Tout, Tout, Let It All Out: SEC Continues Crackdown on Celebs, Athletes Touting Digital Assets

Former NBA player and Hall of Famer Paul Pierce is the latest celebrity cryptocurrency promoter to get caught in the net of the anti-touting provisions of federal securities laws. In a recent settled order issued by the SEC, the agency charged Pierce with violating, among other things, the anti-touting provisions of the Securities Act of 1933. The order provides a great opportunity to revisit those anti-touting provisions, a recap of the SEC's recent policing activities on this front and some key considerations.

Brief History of Anti-Touting Regulation

A longstanding tenet of federal securities laws requires anyone promoting securities to disclose "the nature, scope, and amount of compensation received in exchange for the promotion."1 As explained in a U.S. House of Representatives report connected to the introduction of the Securities Act, Section 17(b) was meant to thwart newspaper articles and periodicals that were presented as offering unbiased opinions when, in reality, the opinions were bought and paid for.2 The provision is critical, as federal securities laws do not prohibit issuers from paying analysts to promote their companies, nor are they under a specific statutory duty to disclose these payments.3

Instead, Section 17(b) of the Securities Act places the duty of disclosing such an arrangement with the parties being paid to perform promotional activities. Section 17(b) prohibits any person from using interstate commerce or publishing or giving publicity to a security for consideration received from an issuer, underwriter or dealer without fully disclosing such consideration.4 Unlike with its Section 17(a)(1) counterpart, the SEC need not establish scienter for an anti-touting violation.5

Celebrities and Athletes Touting Crypto Assets

In 2017, the cryptocurrency industry was booming with initial coin offerings (ICOs) – unregistered offerings of coins and tokens by developers and creators to raise money for their ventures.6 Although several ICOs raised capital for innovative projects, many projects were of dubious quality or even outright frauds. Nevertheless, investors piled in, due in part to influencers and celebrities promoting and touting these ICOs.

As celebrities and other influencers leveraged their extensive social media platforms to endorse various digital assets, concerns about investor harm arising from these ICOs caused the SEC to issue its November 2017 Statement Urging Caution Around Celebrity Backed ICOs. The SEC's warnings in this space lead to the threshold jurisdictional question involving digital assets: Are these coins and tokens securities? Staking a position that has led to deep divisions within the agency and reinforced by its repeated enforcement activity, the SEC's current view (led by SEC Chair Gary Gensler) is that most tokens are securities and thus subject to federal securities laws (including the anti-touting provisions).7 Over the last several years, the SEC has filed several notable enforcement actions against celebrities and influencers for alleged violations of the anti-touting provisions in connection with several token promotions.

Now, with the SEC's recent order against Pierce, the agency has now double-dipped on promotional activities tied to one well-known offering: the EthereumMax (EtherMax) offering of EtherMax tokens (EMAX).8

Ethermax Enforcement Actions

The SEC signaled it was indeed "Keeping Up with the Kardashians" when, on Oct. 3, 2022, it announced settled charges against Kim Kardashian for violating Section 17(b) based on her promotion of EMAX. Without admitting or denying the findings in the order, Kardashian agreed to pay $1.26 million in disgorgement and penalties and to an undertaking limiting her promotional activities tied to "crypto asset securities" for three years.9

The SEC again targeted EtherMax promotions with its latest order against Pierce for his purported violations of both Section 17(b) and one of the negligence-based antifraud provisions under Section 17(a) of the Securities Act. The SEC alleged that Pierce, who has more than 4 million Twitter followers, promoted EMAX on his Twitter account in exchange for approximately $244,000 of "crypto securities." Notably, the SEC included several allegations to establish that EMAX tokens were "investment contracts," and thus securities, in accordance with the U.S. Supreme Court's decision in SEC v. W.J Howey & Co.10 The SEC then alleged that while Pierce was receiving his EMAX tokens, he contemporaneously promoted EMAX on his Twitter without disclosing that he was compensated for the promotion or the amount of such compensation:

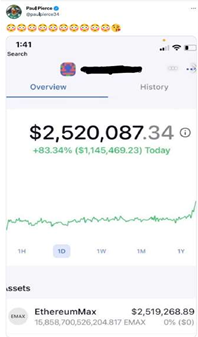

Additionally, the SEC alleged that Pierce made certain misstatements regarding the amount he earned from EMAX and falsely represented that he was holding – and intended to increase – his investment in EMAX while he contemporaneously sold the alleged securities. According to the SEC, Pierce also negligently misrepresented that he made more money from EMAX in a month than he did with ESPN (his current employer, where he earned more than $1 million in compensation the prior year). Furthermore, the SEC focused on a separate tweet of Pierce's with a screenshot showing a quantity of EMAX valued at more than $2.5 million.11

According to the SEC, Pierce failed to disclose that the tweeted quantity of tokens was not his own sum, but a screenshot of someone else's holdings that was provided to Pierce for the promotion.12

Without admitting or denying the findings in the SEC's order, Pierce agreed to pay $1.4 million in disgorgement and penalties and, like Kardashian before him, agreed to an undertaking prohibiting him from promoting crypto asset securities for three years.13

Key Takeaways

The SEC has made it clear that it will aggressively enforce anti-touting violations in the crypto and digital asset space. Given the agency's focus on bringing "message cases" that generate headlines for broader market impact, celebrities and athletes who promote digital assets – as the literal face of such projects – are often low-hanging fruit for SEC enforcement (along with private plaintiffs). Here are some takeaways from the Pierce order:

- Section 17(b)'s obligations require disclosure of both the existence of a compensation arrangement and the amount of such compensation, points difficult to make within a 280-character tweet. Celebrities and athletes need to tread carefully on paid promotional activity. The SEC's action against Pierce showed the agency will drill down to single tweets as an anchor for enforcement actions (and now emojis might be considered fair game as actionable statements).

