Climate and Clean Energy Policy State of Play

Highlights

- Clean energy initiatives and legislation continue to advance with unprecedented direction, momentum and clout in the federal government. President Joe Biden and Congressional Democrats remain fiercely committed to enacting policies to deploy clean technology in order to drive emissions to net zero in the coming decades.

- Lawmakers are actively drafting legislative framework that demonstrate keen interest in bolstering the United States' green technology capacities and promise to transform key domestic industries and put America at the forefront of the global clean energy transition.

- This Holland & Knight alert highlights the biggest clean energy updates and government-related developments from the past few months, and summarizes potential implications of these measures in the coming quarter and year.

Clean energy initiatives and legislation continue to advance with unprecedented direction, momentum and clout in the federal government. President Joe Biden and Congressional Democrats remain fiercely committed to enacting policies to deploy clean technology in order to drive emissions to net zero in the coming decades.

On Capitol Hill, multiple infrastructure packages in play are poised to provide tremendous opportunities for clean energy initiatives. Lawmakers are actively drafting legislative framework that demonstrate keen interest in bolstering the United States' green technology capacities and promise to transform key domestic industries and put America at the forefront of the global clean energy transition.

Against the backdrop of an evolving political climate and multiple policy implications for energy innovation, policy drivers include increasing corporate net-zero carbon commitments, national security concerns, a need for technology and innovation, market participation, education and competition from foreign governments, all of which are only increasing during the Biden Administration.

This Holland & Knight alert highlights the biggest clean energy updates and government-related developments from the past few months, and summarizes potential implications of these measures in the coming quarter and year.

Here are the key developments from throughout the federal government.

Congress

Infrastructure Negotiations

- Congressional Democrats are pursuing a two-pronged approach on infrastructure to enact President Biden's $4 trillion economic agenda.

- President Biden and a group of bipartisan senators reached an agreement on the infrastructure component in the president's original American Jobs Plan: a $579 billion package dubbed the "Bipartisan Infrastructure Framework." That package is expected to move in tandem with a bigger, broader tax and social spending package that will advance via budget reconciliation, which enables Democrats to bypass the filibuster. Senate Majority Leader Chuck Schumer (D-N.Y.) and Budget Committee Democrats, led by Chairman Bernie Sanders (I-Vt.), have reached a deal on a $3.5 trillion topline funding figure for a budget resolution, which greenlights reconciliation. That proposal will enact much of President Biden's American Families Plan.

- The upcoming surface transportation reauthorization, which authorizes federal surface transportation programs for highways, highway safety and transit over five years, is also poised to provide a significant infusion of federal funding for several clean energy initiatives. The prior authorization for surface transportation programs expired in 2020; Congress passed a one-year extension that will expire on Sept. 30, 2021. It is becoming increasingly likely that the surface transportation reauthorization will be linked to broader efforts on infrastructure, such as the Bipartisan Infrastructure Framework.

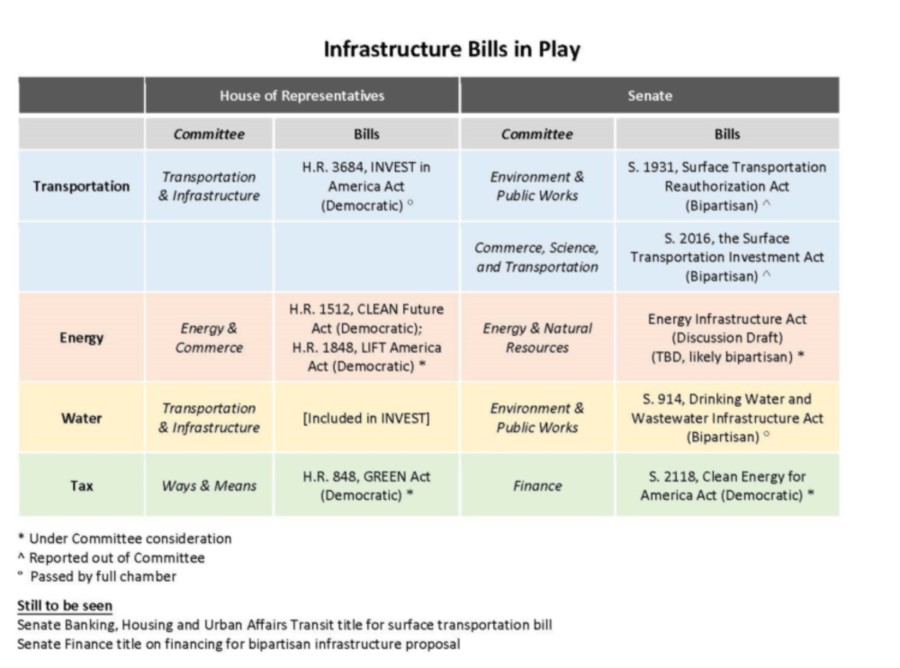

The following provides an overview of the infrastructure packages in current play that stand to have wide-reaching impacts for clean energy.

