Highlights from the SEC Division of Enforcement FY 2021 Annual Report

Highlights

- The U.S. Securities and Exchange Commission's (SEC) Division of Enforcement (Division) published its Annual Report for Fiscal Year 2021 on Nov. 18, 2021.

- The Annual Report – the first issued under new Enforcement Director Gurbir Grewal – summarizes the Division's enforcement results for the fiscal year (FY), which ran from Oct. 1, 2020, to Sept. 30, 2021.

- The Division brought first-of-their-kind actions as well as actions concerning digital assets and cryptocurrency exchanges.

The U.S. Securities and Exchange Commission's (SEC) Division of Enforcement (Division) published its Annual Report for Fiscal Year 2021 on Nov. 18, 2021. The Annual Report – the first issued under new Enforcement Director Gurbir Grewal – summarizes the Division's enforcement results for the fiscal year (FY), which ran from Oct. 1, 2020, to Sept. 30, 2021. The Annual Report highlights 434 newly filed actions, which constitutes a 7 percent increase in new actions over the prior fiscal year. The increase comes despite the ongoing challenges posed by the COVID-19 pandemic, including the SEC's continued telework mandate.1 However, while new actions increased year-over-year, the Division only filed 697 total actions in FY 2021 (combining new and follow-on actions), marking a dip from 715 total filed actions in FY 2020.

Though shorter than previous annual reports and presented as a press release rather than a lengthier brochure as in recent years, the Annual Report highlights key takeaways, including 1) a decrease in total enforcement actions but an increase in newly filed standalone actions, 2) a record-breaking year for the whistleblower program, 3) a decrease in disgorgement awards but an increase in penalties, 4) a boost in monetary settlements, 5) a decrease in admissions of wrongdoing by public company and subsidiary defendants and 6) a rise in COVID-related enforcement actions.

Enforcement Activity

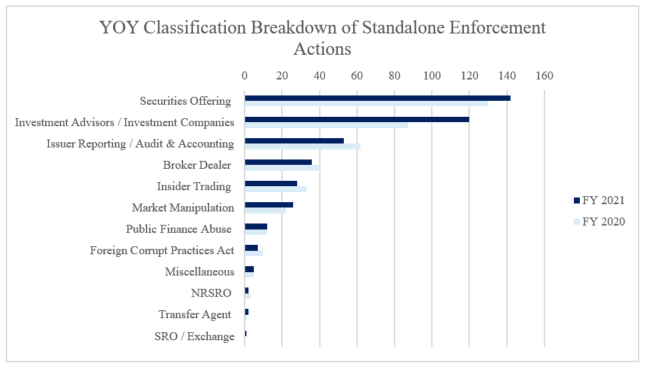

The Division's 697 enforcement actions in FY 2021, including 434 new actions,2 spanned a wide variety of alleged violations, including books and records issues, disclosure and accounting fraud, insider trading, registrant violations and actions focused on cryptocurrency and special purpose acquisition companies (SPAC).3 A year-over-year comparison of the Division's new, standalone actions shows the following:

Sources: U.S. Sec & Exch. Comm’n, Annual Report Addendum FY 2021, supra note 2, at 1; U.S. Sec & Exch. Comm’n, Division of Enforcement 2020 Annual Report, at 29 (2020).

In FY 2021, the Division filed 53 new actions against public companies and their subsidiaries – the lowest number of such actions in the past seven years.4 Of those, 51 percent were based on alleged issuer reporting and disclosure violations.5

Reflecting on the Division's results, Director Grewal, who was appointed to his post in June 2021, stated, "[t]his year has seen a number of critically important and first-of-their-kind enforcement actions, as well as record-breaking achievements for our whistleblower program, which we expect will lead to even more successful actions in the future." Among those actions the Division highlights in its Annual Report (all of which are included in a detailed addendum indexing every action filed in FY 2021) are matters focused on:

- issuer disclosure and financial fraud

- securities offerings

- market integrity and market manipulation, including insider trading, registrant compliance and meme stocks

- Foreign Corrupt Practices Act (FCPA) enforcement

- accountability of investment professionals, gatekeepers (like certified public accountants (CPAs), auditors and attorneys) and individual actors

- first-of-their-kind actions involving cryptocurrency, decentralized finance, the dark web, Regulation Crowdfunding and Form CRS

Public Company, Individual and Gatekeeper Accountability

The Report highlights cooperation by 58 percent of public companies and subsidiary defendants in FY 2021, which mirrors the average cooperation rate from FY 2012 through FY 2020.6 However, 40 percent of defendants who negotiated monetary settlements did not cooperate – the most since FY 2017 and a 7 percent increase from FY 2020.7 This is noteworthy, considering an observed increase in the frequency and substance with which the Division addressed cooperation credit in its press releases and other statements in FY 2021 – a trend that is expected to continue.

