Amendments to Rule 144

The Securities and Exchange Commission recently adopted amendments to Rules 144 and 145 that substantially overhaul the resale requirements for restricted securities. The amendments to Rule 144 become effective on February 15, 2008, and apply to securities acquired before or after that date. The Commission’s stated objective in adopting these amendments is twofold: (1) to increase the liquidity of privately sold securities; and (2) to decrease the cost of capital for all issuers without compromising investor protection. The key features of the new rules are as follows:

- For both affiliates and non-affiliates of a reporting issuer (an issuer that is subject to the reporting requirements of Section 13 or Section 15(d) of the Securities Exchange Act of 1934), the holding period for the resale of restricted securities of the issuer is reduced from one year to six months.

- Non-affiliates of a reporting issuer are no longer subject to the Rule 144 conditions relating to volume limitations, manner of sale requirements or the filing of Form 144; and, after complying with the six-month holding period, non-affiliates may resell restricted securities subject only to the condition that current public information regarding the issuer be available.

- Non-affiliates of reporting issuers and non-reporting issuers are allowed to resell their securities freely after compliance with a one-year holding period.

- The thresholds triggering the requirement to file Form 144 have been increased; a Form 144 is not required unless the intended sale exceeds either 5,000 shares or $50,000 for any three-month period.

- The manner of sale requirements are eliminated and sales volume limitations are raised for the resale of debt securities.

- Several interpretive positions issued by the Division of Corporate Finance that relate to Rule 144 have been codified.

- The “presumptive underwriter” provision of Rule 145(c) is eliminated except when a party to the Rule 145(a) transaction is a shell company.

Holding Periods and Conditions to Resale

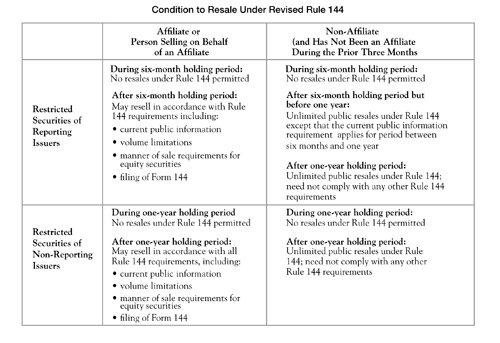

Rule 144 permits a security holder to publicly resell restricted securities if certain conditions are met. Generally speaking, “restricted securities” are securities acquired in unregistered, private sales from the issuer or an affiliate of the issuer. Under revised Rule 144, the conditions applicable to a given Rule 144 transaction will depend upon whether the selling security holder is an affiliate of the issuer, and whether the issuer is a reporting issuer. An affiliate of a reporting issuer may only resell restricted securities after satisfying the six-month holding period requirement, in addition to the other Rule 144 conditions, including the availability of current public information regarding the issuer, compliance with sale volume limitations and manner of sale requirements, and the filing of Form 144. After satisfying the six-month holding period, a non-affiliate of a reporting issuer only needs to comply with Rule 144’s current public information requirement in order to resell restricted securities. If a non-affiliate of a reporting issuer holds the securities for one year, the non-affiliate may freely resell the securities without regard to Rule 144.The resale of restricted securities of a non-reporting issuer is subject to a one-year holding requirement. After complying with the one-year holding period, an affiliate of a non-reporting issuer may only resell restricted securities in accordance with the other Rule 144 conditions, including the availability of current public information regarding the issuer, compliance with sale volume limitations and manner of sale requirements, and the filing of Form 144. Other than the one-year holding period, a non-affiliate of a non-reporting issuer is not subject to any additional conditions and may freely resell restricted securities after complying with the holding requirement.

At the end of this alert is a tabular summary of the conditions applicable to the resale of securities held by affiliates and non-affiliates pursuant to the revised Rule 144.

Resales of Debt Securities

With respect to the resales of debt securities, the Commission eliminated the manner of sale requirements and raised volume limitations. The revised volume limitations permit the resale of debt securities in an amount that does not exceed 10 percent of a tranche, together with all sales of securities of the same tranche sold for the account of the selling security holder within a three-month period.Form 144

An affiliate of a reporting or a non-reporting issuer is required to file a Form 144 if the affiliate intends to resell the issuer’s restricted securities. Prior to the amendments, a Form 144 was required to be filed if the amount of securities sold in reliance upon Rule 144 during any period of three months exceeded 500 shares or had an aggregate sales price in excess of $10,000. The amendments have increased these thresholds to 5,000 shares and $50,000, respectively.Codification of Staff Positions Relating to Rule 144

The amendments also codified several interpretive positions issued by the staff of the Division of Corporation Finance:

- Securities acquired in a non-public transaction under Section 4(6) of the Securities Act are “restricted securities” under Rule 144.

- Tacking of holding periods is permitted when a company reorganizes into a holding company structure. Holders who receive restricted securities of a newly formed holding company may count the holding period of the predecessor company’s securities if the following conditions are satisfied: (1) the newly formed holding company’s securities were issued solely in exchange for the securities of the predecessor company as part of a holding company reorganization; (2) security holders received the same class evidencing the same proportional interest in the holding company as they held in the predecessor company and the rights and interest of the holders are substantially the same; and (3) the holding company had no significant assets other than the securities of the predecessor company and substantially the same assets and liabilities as the predecessor company.

- Tacking of holding periods is permitted for conversions and exchanges of securities. Securities acquired from the issuer solely in exchange for other securities of the same issuer are deemed to have been acquired at the same time as the securities surrendered for conversion or exchange, even if the securities surrendered were not convertible or exchangeable by their terms. Tacking is not permitted if the holder provided additional consideration for the amendment to the original securities that permitted the conversion or exchange. A similar codification was made for cashless exercises of options and warrants.

- As long as pledgees are not the same “person,” a pledgee of securities may sell the pledged securities without having to aggregate the sale with sales by other pledgees of the same securities from the same pledgor, as long as there is no concerted action by those pledgees.

- Rule 144 is not available for the resale of securities by shell companies. Subject to certain current information requirements, holders of former shell companies can resell under Rule 144 one year after the company files a Form 10 reflecting that it is no longer a shell company.

- Security holders selling under a Rule 10b5-1 plan can modify the Form 144 representation to indicate that he or she had no knowledge of material adverse information about the issuer as of the date the holder adopted the written trading plan or gave the trading instructions, instead of as of the date the holder signed the Form 144.

Rule 145

In addition to Rule 144, the Commission adopted amendments to Rule 145, which also become effective on February 15, 2008. Rule 145 applies to certain exchange transactions that are subject to the vote of security holders, including reclassifications of securities, mergers or consolidations, or transfers of assets. Under Rule 145, these exchanges of securities constitute sales that must be registered absent an exemption from registration. Prior to the amendments, Rule 145’s presumptive underwriter provision deemed all persons who were parties to Rule 145 transactions, other than the issuer, to be underwriters that were required to comply with Rule 145’s resale provisions, which incorporate the Rule 144 conditions to resale. Under revised Rule 145, parties to a Rule 145 transaction will only be deemed to be underwriters and subject to Rule 145’s resale requirements if the transaction at issue involves a shell company.Effect of Amendments

The amendments to Rules 144 and 145 are part of the Commission’s continuing effort to promote capital formation. By increasing the liquidity of securities acquired in private transactions, these amendments will afford all companies, particularly smaller companies, with greater access to private capital.The full text of the amendments is available at the following link: http://www.sec.gov/rules/final/2007/33-8869.pdf.