Bipartisan Infrastructure Framework

- President Biden and a bipartisan group of 21 senators announced a bipartisan, $579 billion Bipartisan Infrastructure Framework that includes funding for roads, bridges, ports, broadband, water and resiliency. The package is a scaled-back version of the president's proposed American Jobs Plan.

- Specifically, the framework includes $579 billion in new spending over five years for a total of $973 billion over five years, or $1.2 trillion over eight years. Details include:

- $312 billion for Transportation

- including $7.5 billion for electric vehicles (EV) infrastructure and $7.5 billion for electric buses/transit

- $266 billion for "Other" infrastructure

- $73 billion for power infrastructure, including electricity grid resiliency and electrification

- $65 billion for broadband infrastructure

- $55 billion for water infrastructure

- $47 billion for resilience

- $312 billion for Transportation

- Financing for the Bipartisan Infrastructure Framework relies on a combination of tax enforcement measures, redirecting unspent emergency relief funds, targeted corporate user fees and the macroeconomic impact of infrastructure investment.

- Climate-related initiatives were rolled back from bipartisan negotiations, refocusing more progressive members' efforts on climate issues toward the budget reconciliation process.

- Senate Majority Leader Chuck Schumer (D-N.Y.) is pushing Senate negotiators to wrap up negotiations on the bipartisan infrastructure package and finalize legislative text that aligns with topline spending numbers outlined above. Lawmakers have struggled to reach agreement on how to pay for the package; most recently, Republican senators eliminated increasing Internal Revenue Service (IRS) enforcement from the ways to raise new revenues to fund the framework.

- On July 14, 2021, the Senate Committee on Energy and Natural Resources (ENR) advanced an energy infrastructure package, the Energy Infrastructure Act, by a 13-7 vote, with Sen. Steve Daines (R-Mont.), Lisa Murkowski (R-Alaska) and Bill Cassidy (R-La.) voting with Democrat senators in favor of the bill. Sponsored by Committee Chairman Joe Manchin (D-W.Va.), the bipartisan measure will serve as the legislative text for key portions of the Bipartisan Infrastructure Framework, including power infrastructure, Western water, resilience, and abandoned mine lands and orphan wells.

- As amended, the Energy Infrastructure Act authorizes more than $100 billion to: invest in the reliability and resilience of our electric grid and expand transmission capabilities; demonstrate the critical energy technologies; build out domestic supply chains for clean energy technologies; invest in water infrastructure needed by western states, restore our ecosystems, and mitigate wildfire risk; clean up the abandoned energy infrastructure and mine lands while also reducing methane emissions; and fund the Energy Act of 2020.

- Notably, the bill clarifies "reasonable prospect of repayment" criteria for both the DOE Loan Programs Office (LPO) Title XVII Innovative Energy Loan Guarantee Program and Advanced Technology Vehicle Manufacturing (ATVM) Program. Further, the bill expands eligibility requirements for the Title XVII program to include projects that increase the domestic supply of critical minerals and expand the eligibility of the ATVM program to include medium- and heavy-duty vehicles, trains, aircraft, marine transportation and hyperloop technology.

- The bill features a focus on batteries for electric vehicles, establishing a "Battery Material Processing Grant Program" within DOE's Office of Fossil Energy and creating within the department's Office of Energy Efficiency and Renewable Energy (EERE) a battery manufacturing and recycling grant program to support and sustain a North American battery supply chain. The bill also establishes a grant program focused on small- and medium-sized manufacturers to enable them to build new or retrofit existing manufacturing and industrial facilities to produce or recycle advanced energy products in communities where coal mines or coal power plants have closed.

- The Bipartisan Infrastructure Framework presents opportunities for entities involved in the infrastructure space. Clean energy producers, electric vehicle manufacturers, charging infrastructure companies and battery manufacturers will have a large stake in the legislative outcomes.

