State-by-State: Georgia Implements New Gift and Campaign Finance Disclosure Rules

On January 1, the Georgia Government Transparency and Campaign Finance Commission began to implement statutorily mandated changes to its ethics and campaign finance disclosure rules. Those changes were adopted after intense negotiations between the Georgia House and Senate, culminating in Governor Nathan Deal threatening to call lawmakers back for a special session if they failed to reach an agreement.

Limiting Gifts from Lobbyists

House Bill 142, which was signed by the Governor on May 6, 2013, imposes a general prohibition on individual lobbyists providing public officials with gifts valued at more than $75, specifically including tickets to athletic, sporting, recreational or other entertainment events. This is a significant change because Georgia, like Virginia and a few other states, has not previously limited the monetary value of gifts that a public official may accept from lobbyists.

The law also clarified Georgia's definition of a "lobbyist" to include anyone who receives, or anticipates receiving, $250 per calendar year in compensation or reimbursement to promote or oppose legislation. The term "lobbyist" already included anyone making "lobbying expenditures" in excess of $1,000 or receiving compensation solely to influence the selection of a contractor to provide goods or services to a state agency.

Despite their victory getting this legislation passed, advocacy groups like Common Cause and the Georgia Alliance for Ethics Reform have expressed concerns regarding potential loopholes due to a variety of exemptions included in the final bill. Notably, the bill defines a new class of "lobbying expenditures" that are not subject to this $75 limit, including:

- Food, beverages, and registration at group events to which lawmakers are invited;

- Transportation, lodging, travel, and registration costs for a lawmakers and their staff attending educational, informational, charitable, or civic meetings or conferences in the United States that directly related to official duties; and

- Food and beverages for lawmakers and staff attending such meetings or conferences.

In addition, these groups, as well as conservative activists, have expressed concern that there is no aggregate limit included in this gift rule, potentially allowing for unlimited small gifts, and that the law exempts "any licensed attorney appearing on behalf of or representing a client…when such attorney is not compensated for the specific purpose of lobbying."

Campaign Finance Disclosures

The Commission also began to implement House Bill 143, which mandated electronic filing of campaign finance and personal financial disclosure reports by state and local candidates and committees. The new law also revised the filing schedule for reports and added "qualifying fees" and "attorney's fees connected to the campaign" to the type of "ordinary and necessary expenses" that a campaign or committee may pay using funds from campaign contributions.

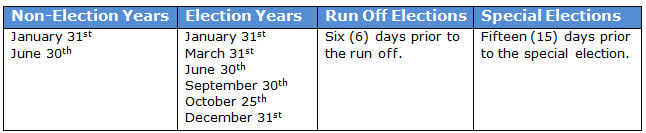

Under the new filing schedule, reports are due based on the following deadlines:

*View the enlarged image

The new law also removed language that previously allowed a 15-day extension for Final Reports and substituted language stating that a Final Report must be filed "within 10 days of the dissolution of a campaign or committee."

Contribution Limits:

The Georgia Ethics in Government Act directs the Commission to raise or lower contribution limits by $100 increments based on inflation or deflation. However, the Commission has not determined that a change is necessary this year, and has not made any changes since December 2010. Contribution limits differ depending on whether or not a candidate is seeking statewide office and apply equally to individuals, corporations, and political committees.

*Source: Georgia Government Transparency and Campaign Finance Commission

Additional Resources:

- Georgia Government Transparency and Campaign Finance Commission

- Announcement Regarding HB 143's Impact on County and Municipal Officials

- Georgia Lobbyist Disclosure Report Filing Schedule

- Georgia Campaign Finance Filing Schedules

- Background on the Bills and Legislative Debate from Angelle C. Smith at Covington & Burling, LLP