2018 NDAA Analysis: The Limits of the 2018 NDAA’s Report on Procurement Fraud

This is the fifth blog post in a series of blogs analyzing the current draft of the 2018 National Defense Authorization Act (NDAA) as agreed-to by House and Senate negotiators on November 8, 2017. Stay tuned for additional blog posts covering additional topics in the near future from Holland & Knight’s Government Contracts Team.

A provision in the NDAA for Fiscal Year 2018 (2018 NDAA; H.R. 2810) would require the Department of Defense (DoD) to prepare a report on defense contracting fraud. Specifically, Section 889 of the 2018 NDAA requires the DoD to report the number of fraud-related criminal convictions of contractors over the past five fiscal years and prepare a listing of those contractors that were debarred or suspended based on their criminal conviction. The report will also require a listing of contractors having civil judgments or settlements related to fraud over the past five years. DoD will be required to provide an assessment of the dollar value of contracts awarded to these companies. The report will also include a recommendation on how to “penalize contractors repeatedly involved in fraud in connection with contracts or other transactions entered into with the Federal Government.” DoD has 180 days to prepare the report upon passage of 2018 NDAA.

This is not the first time Congress has requested such a report. A similar provision was contained in the Department of Defense Appropriations Act, 2010 requiring reporting for fiscal years 2000-2010. That report came out in October 2011.

The 2011 report identified approximately 64 contractors with criminal convictions and over 300 contractors who had fraud-related criminal or civil settlements. The report showed that the overwhelming majority of companies with criminal convictions also received not-insignificant periods of debarment. (The 2011 report is available here and tables here).

Many viewed the 2011 report as evidence of systematic fraud by defense contracting community members, while others panned the report as evidencing isolated incidents of wrongdoing. The former cited with ire the value of contracts received by contractors even after their respective conviction, settlement, or judgment.

This proxy can be misleading though. As a threshold matter, judgments are not equivalent to settlements without admission of liability. A more telling proxy would be a breakout of the number of settlements involving an admission of liability. Second, the report did not establish a threshold amount for civil settlements or judgments. A fair number of the civil settlements and judgments listed in the 2011 report are less than $1 million. Nor is there an indication of the value of the settlement relative to the claimed damages or the size of the company. A not-insignificant number of the companies listed in the 2011 report are multi-billion dollar contractors with a single minor settlement within the ten-year report period. Where the settlement value is relatively low and there is no admission of liability, it more likely evidences companies who settled unmeritorious cases to avoid the time and expense of litigation. This is particularly true of settlements involving qui tam relator claims under the False Claims Act and even more so in those cases where DOJ declined intervention. Finally, as the 2011 report points out, payment of money due to the government is typically indicative of a responsible contractor, restoring its eligibility for continued participation in government contracting.

In addition to these limitations, the report lacks related analytical data points that could be useful. For example, there is no requirement to identify the number of cases stemming from or involving mandatory disclosures. Now just shy of a decade old, the mandatory disclosure rule requires self-disclosure by contractors whenever there is credible evidence of a violation of Federal criminal law involving fraud or violations of the False Claims Act. Many commenters on the rule say it has been a vehicle for reporting minimal overpayments rather than meaningful disclosure of serious fraud. The report could also require a segregation of cases brought by DoD investigative services versus whistleblowers.

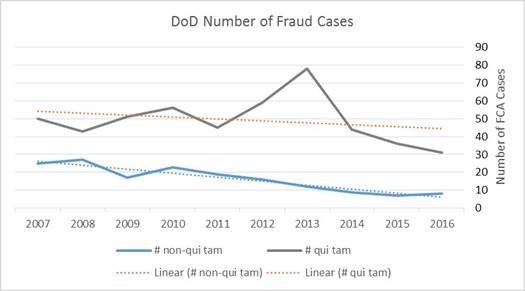

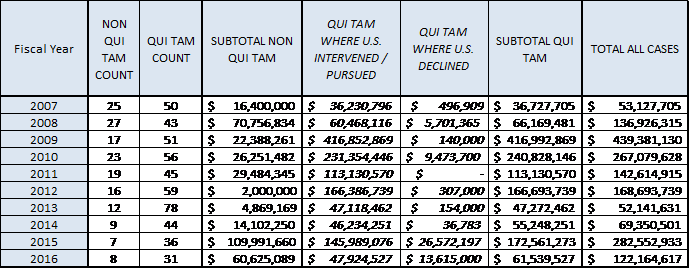

Nor does the report call for a reevaluation of the companies identified in the 2011 report or a year over year trend analysis. The Department of Justice (DOJ) tracks this latter information to some extent as part of its annual Fraud Statistics (which indicates a decline in the number of qui tam and non qui tam DoD fraud cases over the past ten years):

Link Source: Department of Justice, Civil Division, Fraud Statistics – Department of Defense

Back in 2011, DoD relied extensively on DOJ for the underlying data regarding fraud cases. However, as DoD admitted, DOJ’s data was not an ideal for the report - companies were misidentified or not necessarily identified as contractors, judgments and settlements were not apportioned where there was joint and several liability, and cases involving procurement fraud may not have been categorized as such. The 2011 report recognized that DOJ’s data likely underreported the number and value of procurement fraud cases. If DOJ’s collection and categorization methods have improved or if DoD started tracking cases in parallel, we might see a different trend line from that currently reported out of DOJ.