SEC Chair Takes Heat for Agency's Continuing Workforce Challenges

SEC Chair Gary Gensler is facing criticism from lawmakers concerned that the agency's "aggressive agenda" is endangering the U.S. securities markets, in part due to challenges the SEC is facing from staffing shortages and higher-than-usual employee attrition, as detailed in an Oct. 13, 2022, report from the SEC's Office of Inspector General (OIG Report).

The OIG Report references four areas where the SEC faces management and performance challenges to varying degrees: 1) meeting regulatory oversight responsibilities; 2) protecting systems and data; 3) improving contract management; and 4) ensuring effective human capital management.1

Regarding the first area, the OIG Report notes that the SEC proposed 26 new rules in the first eight months of 2022, which is more than twice as many new rules proposed in 2021 and more than in each of the previous five years. OIG Report at 2. The OIG Report also identifies a variety of related staffing challenges, including difficulties hiring individuals with rulemaking experience, reliance on temporary workers with little or no experience in rulemaking, and shortened drafting and public comment periods (comment periods the Commission establishes itself and recently extended for a number of proposed rules and rule amendments).2 According to the OIG Report, these challenges may have negative impacts, including limited time for staff research and analysis and increased litigation risk. Id. at 3.

High Turnover

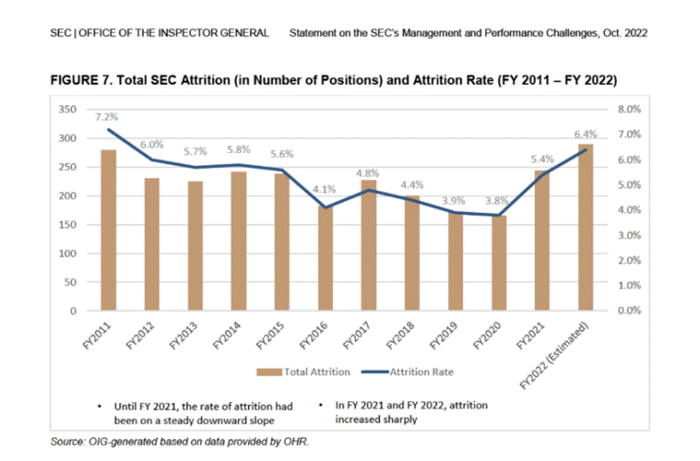

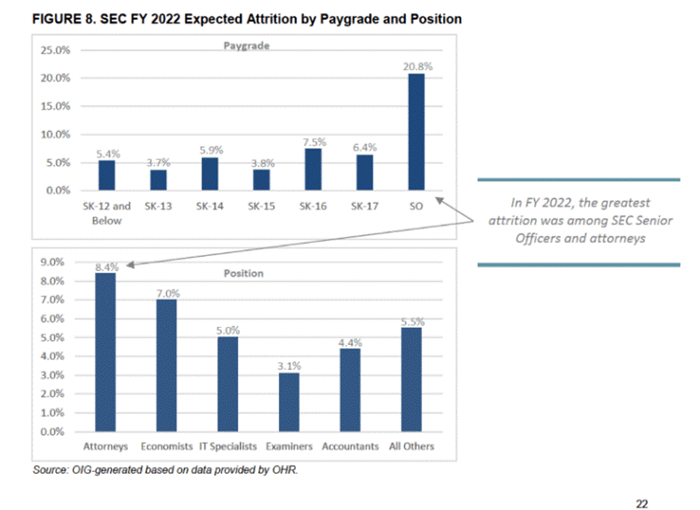

Employee attrition — now at its highest rate in 10 years — is one of the biggest challenges the SEC faces, according to the OIG Report. As noted in the fourth area of the OIG Report, the SEC is experiencing a significant increase in attrition during the last few years, from 3.8 percent in fiscal year 20203 to an estimated 6.4 percent in fiscal year 2022 (which ended Sept. 30, 2022). OIG Report at 21. "Most concerning is the increased attrition in Senior Officer and attorney positions, expected to be about 20.8% and about 8.4% for [fiscal year] 2022, respectively."4 Id.

The increased attrition rate is illustrated here:

OIG Report at 22.

And here:

Id.

The OIG posits that the SEC may see even more attrition when it requires employees to return to the office following the COVID-19 pandemic, a deadline the agency has repeatedly bumped back, including recently pushing it back from Sept. 6, 2022, to Jan. 9, 2023. OIG Report at 26.

However, increasing attrition is not unique to the SEC. According to the Partnership for Public Service, fiscal year 2021 government-wide attrition rates averaged 6.1 percent, with certain groups experiencing even higher rates, such as women (6.4 percent) and executives (9.2 percent). OIG Report at 23.

