New Tariff Nomenclature in Mexico Can Be Requested by Private Entities

Through the new General Import and Export Tax Law (Ley de los Impuestos Generales de Importación y Exportación or LIGIE) of July 1, 2020, the Mexican legislation established the faculty of the Ministry of Economy to adopt new tariff rates, through the addition of Commercial Identification Numbers (números de identificación comercial or NICO) to the Mexican Harmonized System (HS) Codes.1

The decree published on Aug. 28, 2020, in Mexico's Official Gazette (Diario Oficial de la Federación or DOF in Spanish), indicates the procedure to request the creation or modification of the NICOs.2

On Nov. 17, 2020, and Nov. 18, 2020, the DOF published two decrees that establish the NICOs and the tariff correlation charts of the LIGIE tariff.3

Also, on Dec. 27, 2020, two additional decrees were published in the DOF. In the first decree, certain HS Codes of the First and Second Articles of the decree published on Nov. 17, 2020, were amended (modified, added and derogated).4 The second decree modified the Single Article of the decree published on Nov. 18, 2020, to add the correlations of the pending HS Codes.5

With the NICOs in force, Mexico joined the practice of the main users of international trade such as the United States, China, Canada and Korea, among others, that use this type of identifier. Previously, the Mexican tariff rates were arranged in eight-digit codes (which were known as HS Codes), in accordance with the practice established by the HS of the World Customs Organization (which assigns six-digit codes, allowing participating countries to classify beyond the six-digit level).6

Among the objectives pursued by the NICOs are to facilitate the identification of merchandise without modifying the LIGIE rate and improve statistical information for the development and implementation of public policies. They also help in foreign trade audits by allowing improved traceability and identification of imported merchandise or goods (for example, quickly identifying items that may pose health threats or identify goods that are subject to commercial conflicts), which will avoid requiring the exercise of presidential power to impose tariff sanctions and modify the LIGIE, among others.

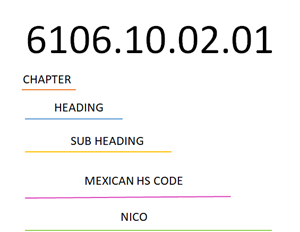

The NICOs consist of two digits placed after the HS Code (an eight-digit code) and shall be arranged progressively from 00 to 99. For a better understanding, please find below an image that illustrates the integration of the NICO:

The creation of the NICOs follows three criteria: 1) abide to the nomenclature and rules of interpretation of the HS, 2) customs effectiveness in order to avoid obstacles in the customs clearance and 3) annual commercial value of at least US$1 million (except in case of national security or public health purposes that require their creation).

By virtue of this, not all merchandise shall be accompanied by a NICO other than the generic double zero (00). However, new NICOs can be established as long as the three criteria abovementioned are met, which creation and adjustments shall be made twice a year.

Holland & Knight has trained personnel to carry out the necessary procedures to create or modify a NICO related with the goods that are to be imported or exported.

The NICOs applicable in Mexico as of Dec. 28, 2020, can be consulted at the National Foreign Trade Information Service website.

Notes

1 LIGIE, Article 2, Paragraph II, Complementary Rule 10, published on July 1, 2017.

2 DOF, "Decree on the Establishment of the Methodology for the Creation and Modification of the NICO," Aug. 28, 2020.

3 DOF, "Decree for the Establishment of the NICO and Tariff Correlation Charts," Nov. 17, 2020; DOF, "Decree for the Establishment of the Correlation Tables Corresponding to the HS Codes of the LIGIE Rate of 2012 and 2020," Nov. 18, 2020.

4 DOF, "Decree Amending the Establishment of the NICO and Tariff Correlation Charts," Dec. 27, 2020.

5 DOF, "Decree Amending the Establishment of the Correlation Tables Corresponding to the HS Codes of the LIGIE Rate of 2012 and 2020," Dec. 27, 2020.

6 National Foreign Trade Information Service (SNICE in Spanish), General Information; WTO, Glossary Term, Harmonized System.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem, and it should not be substituted for legal advice, which relies on a specific factual analysis. Moreover, the laws of each jurisdiction are different and are constantly changing. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. If you have specific questions regarding a particular fact situation, we urge you to consult the authors of this publication, your Holland & Knight representative or other competent legal counsel.