- The lack of specific guidance on the issue of "crypto as security" leaves any paid promotional activity of coins or tokens by celebrities, athletes and other influencers vulnerable to an SEC investigation, enforcement action or class-action lawsuit. The risk has only increased as the SEC's Division of Enforcement has expanded its focus beyond coins and tokens to paid promotional activity in connection with certain NFT (non-fungible token) promotions. A recent ruling by the U.S. District Court for the Southern District of New York denying a motion to dismiss in connection with a complaint alleging certain NFTs are securities will only add fuel to the flames of this growing fire.14 When in doubt, parties should give careful consideration to proactively disclosing any and all compensation received in connection with any promotional activity involving digital assets.

- The SEC's order against Pierce demonstrates the SEC will seek to inflict severe penalties for this type of misconduct. Pierce agreed to pay more than $1.1 million in civil penalties relative to his approximate $244,000 in disgorgement, a greater than 4.5:1 ratio. This is similar to the SEC's resolution with Kardashian, where the SEC obtained a $1 million penalty relative to approximately $260,000 in disgorgement. For comparison, the statutory maximum for insider trading penalties under Section 21A of the Exchange Act of 1934 is capped at a 3:1 ratio of penalties to ill-gotten gains (or losses avoided).

- Given the aggressive posture taken by the SEC toward policing promotion and sale activities around crypto and NFT assets, athletes and celebrities should exercise caution when an endorsement opportunity arises, as it just may turn out to be more trouble than it is worth in endorsement dollars.

The SECond Opinions Blog will continue to monitor the activity in this space and provide further updates. If you need additional information on this topic – or anything related to securities enforcement or investigations – please contact the authors or other members of Holland & Knight's Securities Enforcement Defense Team and/or Holland & Knight's Sports Law Practice.

Notes

1 Id.

2 United States v. Amick, 439 F.2d 351, 365 (7th Cir. 1971) (citing Committee on Interstate and Foreign Commerce, H.R. Rep. No. 85, 73d Cong., 1st Sess., at 24 (1933)).

3 See, e.g., In re Galectin Therapeutics, Inc. Securities Litigation, 843 F.3d 1257, 1272-73 (11th Cir. 2016); Garvey v. Arkoosh, 354 F.Supp.2d 73, 83 (D. Mass. 2005). We note that more generalized disclosure obligations under the federal securities laws (such as those under Exchange Rules 10b-5 or 12b-20) may necessitate such disclosure.

4 See 15 U.S.C. § 77q(b).

5 Sec. & Exch. Comm'n v. Liberty Cap. Grp., Inc., 75 F. Supp. 2d 1160, 1163 (W.D. Wash. 1999) ("In short, the plain meaning of § 17(b) excludes an element of intent, and none of the Supreme Court's reasons for reading that element into § 17(a)(1) in Aaron apply here.").

6 Brady Dale, ICO Mania Revisted: The Investors and Token Issuers Who Made Good, CoinDesk (Aug. 9, 2021).

7 Gary Gensler, "Kennedy and Crypto," SEC (Sept. 8, 2022). In fact, the SEC's recent Safeguarding Rule proposal reinforces the agency's current view that most crypto assets are securities.

8 Several celebrities and athletes have promoted EtherMax and its token EMAX, including Kim Kardashian, Paul Pierce and Floyd Mayweather. Now, Mayweather, Kardashian, Pierce and others are named defendants in private securities litigation brought by EtherMax investors in California's Central District. The case is in its early days, and a motion to dismiss is pending. In re EthereumMax Investor Litigation, No. 22-cv-00163 (C.D. Cal. Feb. 21, 2023). Mayweather previously settled with the SEC for his alleged role in promoting digital asset securities. In late 2018, he settled with the SEC for allegedly touting another digital asset project, Centra, and agreed to pay $614,775 in fines and disgorgement. Floyd Mayweather Jr., Securities Act Release No. 10578 (Nov. 29, 2018).

9 SEC Charges Kim Kardashian for Unlawfully Touting Crypto Security, SEC (Oct. 3, 2022).

10 328 U.S. 293 (1946).

11 Paul Anthony Pierce, Securities Act Release No. 11157 ¶ 13 (Feb. 17, 2023).

12 Id. ¶ 14.

13 Paul Anthony Pierce, Securities Act Release No. 11157 (Feb. 17, 2023).

14 Friel v. Dapper Labs, No. 21 Civ. 5837, 2023 WL 2162747 (S.D.N.Y. Feb. 22, 2023).