For example, in In re Cheesecake Factory Inc.,8 the Cheesecake Factory agreed to pay a $125,000 civil penalty and cease and desist from future violations of Sections 13(a) of the Securities Exchange Act and Rules 12b-20 and 13a-11 thereunder.9 In that action, the SEC alleged that in the midst of the mounting pandemic, the Cheesecake Factory reported that its restaurants were "operating sustainably" despite internal documents showing otherwise.10 In its order, the SEC expressly noted that it took the company's cooperation into account. In announcing the action, then-SEC Chairman Jay Clayton noted the SEC will give "appropriate credit for prompt and substantial cooperation in investigations."11

Also of note, no public company or subsidiary defendants were required to admit wrongdoing in FY 2021.12 Longstanding Division practice typically permits defendants to neither admit nor deny allegations against them when settling, unless certain factors are present that warrant requiring admissions. The number of public company and subsidiary defendants admitting wrongdoing has consistently dropped in recent years from five in 2019 to two in 2020 and zero in 2021.13 Despite this downward trend, both Grewal and Chair Gary Gensler recently announced a renewed vigor to seek admissions in cases where "heightened accountability and acceptance of responsibility are in the public interest."14

Additionally, the Division, similar to previous years, also kept its focus on holding individuals and gatekeepers accountable for their actions. The Annual Report touts various examples where the Division secured orders barring multiple individuals from serving as public company officers or directors because of misdeeds.15 The Annual Report also highlights actions against CPAs, attorneys, consultants and others.16

Record Year for the Whistleblower Program

The Division credits the agency's robust Whistleblower Program for the 7 percent increase in new enforcement actions over the previous fiscal year.17 A product of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Whistleblower Program contains numerous provisions that encourage employees to come forward with suspicions of possible securities law violations.18 For FY 2021, the SEC Whistleblower Program received 12,200 whistleblower tips and issued $564 million in whistleblower awards to 108 individuals.19

Disgorgement and Penalties

In 2017, the U.S. Supreme Court decided Kokesh v. SEC.20 Kokesh held that because disgorgement was punitive, it is considered a penalty for the purposes of 28 U.S.C. § 2462 and must comply with a five-year statute of limitations period. But the Kokesh decision did not address whether disgorgement could be considered equitable relief under 15 U.S.C. § 78u(d)(5) until Liu v. SEC in 2020.21 (See Holland & Knight's previous alert, "Supreme Court Permits SEC Disgorgement of Net Profits in Liu v. SEC," June 22, 2020.) There, the Court held that disgorgement not exceeding a wrongdoer's net profits and awarded to victims is equitable relief under § 78u(d)(5). Furthermore, the implementation of the National Defense Authorization Act statutorily codified the SEC's right to seek disgorgement on scienter-based claims and expanded the statute of limitations from five years to 10 years. (See Holland & Knight's previous alert, "National Defense Authorization Act Codifies SEC's Right to Seek Disgorgement; Grants Agency a 10-Year Statute of Limitations in Certain Cases," Jan. 13, 2021.)

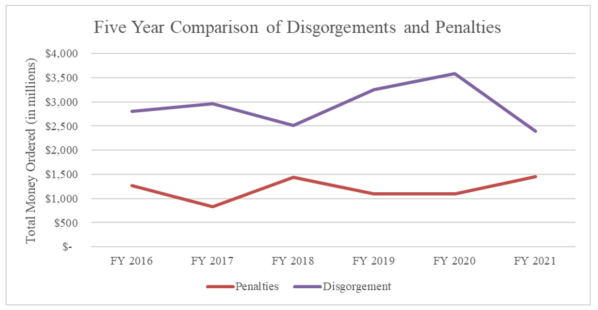

As a result of these rulings, many expected the SEC would sharpen its focus on penalty calculations and awards – especially in insider trading actions where disgorgement cannot be tied to identifiable harmed investors. The Division's Annual Report confirms this expectation, showing a 33 percent decrease in disgorgement and a 33 percent increase in penalties for FY 2021.22 FY 2021 penalties totaled $1.456 million, compared to $1.091 million in FY 2020, while total disgorgement in FY 2021 was $2.396 million, compared to $3.589 million in FY 2020.

Source: U.S Sec & Exch. Comm’n, Annual Report Addendum FY 2021, supra note 2, at 2.

Looking Ahead

In FY 2021, the Division adjusted to the priorities and pace of the newly appointed SEC chair and repeatedly emphasized its pro-enforcement stance. The Division also demonstrated a willingness to pursue novel legal theories, as shown in the DeFi Money Market,23 dark web insider trading24 and shadow trading25 actions filed in FY 2021. As is its mission, the Division will continue to investigate and charge alleged violations in the coming year, and the staff is expected to continue leveraging its increasing arsenal of data analytics and strong interagency relationships to do so with an eye to increased efficiency and parallel action with the U.S. Department of Justice (DOJ) and other law enforcement. Looking ahead, it appears that the Division will focus on:

- individual accountability for senior management, gatekeepers and other actors

- private and public company financial statement and disclosure matters including, but not limited to, revenue; cybersecurity; environmental, social and corporate governance (ESG); and SPACs

- private funds, conflicts of interest and registrant compliance

- cryptocurrency and decentralized finance

- seeking admissions "where heightened accountability and acceptance of responsibility are in the public interest"26

- notwithstanding an increased effort to obtain admissions, finding opportunities to encourage and discuss self-reporting and cooperation credit

For more information about the FY 2021 Annual Report, please contact the authors.

