OFAC Publishes New Guidance on Russian Oil Price Cap with Impact on Maritime Services

Highlights

- The U.S. Department of the Treasury Office of Foreign Asset Control (OFAC) has published its much-anticipated Russian oil price cap rule along with related general licenses and compliance guidance, all of which directly impact a wide range of the maritime sector to include trading/commodities brokering, financing, shipping, protection and indemnity (P&I) insurance and reinsurance, flagging and customs brokering.

- OFAC released a determination pursuant to Executive Order 14071 (the Determination) restricting certain services related to the maritime transport of crude oil of Russian Federation origin (Russian oil) that exceeds a certain price on Nov. 21, 2022.

- OFAC provided additional guidance regarding the Determination explaining when Russian oil is not subject to the determination and requirements for safe harbor from OFAC enforcement actions.

The U.S. Department of the Treasury Office of Foreign Asset Control (OFAC) on Nov. 21, 2022, published a determination pursuant to E.O. 14071 prohibiting U.S. persons from providing certain services related to the maritime transportation of crude oil of Russian Federation origin (Russian oil) that exceeds a price cap (the Determination). This Determination is part of an ongoing effort by the U.S. and an international coalition to maintain a steady oil supply to the global market without further enriching the Russian Federation. OFAC additional guidance (the Guidance) sets forth a range of complex rules for when a price cap applies. While the Guidance makes clear that imports into the United States are not allowed, maritime industry stakeholders and others who might be involved in Russian oil transactions elsewhere should review the Determination and Guidance carefully.

Specifically, the Determination authorizes U.S. persons to provide the following services related to the maritime transport of Russian oil, provided it is purchased at or below a certain price:

- trading/commodities brokering

- financing

- shipping

- insurance, including reinsurance and protection and indemnity (P&I clubs)

- flagging

- customs brokering

The Determination goes into effect on Dec. 5, 2022. However, any Russian oil loaded onto a vessel at the port of loading prior to 12:01 a.m. EST Dec. 5, 2022, and unloaded at the port of destination no later than 12:01 a.m. EST Jan. 19, 2023, is grandfathered, and therefore not subject to the Determination.

Additional OFAC Guidance

OFAC has recently released policy guidance regarding its implementation of the Determination, which includes specific guidance on the price cap requirements for safe harbor from OFAC enforcement actions.

Calculating the Price Cap

The price cap for Russian oil will be set by the Price Cap Coalition, an international coalition that includes the G7, European Union (EU) and Australia, but has not been released at this time. However, OFAC has stated that shipping, freight, customs and insurance costs will not be included when calculating the price cap. These additional costs must be invoiced separately and at commercially reasonable rates. The Guidance notes that any additional costs that are not commercially reasonable will be viewed as a sign of potential evasion of the price cap. How OFAC will determine what is or is not "commercially reasonable" is not specified.

Substantial Transformation

OFAC Guidance states that the price cap does not apply to subsequent sales transactions once Russian oil has cleared customs in a jurisdiction other than the Russian Federation. That is, the price cap does not apply for any further "onshore" sales. However, if the oil is reexported without further processing (without being "substantially transformed" in U.S. Customs terminology), then it is subject to the price cap once again.

Generally, when a product is substantially transformed, its country of origin becomes the country in which it was substantially transformed. However, "substantially transformed" is not expressly defined in the Guidance, although OFAC provides an example that when a product loses its identity and is transformed into a new product having a new name, character and use, in a jurisdiction other than the Russian Federation, it may have become "substantially transformed" and no longer considered to be of Russian Federation origin. Notably though, OFAC does not consider blending of crude oil alone to be substantial transformation. However, OFAC does note that it would not consider a shipment of Russian oil solely because it contains a de minimis amount of crude oil left over from a container or tank.

In practice, such assessments of when a product is "substantially transformed" are usually far from clear and require additional careful analysis of various U.S. agency interpretations and U.S. Customs rules to avoid running afoul of the OFAC prohibitions. For purposes of assessing whether crude oil is of Russian origin, U.S. persons may reasonably rely upon a certificate of origin, but they should exercise caution if they have reason to believe such certificate has been falsified or is otherwise erroneous, and thus must continue to conduct heightened due diligence on all Russian oil transactions.

Safe Harbor Requirements

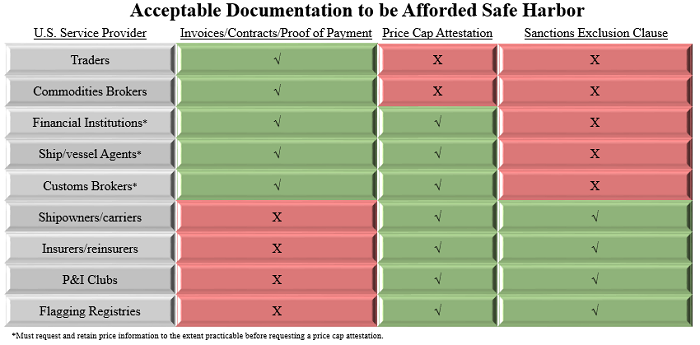

U.S. service providers that comply with recordkeeping and attestation requirements will be afforded safe harbor for OFAC enforcement action taken for violations of the Determination. OFAC has divided safe harbor requirements into three tiers:

- Tier 1. Tier 1 actors include traders and commodities brokers. They must maintain and retain information showing that Russian oil was purchased at or below the price cap. Acceptable forms include invoices, contracts, receipts/proof of payment or other documentation that shows price information.

- Tier 2. Tier 2 actors include financial institutions, ship/vessel agents and customs brokers. They must request and retain similar price information as Tier 1 actors, but may accept a written attestation from their customer if price information is unavailable.

- Tier 3. Tier 3 actors include shipowners/carriers, insurers/reinsurers/P&I clubs and flagging registries. They may accept a written attestation from their customers similar to Tier 2 actors. Additionally, Tier 3 actors may include sanctions exclusion clauses in all policies and contracts to include preexisting sanctions exclusion clauses or clauses specific to the maritime transport of Russian oil purchased above the price cap.

All records and attestations must be maintained for five years in accordance with 31 C.F.R. Part 501.604. The Table below lists acceptable "safe harbor" documentation (green checked items) for each U.S. service provider. This is not an exhaustive list of acceptable documentation.

Impact on the Maritime Sector

The Determination and Guidance is only the next compliance measure by the U.S. government in what have been several years of concerted effort to more closely scrutinize global trade within the complex maritime sector. (See previous Holland & Knight alerts, "U.S. Sanctions on Russia: Impact on Shipping Business and Contractual Considerations," March 7, 2022, and "Executive Order Targeting Russian Energy Sector Has Immediate Effect on Shipping Industry," March 14, 2022). Moreover, the Determination raises the stakes for U.S. service providers: affected U.S. parties now must follow an attestation process that should be developed on a bespoke basis, but they still must continue to conduct case-by-case due diligence and risk assessments. They must also be prepared to evaluate and explain whether they "knew or had reason to know" Russian oil was purchased above the relevant price cap using falsified or erroneous documentation. Thus, the attestation and recordkeeping burden placed on shipowners should not be treated as a trivial matter.

How We Can Help

For additional information or questions regarding the determination, associated guidance or any other trade-related matters, please contact the authors or another member of Holland & Knight's International Trade Group.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem, and it should not be substituted for legal advice, which relies on a specific factual analysis. Moreover, the laws of each jurisdiction are different and are constantly changing. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. If you have specific questions regarding a particular fact situation, we urge you to consult the authors of this publication, your Holland & Knight representative or other competent legal counsel.