2023 Mexican Tax Considerations for Mexican and Foreign Taxpayers

Although no major tax reform was adopted in Mexico as part of the 2023 Economic Package, changes at an international level and some being brought at the regulatory level could have significant implications for different sectors that will require action not only from Mexican taxpayers but also from foreign multinationals such as U.S.-parented corporate groups with Mexican operations.

This Holland & Knight alert touches on some of these changes, including anti-avoidance measures, limitations on treaty benefits, minimum global taxation, new filings and more that should be on the radar of investors or businesses transacting with Mexico or those that have any sort of presence in Mexico.

1. Mexican Tax Authorities Will Now Be Able to Enforce the General Anti-Avoidance Rule (GAAR)

Under the Mexican GAAR, implemented in 2020, acts that lack a business purpose could be disregarded for tax purposes. When that happens, the GAAR could cause the tax due to be recalculated and charged as if the taxpayer had chosen a legal arrangement adequate to pursue the reasonable economic benefit. Although the legal and commercial obligations will not be altered, the tax will be recalculated based on a hypothetical transaction or counterfactual scenario selected by the authorities as an adequate replacement for the original transaction.

Such rule, however, had remained dormant because its application requires the appointment of an advisory panel whose function is to review and approve the lack of business reason or the counterfactual in a specific circumstance. This year, Mexican treasury regulations include rules for the integration and functionality of the advisory panel. Hence, taxpayers should expect authorities to be adding this tool to their artillery to perform more sophisticated audits. Holland & Knight attorneys can help review past and future transactions accordingly to document and evidence the business purpose behind transactions to pass the GAAR test.

For more about the operation of the GAAR in Mexico, see "Mexico's GAAR: Will the Bullied Become the Bully?", Feb. 1, 2021.

2. Tax Treaty Benefits with Mexico Might Be Compromised

Sometimes, taxes otherwise levied in Mexico can be reduced or eliminated through the application of one of the more than 60 tax treaties that Mexico has signed with other jurisdictions.

At an international level, abuses of tax treaty benefits — along with other strategies to artificially shift profits to low-tax or no-tax locations — caused the Organization for Economic Co-operation and Development (OECD) to lead an effort in the middle of the last decade to curb these practices. One of its results was the implementation of a Multilateral Tax Treaty (MLI), signed in 2017 by more than 100 jurisdictions to automatically implement, upon ratification by each country, certain OECD accorded anti-abuse measures in their tax treaties.

The MLI was ratified by Mexico at the end of 2022. As such, the vast majority of its treaties will be subject to additional obligations in order to access their benefits.

In particular, one of the most concerning changes in treaties with Mexico will be the application of a new Principal Purpose Test (PPT). This test dictates that if one of the principal purposes of the action undertaken by the taxpayer was to obtain a benefit under the tax treaty with Mexico, such benefit could be denied.1 Because this is a facts-and-circumstances test and will apply at the discretion of Mexican authorities, the PPT has the potential to be a landmine that could blow any chances to access any treaty benefits.

This has made it of utmost importance for investors coming into Mexico or Mexican investors going abroad to review their international structures and to document every step of their decision as to why they choose to use x or y company or x or y jurisdiction and to properly reflect the levels of substance that multinationals should maintain in Mexico or in any relevant jurisdiction.

The MLI incorporates other rules related to the creation of permanent establishments in Mexico, hybrid mismatches and mutual agreement procedures, which as a positive aspect of the MLI, involves procedures to request agreements between administrations to avoid double taxation.

Although some effects of the MLI will be felt only until 2024, it is important for investors to start taking action and review their operations to determine whether any current payments could be affected by this new test.

3. Foreign/Mexican Multinationals Should Review Impacts of Implementation of the Global Minimum Tax by Mexico

Mexico has expressed its intention to implement what has been known as the Global Minimum Tax, which consists of two rules: 1) the Income Inclusion Rule (IIR), a top-up tax over low-taxed subsidiaries' income, and 2) the Under Tax Profits Rule (UTPR), a back-up tax applied when the IIR is not applicable and allegedly now also applicable even when there are no intragroup payments or payments to countries with low tax.

U.S.-parented groups with Mexican subsidiaries and the biggest companies in Mexico may resent the effects of the implementation in Mexico of this new provision, which could be reaching its final touches at the end of this year.