Related Article

Holland & Knight Partners Bill Banowsky and Jessica Magee, along with Associate Jenna Johnson, co-authored the Securities Regulation chapter in the 2021 SMU Annual Texas Survey, published by the Southern Methodist University Dedman School of Law. The chapter focuses on developments in securities regulation law from Dec. 1, 2019, to Nov. 30, 2020, including Texas and federal enforcement actions and trends, a review and evaluation of the Texas Securities Act and federal securities law cases, U.S. Securities and Exchange Commission (SEC) priorities and policy shifts under the Biden Administration, as well as predictions for the year ahead.

Notes

1 U.S. Sec. & Exch. Comm’n, SEC Coronavirus (COVID-19) Response (Oct. 28, 2021). In an update on its COVID-19 Response website, the Division reports that it, like many other businesses and agencies across the country and the world, would continue to implement a "full telework posture with limited exceptions" until at least Jan. 3, 2022. Id. With enforcement officers and corporate employees alike working remotely, onsite monitoring by compliance officers has decreased substantially.

2 U.S. Sec & Exch. Comm’n, Addendum to Division of Enforcement Press Release Fiscal Year 2021, at 2 (2021) [hereinafter Annual Report Addendum FY 2021].

3 Press Release, U.S. Sec. & Exch. Comm’n, SEC Announces Enforcement Results for FY 2021 (Nov. 18, 2021).

4 Cornerstone Research, SEC Enforcement Activity: Public Companies and Subsidiaries 3 (2021).

5 Id. at 4.

6 Id. at 6.

7 Id.

8 Press Release, U.S. Sec. & Exch. Comm’n, SEC Charges the Cheesecake Factory for Misleading COVID-19 Disclosures (Dec. 4, 2020), [hereinafter SEC Charges the Cheesecake Factory].

9 According to the Order, the Cheesecake Factory’s cooperation with the SEC was an important factor leading the SEC to accept a settlement offer. See Order, U.S. Sec. & Exch. Comm’n, In re Cheesecake Factory Inc., File No. 3-20158, at 4 (Dec. 4, 2020).

10 Press Release, U.S. Sec. & Exch. Comm’n, SEC Charges the Cheesecake Factory, supra note 8.

11 Id.

12 Cornerstone Research, supra note 4, at 9.

13 Id.

14 Speech, U.S. Sec. & Exch. Comm’n, Prepared Remarks at the Securities Enforcement Forum (Nov. 4, 2021); see also Speech, U.S. Sec. & Exch. Comm’n, Remarks at SEC Speaks 2021 (Oct. 13, 2021).

15 See Press Release, U.S. Sec. & Exch. Comm’n, Enforcement Results FY 2021, supra note 3 (describing various individuals against whom bars were secured, including two CEOs charged with misleading investors and falsifying the company’s financial condition, respectively).

16 Id.

17 Id.

18 U.S. Sec. & Exch. Comm’n, Office of the Whistleblower: Statutes and Regulations (Oct. 7, 2021).

19 Press Release, U.S. Sec. & Exch. Comm’n, Enforcement Results FY 2021, supra note 3.

20 Kokesh v. SEC, 137 U.S. 1635 (2017).

21 Liu v. SEC, 140 U.S. 1936 (2020).

22 Press Release, U.S. Sec. & Exch. Comm’n, Enforcement Results FY 2021, supra note 3; see also U.S. Sec. & Exch. Comm’n, Annual Report Addendum FY 2021, supra note 2, at 2.

23 Press Release, U.S. Sec. & Exch. Comm’n, SEC Charges Decentralized Finance Lender and Top Executives for Raising $30 Million Through Fraudulent Offerings (Aug. 6, 2021).

24 Press Release, U.S. Sec. & Exch. Comm’n, SEC Charges The Bull with Selling “Insider Trading Tips” on the Dark Web (July 9, 2021).

25 Press Release, U.S. Sec. & Exch. Comm’n, SEC Charges Biopharmaceutical Company Employee with Insider Trading (Aug. 17, 2021).

26 Speech, U.S. Sec. & Exch. Comm’n, Prepared Remarks at the Securities Enforcement Forum, supra note 14.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem, and it should not be substituted for legal advice, which relies on a specific factual analysis. Moreover, the laws of each jurisdiction are different and are constantly changing. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. If you have specific questions regarding a particular fact situation, we urge you to consult the authors of this publication, your Holland & Knight representative or other competent legal counsel.

Holland & Knight LLP and Thompson & Knight LLP completed their merger effective August 1, 2021, becoming one of the largest law firms in Texas, with more than 300 attorneys in the state in four business centers – Austin, Dallas, Fort Worth and Houston. The combination expands the firms' collective capabilities in important industries, including energy, real estate and hospitality, financial services and technology. For more information on the merger, please click here.