Surface Transportation Reauthorization

- It is becoming increasingly likely that the surface transportation reauthorization will be linked to broader efforts on infrastructure, as the current authorization expires on Sept. 30, 2021. Specifically, the Bipartisan Infrastructure Framework will likely incorporate the text of the surface transportation bill approved by the Senate Committee on Environment and Public Works (EPW).

- The Senate EPW Committee voted unanimously in May to approve the Surface Transportation Reauthorization Act of 2021 (S. 1931), to reauthorize highway programs. As the title suggests, the bill proposes $311 billion on highways in the next five years, an increase of 34 percent over the previous surface authorization. It would put more than $270 billion into the Highway Trust Fund and provide aid to expand rural transportation infrastructure, maintain bridges and build infrastructure for alternative fuel vehicles.

- The surface reauthorization is poised to provide a significant infusion of federal funding for critical infrastructure, as each proposal in both chambers sets baseline funding levels at historic highs. Throughout the legislative process, congressional lawmakers have emphasized fixing existing roads and bridges, as well as making significant investments in passenger rail, public transit, cycling and walking infrastructure, and zero-emission options to create safer, more connected communities.

- On June 10, 2021, the House passed its version of the surface transportation – the $715 billion INVEST in America Act (H.R. 3684). Among other provisions, the package includes more than $40 billion for transportation electrification initiatives, including EVs and EV-charging infrastructure.

Budget Reconciliation Package

- In parallel to the Bipartisan Infrastructure Framework, Senate Democrats are working to finalize a budget resolution that would allow for $3.5 trillion in spending over the next decade through budget reconciliation. The deal is expected to include elements of President Biden's American Families Plan and American Jobs Plan that are not included in the Bipartisan Infrastructure Framework, including energy and climate-related programs. Congressional Democrats are expected to proceed with a reconciliation package regardless of the outcome of infrastructure negotiations.

- Budget reconciliation is a process through which a bill can be passed with simple majorities in both chambers; the filibuster-proof process starts with a budget resolution, which Senate Democrats have agreed to set at a ceiling of $3.5 trillion.

- Democrats are hashing out the details of the party-line spending package, with Senate Democrats coalescing around a budget resolution to set up the plan. Key Senate Democrats have vowed to push forward a $3.5 trillion budget resolution framework that would fund a clean energy transition and policies to combat climate change. The plan includes tax incentives for clean energy and electric vehicles, a clean energy standard and the creation of a civilian climate corps program.

- The legislation's climate prospects may depend on crafting a clean electricity standard that the Senate parliamentarian will approve under the rules governing reconciliation, which would allow Democrats to pass the measures with a simple majority in the Senate. The White House also has said that it would push for such a standard, which is supported by the electric utility industry and other companies, in the reconciliation deal. Nevertheless, Senate Democrats must bring centrist party members aboard on the climate change and clean energy measures.

- This package will serve as the prime vehicle for clean energy incentives this year. Through this unique process, all provisions must have a nexus to the federal budget in that they create measurable changes in revenues or outlays. Because tax provisions have clear impacts on revenues and outlays, they are considered prime targets for reconciliation. Thus, the congressional tax committees – House Committee on Ways and Means and Senate Committee on Finance – will be key players as lawmakers hash out the details of this expansive package.

- The reconciliation package will likely represent the president's best chance to deliver on the climate agenda he outlined at the beginning of his term. President Biden, House Speaker Nancy Pelosi (D-Calif.) and Schumer have acknowledged that the Bipartisan Infrastructure Framework falls short on climate, and have committed to simultaneously advance bold investments through the reconciliation package.

- Senior White House officials released a memo on June 29, 2021, in which they emphasize that the bipartisan framework "leaves out critical initiatives on climate change," and commit to working with "with Congress through the budget process to pass additional legislation that will position the U.S. to combat climate change, create good-paying, union jobs, and win the clean energy future."

Fiscal Year 2022 Appropriations Process Underway on Capitol Hill

- The House Committee on Appropriations completed its work during the week of July 12, 2021, on the 12 spending measures to fund the government for the fiscal year (FY) beginning on Oct. 1, 2021. The panel approved the remaining six bills – Commerce-Justice-Science, Defense, Energy-Water, Homeland Security, Labor-Health and Human Services (HHS)-Education and Transportation-Housing and Urban Development (HUD) – after acting on the first six measures before the July 4 recess. It advanced most of the bills on party-line votes.