The agency's staffing challenges have not gone unnoticed by lawmakers. On Oct. 25, 2022, two ranking members on the House Financial Services Committee, Patrick McHenry (R-N.C.) and Bill Huizenga (R-Mich.), wrote a letter to Committee Chair Maxine Waters (D-Calif.) requesting that Chair Gensler testify before the committee on this and other issues. And on Oct. 27, 2022, six members of the Senate Banking Committee — Sens. Thom Tillis (R-N.C.), Mike Crapo (R-Idaho), Tim Scott (R-S.C.), M. Michael Rounds (R-S.D.), Bill Hagerty (R-Tenn.) and Steve Daines (R-Mont.) — issued a letter (Senate Letter) to Chair Gensler expressing their "deep concerns" about the "operational integrity" of the SEC. Citing several "grave deficiencies" in the OIG Report, including the agency's workforce, level of rulemaking experience and length of public comment periods, the Senators requested Chair Gensler address several questions by Nov. 11, 2022, including whether he: 1) knew about the challenges outlined in the OIG Report prior to its publication; 2) disagrees with the OIG's findings; 3) has spoken to SEC division managers or staff about the challenges; 4) can provide any assurances that he will consider all possible solutions to ensure that the SEC can operate effectively and fulfill its mission; and 5) will commit to slowing the pace of agency rulemaking. Senate Letter at 2-3.

The Senate Letter concludes with the statement that, "[a]ny efforts to ram through hurried rulemaking without proper analysis, deliberation or consideration of downstream negative impacts is nothing sort of regulatory malpractice." Senate Letter at 3. In closing, the Senators suggested the SEC "focus on ensuring it meets its mission requirements to protect investors, maintain fair, orderly, and efficient markets, and facilitate capital formation." Id. Chair Gensler has not responded to the Senate Letter as of the date of this blog post.

Addressing Challenges

In the meantime, the agency has taken steps to combat some of the workforce challenges it faces, including launching a new program called "LEAD" (Leadership, Evaluation, Accession and Development) in August 2022 to "help SEC employees develop the leadership skills necessary to apply for future Senior Officer opportunities." OIG Report at 23. To help attract talent, the SEC has issued a 2022-2024 recruiting plan "which identifies strategies to attract diverse talent and to aid in filling mission critical occupations that have been deemed hard-to-fill," including "branding and marketing that speaks to prospective applicants," a multimedia recruitment and agency branding campaign that highlights successes of current SEC employees, developing a comprehensive internal communications strategy, and "creating an overarching recruitment, outreach, and engagement tool to enhance the recruitment process." Id. at 24. However, the agency already has discontinued the "Performance Incentive Bonus program," an employee retention program it implemented only a year ago. Id. It is too soon to tell if any of these events will have an impact on recruitment or retention, or what the net effect will be.

In the short term, the SEC is seeking to hire more employees. The agency requested 5,2621 positions in its fiscal year 2023 Congressional Budget Justification, an increase of 454 positions from fiscal year 2022. OIG Report at 24. However, stiff competition from the private sector — which offers higher wages than the SEC typically does — and a significant delay in onboarding new employees, which clocks in at an average of 98 days (more than twice as long as the private sector), are adding to existing staffing difficulties. Id.

The OIG Report identified several steps the agency is taking, or plans to take, to overcome the hiring and retention challenges it faces, including: 1) evaluating workplace safety protocols developed in response to the COVID-19 pandemic; 2) reviewing the agency's upward mobility program; 3) monitoring the SEC's progress in addressing prior open audit recommendations related to human capital management; 4) auditing the agency's small business contracting to assess the SEC's efforts to promote diversity, equity, inclusion, accessibility and opportunity; and 5) assessing the operations and controls over the agency's equal employment opportunity program. OIG Report at 26.

Conclusion

Time will soon tell if the results of the upcoming midterm elections will alter the pressure on Chair Gensler to ramp up hiring, tamp down his desired agenda or even back off some of the agency's new initiatives, including recent rules on incentive compensation as discussed by this blog, and climate-related disclosures, discussed here and here. The SECond Opinions Blog will continue to monitor the situation, including any response to the Senate Letter by Chair Gensler, through scheduled testimony or otherwise, and will provide important updates.

Notes

1 See also Feb. 28, 2022, OIG Audit Report, "The SEC Can Improve in Several Areas Related to Hiring" (identifying several key areas for improvement, including management controls over data entry, consistent and accurate quarterly reviews, and improved pay-setting guidance). OIG Report at 24-25.

2 In October 2022, the SEC reopened the public comment period for 11 rule making proposals, one request for comment and eight Self-Regulatory Organization matters following the discovery of a technical glitch that prevented the agency from receiving all comments. See Oct. 7, 2022, SEC release and SECond Opinions blog post discussing same.

3 External factors that reduced attrition in 2020 that are not considered in the OIG Report may include the possibility that employees might have been less willing to change employers due to uncertainty during the height of the COVID-19 pandemic.

4 Contributing to the exodus is increased activity in the agency's Enforcement and Examination Divisions, combined with a strong economic recovery in 2021 and early 2022, which have led to high demand for experienced, senior SEC personnel in the private sector.