Summary: Financial Aid in Legislative and Administrative Responses to COVID-19

Congress has completed two rounds of legislation in response to the coronavirus (COVID-19) pandemic and resulting economic crisis. These include an $8.3 billion supplemental appropriation (round 1) signed into law on March 6, as well as the Families First Coronavirus Response Act (round 2), which President Trump signed into law on March 18. Debate on the third round is now underway following Senate Majority Leader Mitch McConnell’s release of the $1 trillion Senate Republican proposal, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Soon after passing a third round of legislation, Congress is expected to turn to the Administration's requested additional supplemental appropriation of $45.8 billion.

The two laws, as well as the proposed legislation and requested additional supplemental appropriation, contain a wide range of economic relief measures aimed at directing financial aid to individuals and employers affected by the current crisis. This summary provides an outline of these measures and which industries and sectors might benefit.

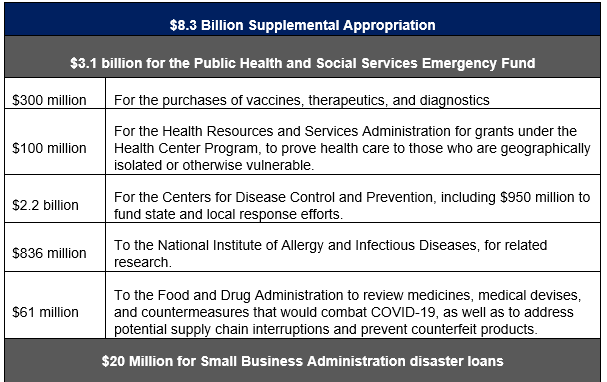

Congressional Round 1: $8.3 Billion Supplemental Appropriation

This initial measure appropriated $8.3 billion for operations across government. Included in these were the following amounts:

Congressional Round 2: Families First Coronavirus Response Act

The Families First Coronavirus Response Act was enacted into law on March 18, 2020. Key provisions of interest to employers are the Emergency Family and Medical Leave Expansion Act, Emergency Paid Sick Leave Act and corresponding tax credits available to employers to offset some of the associated costs. The Act is limited in direct financial assistance but includes the following provisions:

- A new private sector emergency family medical leave requirement, as well as an emergency paid sick leave requirement, discussed in detail here.

- Employers with fewer than 500 employers are forced to offer this leave, and the Labor Department can exempt employers with fewer than 50 employees.

- To offset some of the costs of these two new mandates, the law also created employer tax credits. These credits are dollar-for-dollar credits based on the wages paid, but are limited both daily and in the aggregate.

- For example, under the Emergency Paid Sick Leave Act, the credit is capped at $511 per day, or $200 if for employees who take leave to care for others or for childcare. The credit is refundable.

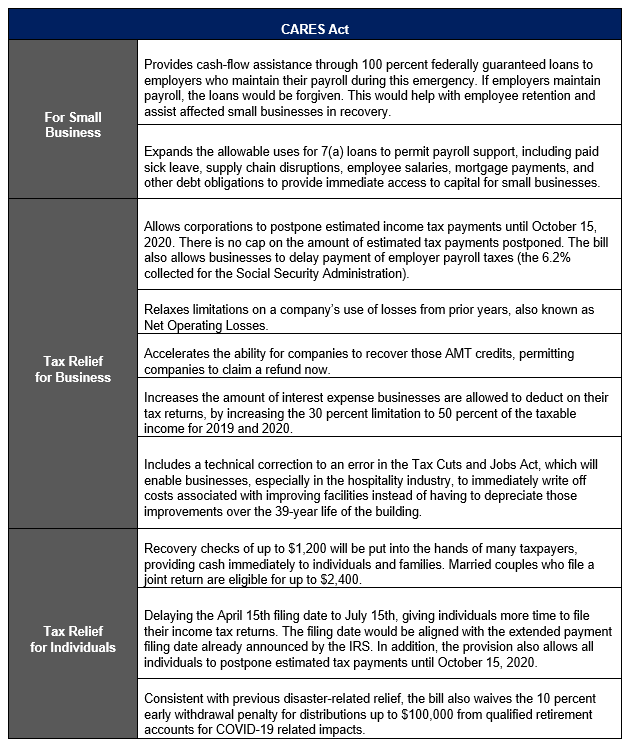

Potential Congressional Round 3: CARES Act

Majority Leader Mitch McConnell has released the Senate Republican proposal for round three, which is now the subject of negotiation between Senate Democrats and Republicans. The bill includes provisions on small business relief, tax relief for individuals and businesses, liquidity assistance for distressed business, and health care provisions, including the following measures:

The bill will continue to be negotiated and although we expect round 3 to become law, it will be with modifications.

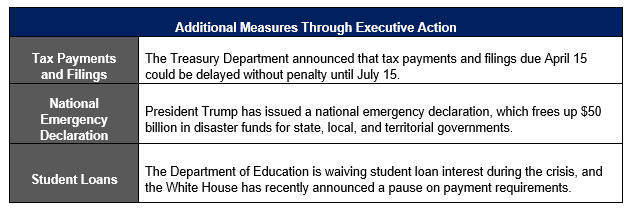

Additional Measures Through Executive Action

The Administration has taken several steps using existing authority and in response to the COVID-19 pandemic, including:

DISCLAIMER: Please note that the situation surrounding COVID-19 is evolving and that the subject matter discussed in these publications may change on a daily basis. Please contact the author or your responsible Holland & Knight lawyer for timely advice.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem. Moreover, the laws of each jurisdiction are different and are constantly changing. If you have specific questions regarding a particular fact situation, we urge you to consult competent legal counsel.