- Appropriations Committee Republicans broadly criticized the measures, including the topline spending numbers for each bill. The bills approved by the committee would provide a modest increase for the Pentagon alongside a more significant boost for domestic programs.

- House Democrats are seeking to pass a seven-bill appropriations package during the last week of July, which will include the Agriculture-Food and Drug Administration (FDA), Energy and Water, Financial Services, Interior-Environment, Labor-HHS-Education, Military Construction-Veterans Affairs and Transportation-HUD spending bills, according to House Majority Leader Steny Hoyer (D-Md.).

- With the start of the new fiscal year on Oct. 1, 2021, fast approaching, Congress is very likely to pass a continuing resolution to maintain existing spending levels beyond the expiration of the FY 2021 budget. The Senate Committee on Appropriations has not announced a markup schedule.

- Throughout the first quarter, Congressional committees held hearings with agency and department heads on the requests to learn more about the Biden Administration's vision for the federal government over the next fiscal year.

- Of note to clean energy initiatives, the House Appropriations Committee on July 16, 2021, approved the FY 2022 Energy and Water Development and Related Agencies funding bill on a 33-24 vote. The bill provides robust funding for developing clean energy: the U.S. Department of Energy (DOE) would receive $45.1 billion in the proposed legislation, a $3.2 billion increase from FY 2021 enacted level, but slightly less than President Biden's request of $46.2 billion.

- Congressional support for clean energy research, development and demonstration (RD&D) remains strong, as evidence by increasing budgets for most of the relevant programs at federal agencies, especially DOE. Every DOE program dedicated to clean energy research, development and deployment received a proposed increase for FY 2022, making billions of dollars potentially available through grants, cooperative agreements, loans and loan guarantees, and other federal support.1

- For the DOE Office of Energy Efficiency and Renewable Energy (EERE), the legislative provides $3.77 billion, an increase of $906 million above the FY 2021 enacted level. This funding provides for clean, affordable and secure energy, and ensures American leadership in the transition to a global clean energy economy.

- The bill provides $600 million for the Advanced Research Projects Agency – Energy (ARPA-E), an increase of $173 million above the FY 2021 enacted level. This funding supports research aimed at rapidly developing energy technologies that are capable of significantly changing the energy sector to address the nation's critical economic, environmental and energy security challenges.

- The bill maintains funding consistent with FY 2021 levels for the Loan Programs Office (LPO) for financing clean energy and advanced transportation projects. The bill appropriates for administrative expenses $32 million for Title XVII, $5 million for ATVM and $2 million for the Tribal Energy Loan Guarantee Program.

Senate Passes Sweeping Bill Aimed at Competition with China

- On June 8, 2021, the Senate passed the U.S. Innovation and Competition Act (USICA) (S. 1260), in a 68-32 bipartisan vote. The expansive, $250 billion bill is aimed at addressing the challenges of U.S. competition with China through investments in high-technology innovation, research and development (R&D), and manufacturing operations in the United States.

- The USICA consists of seven divisions that cover a broad array of priorities with respect to U.S. supply chains. Importantly, the Endless Frontiers Act (USICA Division B) authorizes approximately $120 billion in funding for R&D and commercialization in key technology areas by offering grants and creating various interagency and cross-sector bodies. The package authorizes the National Science Foundation (NSF) with more than $70 billion to implement technology test beds, fund research and sponsor science, technology, engineering and mathematics (STEM) education. It authorizes DOE with $16 billion, in part to research "energy-related supply chain activities within key technology focus areas."

- Having passed the Senate, the bill is being considered in the House. While the Senate pulled separate pieces of legislation into a single bill, the House is taking a more piecemeal approach. The House and Senate will have to negotiate differences before a final version emerges and gets a vote in both chambers.

- On June 29, 2021, the House passed two bills – by wide bipartisan margins – that are expected to form the core of legislation in the lower chamber and are designed to boost U.S. research and development. The National Science for the Future Act (H.R. 2225) and the Department of Energy Science for the Future Act (H.R. 3593) together would authorize $128 billion over five years in combined funding for the NSF and DOE, with $14 billion set aside to help stand up a new agency dedicated to developing technologies to help the U.S. stay ahead of its international rivals

- Not only are the initiatives in the USICA important to revitalize innovation and manufacturing in the United States, but are also key to driving job creation across the nation to catalyze economic recovery from the coronavirus pandemic. The bill suggests that federal grant funding may become a significant revenue source for organizations going forward, particularly for organizations in critical industries or those with significant research and development roles. The bill also tightens domestic preference, or Buy American, laws.

