns a specified foreign financial asset. Additionally, if the taxpayer owns any part of a grantor trust (other than a bankruptcy liquidating trust or a domestic widely held fixed investment trust), the taxpayer is deemed to own any specified foreign financial assets held by the trust.

Valuation Thresholds

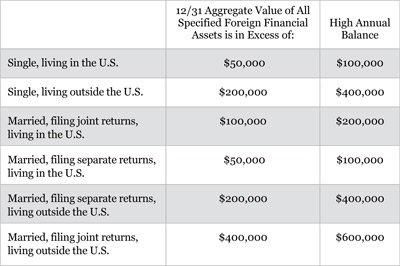

Specified foreign financial assets must be reported if the high value or year end value exceeds certain thresholds. For single taxpayers living in the United States, the high value threshold is $100,000 and the year end value threshold is $50,000. The thresholds are the same for married taxpayers living in the U.S. who file separate returns. However, the high value threshold is doubled to $200,000 and year end value threshold doubled to $100,000 for married taxpayers living in the U.S. who file a joint income tax return. (See the chart below.)

The filing thresholds are more generous for taxpayers living abroad. If the taxpayer is a bona fide resident of a foreign country, which is defined as living uninterrupted in the foreign jurisdiction for an entire tax year or for at least 330 full days during a tax year, the high value threshold is $400,000 and year end value threshold is $200,000 so long as the taxpayer does not file a joint income tax return. Consequently, this applies to both single taxpayers and those who are married, but who file separate tax returns. The high value threshold is $600,000 and year end value threshold is $400,000 for married taxpayers living abroad who file a joint income tax return and satisfy the foreign residency requirements described above.

Determining Value

When determining the valuation thresholds taxpayers may rely on statements provided by the financial institution unless they have reason to know that the statements do not provide a reasonable estimate of the maximum value. Similarly, taxpayers may use the year end value for an asset that is not a financial account unless they have reason to know that the year end value does not reflect a reasonable estimate of the maximum value.

If the taxpayer is a discretionary beneficiary of a foreign trust, the maximum value is the total of all distributions received during the tax year from the trust. If the taxpayer is entitled to mandatory distributions, then such distributions are valued in accordance with the rules in Section 7520.

If the taxpayer is a beneficiary of a foreign estate, foreign pension plan or foreign deferred compensation plan, the maximum value is the fair market value of the taxpayer’s interest as of year end. If the taxpayer does not know the value or cannot determine the value, the value to be used is equal to the cash and other property distributed to the taxpayer during the year.

Exceptions

Clearly, an account held with either a U.S. financial institution located in the U.S. or a domestic branch of a foreign financial institution is not a specified foreign financial asset, as the account is not foreign. However, the instructions also indicate that an account held with the foreign branch or foreign subsidiary of a U.S. financial institution is exempt from the filing requirement. Additionally, accounts maintained by dealers or traders in securities or commodities are exempt if all of the holdings are subject to the mark to market accounting rules for dealers in securities or an election under Section 475(e) or (f) is made.

While the above accounts are completely exempted from the reporting obligation, the instructions provide for simplified filing for a number of assets. In an effort to eliminate duplicative filings, if a taxpayer reports the existence of a specified foreign financial asset on a Form 3520, Form 3520A, Form 5471, Form 8621, Form 8865, or Form 8891, the asset does not need to be reported on Form 8938. However, the taxpayer must still complete Part IV of Form 8938 and provide their identifying information on the top of the form.

Penalties

The minimum penalty for failing to submit the required disclosure is $10,000 and it increases by $10,000 for each 30-day period following notification from Treasury, with the maximum penalty being $50,000. There is, however, a 90-day grace period following notification from Treasury before the additional $10,000 penalties accrue. This is similar to the penalty for failure to file Form 5471 and Form 3520. As with those forms, the penalty may be waived if the taxpayer is able to demonstrate the failure to file was due to reasonable cause. The instructions indicate that if the foreign jurisdiction would impose a civil or criminal penalty for disclosing the information, it will not satisfy reasonable cause. It is important to realize that taxpayers who have this disclosure requirement will likely also have an FBAR filing requirement. While the penalty for failure to file the FBAR is much harsher than the penalty under Section 6038D for failure to file this new disclosure, both of these penalties may be assessed.

Married taxpayers filing a joint return who fail to file a Form 8938 are subjected to the penalty, as if each was a single person. Both spouses will incur liability for the penalties, and the liability will be joint and several.

If the taxpayer underpays tax as a result of an undisclosed specified foreign financial asset, the deficiency will be subjected to a 40 percent penalty. If the taxpayer underpays tax as a result of fraud, the deficiency will be subject to a 75 percent penalty. In addition to the failure to file penalty, accuracy related penalty and fraud penalty, the instructions state that criminal penalties may also apply for the failure to file the Form 8938, report an asset or underpay tax.

Statute of Limitations

If a taxpayer omits more than $5,000 of income attributable to one or more assets required to be reported under Section 6038D, the IRS will have six years from the date the Form 8938 is filed to audit the taxpayer. Even if there is no omission of income attributable to a specified foreign financial asset, the three-year statute of limitations is tolled until the form is filed.

Conclusion

If the IRS believes a taxpayer has an interest in one or more specified foreign financial assets and asks the taxpayer for information on the assets value, there is a presumption that the value is in excess of the filing threshold provided the taxpayer cannot supply sufficient information as to its value. Additionally, practitioners should be on the lookout for a revised Form 8621. As stated above, FATCA amended Section 1298 of the Code to require shareholders in a PFIC to file an annual information return disclosing their ownership of the PFIC (Section 1298(f)). Under previous law, such disclosure was required only when taxpayers made a qualifying elective fund election, received certain distributions from the PFIC, or disposed of their interest in the PFIC. Notice 2011-55 also suspended the filing of Form 8621 for shareholders that are not otherwise required to file the form under its current instructions. Taxpayers have a Form 8938 filing obligation, if they satisfy the thresholds in either column.