Under the IIR, Mexican multinationals with annual group revenue exceeding 750 million euros that are ultimate parents must pay a top-up tax in Mexico to bring its effective tax rate (ETR) on income generated in low-tax jurisdictions of up to 15 percent, after accounting for a substance-based carveout. Under the UTPR, if the relevant countries do not collect the IIR on the full amount, a country where another group entity is located can charge a top-up tax under the UTPR either through denying deductions in computing corporate income tax or by way of an equivalent adjustment.

How It Works

Although the mechanics are much more complicated, what follows is a basic description of the Global Minimum Tax operation.

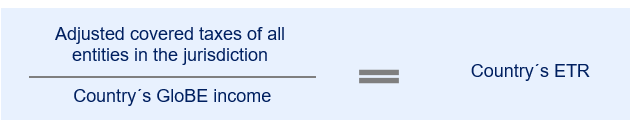

The ETR is calculated annually by in-scope Mexican companies as follows, where covered taxes are taxes paid in each country based on local tax rules, and GloBE Income is the profit or loss before income tax using the relevant financial accounting standard [e.g., International Financial Reporting Standards (IFRS), Generally Accepted Accounting Principles (GAAP)]. If the ETR on foreign operations is below 15 percent, the Global Minimum Tax applies.

A. The IIR

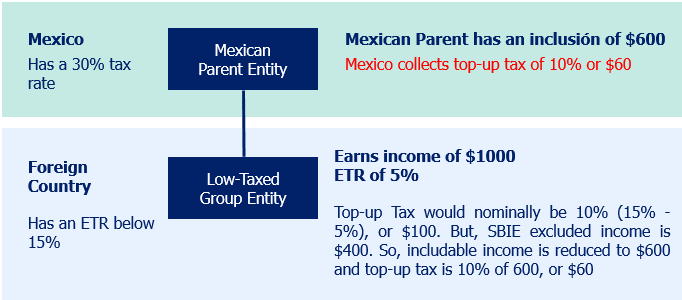

The IIR permits Mexico, as ultimate parent entity jurisdiction, to collect the difference between the ETR and 15 percent. However, two other rules can deny the right of Mexico to tax the difference: the substance-based income exclusion (SBIE) and the Qualified Domestic Top-Up Tax (QDMTT). The SBIE exempts from top-up tax an amount based on a percentage of tangible property and payroll. And an otherwise low-tax country may adopt a QDMTT that will allow it to charge any additional tax as necessary to bring the ETR to 15 percent and stop any chances of the tax being levied at the parent entity country.

Example:

B. Under-Taxed Profits Rule

From an interpretation of the history behind the creation of the UTPR, its application would be limited to intragroup payments to low-taxed entities. However, under new model rules, no such limitations exist. So, Mexico can now have a new right to tax only based on having a group entity located in Mexico and the corporate group's income not being taxed by another country up to a 15 percent ETR. This approach is revolutionary, and it can even raise legal concerns. It creates a new basis for tax profits that are neither earned by a resident company in Mexico nor sourced in Mexico.

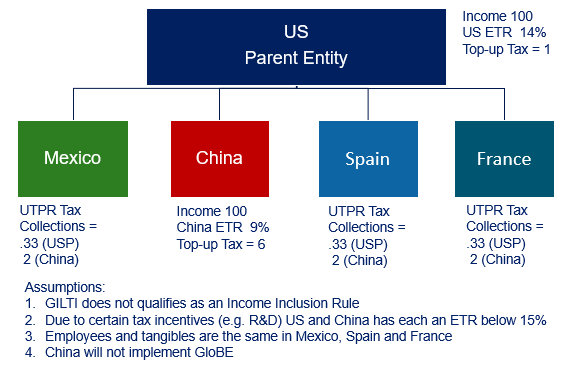

Example: Assuming the U.S. and China do not have IIR equivalents, the UTPR would kick-in in order to grant the other jurisdictions of the group the right to tax. In the following example, $0.33 not collected by the U.S. will be collected by Mexico, Spain and France, whereas $2 out of the $6 top-up tax over Chinese income will be collected by Mexico, Spain and France. This achieves a 15 percent ETR at a group level, regardless of any lack of connection of the income with Mexico.

The top-up tax could be collected by Mexico through denying deductions to the Mexican company in payments made by such entity to anyone.

