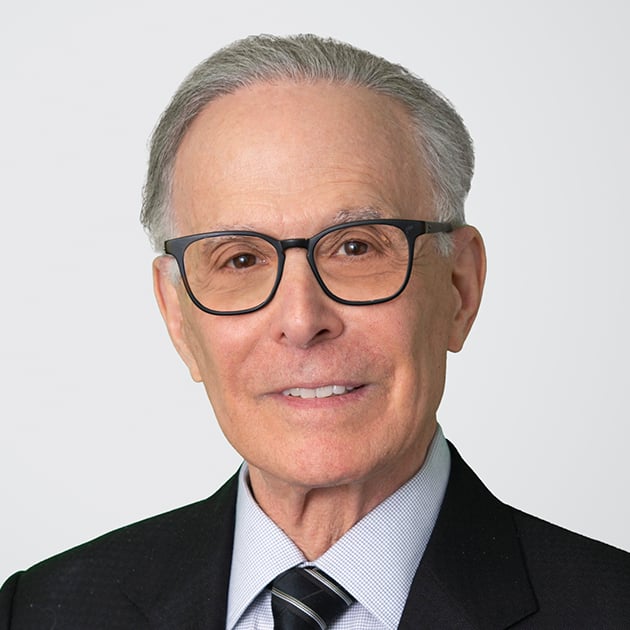

Alan Winston Granwell

Of Counsel

Overview

Alan Granwell is an attorney in Holland & Knight's Washington, D.C., office, with more than 50 years of experience in international taxation. In his long and wide-ranging career, he has represented multinational corporations and globally oriented high-net-worth clients in a broad array of international tax planning, compliance and controversy matters, including serving as an expert witness.

Mr. Granwell also advises on tax transparency initiatives, including the Corporate Transparency Act (which will have widespread application to privately held companies and their beneficial owners), the Foreign Account Tax Compliance Act, the Common Reporting Standard and the U.S. Department of Justice Swiss Bank Program.

In the early 1980s, Mr. Granwell was the International Tax Counsel and Director, Office of International Tax Affairs, U.S. Department of the Treasury. In that capacity, Mr. Granwell was the senior international tax adviser at the Treasury Department and was responsible for advising the Assistant Secretary for Tax Policy on legislation, regulatory and administrative matters involving international taxation and directing the U.S. tax treaty program.

Mr. Granwell began his career working at Wall Street law firms. He then moved to Washington, D.C., to accept his government appointment to work for the Treasury Department. Thereafter, he returned to private practice in Washington, D.C. Prior to joining Holland & Knight, Mr. Granwell was a tax attorney for a boutique international tax law firm.

Mr. Granwell is a Fellow of the American College of Tax Counsel and a well-known, frequent commentator and lecturer on international tax matters. He has authored numerous articles for publications, both in the United States and abroad. He has made presentations for the American Bar Association, Section of Taxation, the International Bar Association, the International Fiscal Association, the Society of Trust and Estate Practitioners (STEP) and other organizations in numerous countries around the world. Mr. Granwell also is an active member of the STEP, particularly organizing, moderating and presenting at educational webinars, and is a former chair of the Mid Atlantic Branch, the current Co-Director of Programs for the Mid Atlantic Branch, and a frequent contributor to STEP USA Alerts.

Credentials

- New York University School of Law, LL.M.

- Boston University School of Law, LL.M., Taxation

- Boston University School of Law, J.D.

- Middlebury College, A.B.

- District of Columbia

- Massachusetts

- New York

- U.S. Tax Court

- U.S. Court of Federal Claims

- U.S. District Court for the Southern District of New York

- U.S. District Court for the Eastern District of New York

- U.S. Court of Appeals for the Second Circuit

- Society of Trust and Estate Practitioners (STEP), Mid-Atlantic Branch, Vice-Chair: Programs

- International Bar Association, Taxation Section (Taxes and Individual Tax and Private Client)

- International Fiscal Association

- American Bar Association, Section of Taxation

- District of Columbia Bar Association, Tax Section

- New York State Bar Association, Tax Section, Nonresident Member

- International Tax and Finance Forum, A Private Tax Discussion Group (Washington, D.C.)

- Tax Review, A Private Tax Discussion Group (New York, N.Y.), Founding Member

- Washington International Tax Study Group (Washington, D.C.), A Private Tax Discussion Group

- The Best Lawyers in America guide, Tax Law, 2006-2026

- Who's Who Legal: Corporate Tax, 2022; Corporate Tax - Advisory, 2022

- Washington, D.C., Super Lawyers magazine, 2018