Effectively, U.S. and Chinese bases are shifted to Mexico, Spain and France. Finally, please also note that Chinese income could be taxed in China, Mexico and the U.S. under global intangible low-taxed income (GILTI).

Implementation could be in 2024. There will be exemptions and certain transitional rules and safe harbors applicable before 2027 to skip having to do detailed Global Minimum Tax calculations in certain circumstances. However, due to the significant administrative burden and onerous budgets needed to comply, it is important for big Mexican companies to start taking action.

Even if no global agreement is reached, it is likely to see Mexico willing to pursue unilateral implementation just like France, Germany, Netherlands, Spain, Italy, the United Kingdom (UK) and other OECD jurisdictions.

4. Withholding Tax Rate to Be Applied by Mexican Financial Institutions

Mexico has increased the withholding income tax rate applicable to interest payments made by financial institutions. Effective Jan. 1, 2023, the withholding tax rate will increase from 0.08 percent to 0.15 percent.

5. Mexican Real Estate Investment Trusts (REITs) (Fideicomiso de Infraestructura en Bienes Raíces or FIBRAS)

FIBRAS will now need to comply with additional filing obligations after a distribution of income, capital reimbursement, sale of property, or sale of certificates by investors or sale of immovable property by the REIT. These could represent the start of policing practices of the Mexican tax authorities over the operation of Mexican REITs and the fulfillment of the different imposed-by-law obligations.

6. Mexican Public Companies' Obligation to Report Sale of Shares Between Foreign Tax Residents Has Been Relaxed

Mexican companies with shares registered in the Stock National Registry will have to file to the Mexican tax authorities the notification regarding the sale of their shares between foreigners only with respect to shareholders that have 10 percent or more of their shareholding percentage and when the sales during the previous three months reach a value of 1 million investment units (approximately US$380,000).

7. Mexican Companies with Related Party Transactions Will Not Need to File Information Tax Returns Under Certain Circumstances

Aside from the documentation required to demonstrate that related party transactions complied with transfer pricing principles, Mexican companies are obligated to report any transactions with foreign or Mexican related parties before May 15 of each year. However, for 2023, Mexican treasury regulations have introduced an exemption under which Mexican companies with less than approximately US$650,000 annual income will not be obligated to comply with this reporting. Yet, please note that such thresholds will not be applicable to residents in Mexico that transact with companies located in certain low-tax jurisdictions (sometimes including the U.S.) or to contractors referred to in the Hydrocarbons Income Law.

8. Exchange of Information for Cryptos

Service providers facilitating transactions in crypto-assets should start reviewing their capacities to comply with new disclosing rules as a result of the OECD initiative on the Crypto-Asset Reporting Framework and the amendments already made to the OECD Common Reporting Standard that will force them to report customer residents abroad to the corresponding jurisdictions. Foreign service providers would then be forced to report to Mexico any transactions and account information with respect to clients residing therein.

As such, it is important for Mexican residents involved in these operations to become compliant with any tax obligations they may have had to avoid any bigger consequences in the future. The bear crypto market might discourage the willingness to do so; however, the recognition of losses makes it also relevant.

Notes

1 The principal purpose test has two tests: a subjective test and an objective test. The subjective element establishes "if it is reasonable to conclude, having regard to all relevant facts and circumstances that obtaining the benefit was one of the principal purposes of any arrangement or transaction that resulted directly or indirectly in that benefit,” the benefits will be denied. On the other hand, the objective element to be demonstrated by the taxpayer, states "if it is established that granting that benefit in these circumstances would be in accordance to the object and purpose" of the relevant tax treaty.

Please note that there are two options of principal purpose test followed by countries. That menu of options can result in mismatches that can oblige to mini-treaty negotiations. For instance, if a country has chosen the Principal Purpose Test and the other country has chosen the Principal Purpose Test with simplified limited of benefits provisions (like Mexico), these two countries will need to decide whether the simplified limitation of benefits clause can be introduced, but this will require a mini-treaty negotiation.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem, and it should not be substituted for legal advice, which relies on a specific factual analysis. Moreover, the laws of each jurisdiction are different and are constantly changing. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. If you have specific questions regarding a particular fact situation, we urge you to consult the authors of this publication, your Holland & Knight representative or other competent legal counsel.