White House

Biden Administration Issues Report Outlining Strategy to Invigorate Domestic Supply Chains

- On June 8, 2021, the Biden Administration released findings from a 100-day interagency domestic supply chain assessment of critical products and outlined a series of steps that it will take in order to strengthen U.S. critical supply chains and shore up domestic manufacturing, pursuant to Executive Order (EO) 14017.

- President Biden on Feb. 24, 2021, signed EO 14017, directing a whole-of-government approach to assessing vulnerabilities in, and strengthening the resilience of, critical supply chains.

- The 100-day review found structural weaknesses in both domestic and international supply chains, which threaten America's economic and national security. The report features assessments and an expansive list of recommendations intended to address not only the immediate issues but also prevent shortages in the long term. The report's initial recommendations to bolster these supply chains focus on prioritized products critical to the U.S. economy, including large capacity batteries and critical minerals and materials. Broadly, the recommendations call for more investments, new supply chains and less reliance on other countries for crucial goods.

- See Holland & Knight's previous alert, "Biden Administration Report Outlines Strategy to Invigorate Domestic Supply Chains," June 11, 2021

- DOE announced immediate policy actions to spur domestic supply chains in the aforementioned critical sectors:

- National Blueprint for Lithium Batteries: The Federal Consortium of Advanced Batteries (FCAB) released the National Blueprint for Lithium Batteries 2021-2030, which codifies the findings of DOE's battery supply chain assessment, and details how strategic and immediate federal investments will position the U.S. to lead an emerging global market. The blueprint lays out five critical goals and key actions to guide federal agency collaboration (in addition to DOE, FCAB is led by U.S. Department of Defense, U.S. Department of Commerce and U.S. Department of State).

- Strengthening U.S. Manufacturing in Federally Funded Grants, Cooperative Agreements and Research and Development (R&D) Contracts: DOE announced a new policy to support domestic job creation by ensuring that all innovations – including those relating to advanced batteries. DOE Science and Energy Programs require awardees to substantially manufacture those products in the United States. DOE will implement these actions through a Determination of Exceptional Circumstances under the Bayh-Dole Act. This policy change will cover the more than $8 billion in climate and energy innovation funding requested in DOE's FY 2022 budget, including more than $200 million to support battery technology research, development and demonstration (RD&D).

- LPO Financing to the Advanced Battery Supply for Electric Vehicles: DOE's Loan Program Office (LPO) published guidance and released a fact sheet to clarify the various uses of the Advanced Technology Vehicles Manufacturing Loan Program (ATVM), which has approximately $17 billion in loan authority. ATVM makes loans to manufacturers or advanced technology vehicle battery cells and packs for reequipping, expanding or establishing such manufacturing facilities in the U.S.

- Procuring Stationary Battery Storage at FEMP: The Federal Energy Management Program (FEMP), housed in the Office of Energy Efficiency and Renewable Energy (EERE), is kicking off a federal government-wide energy storage opportunity diagnostic that will evaluate the current opportunity for deploying battery storage at federal sites. FEMP will also launch a call for projects from federal sites interested in deploying energy storage projects, and provide the necessary technical assistance to get those projects built. These actions build off steps taken earlier this year to leverage $13 million in FEMP's Assisting Federal Facilities with Energy Conservation Technologies (AFFECT) grants to unlock an estimated $260 million or more in project investments, including battery storage projects.

Biden Administration Hosts U.S. Climate Action Week

- The Biden Administration hosted its first U.S. Climate Action Week in April, which served as a focus point for policy decisions – both international and domestic – demonstrating the president's "whole of government" approach to addressing climate issues. A two-day Climate Leaders' Summit was held to unveil the renewed climate leadership in the U.S.

- For the U.S.' nationally determined contribution (NDC) under the Paris Agreement, President Joe Biden committed the nation to reducing its greenhouse gas emissions (GHG) by 50 percent to 52 percent below its 2005 emissions by 2030.

- Other noteworthy announcements following Climate Action Week include:

- President Biden announced international climate finance commitments to assist developing countries reduce GHG emissions.

- The Council of Economic Advisers published a report warning that without significant investment in research and development for clean energy technologies, the U.S. could become dependent on its competitors.

- Energy Secretary Jennifer Granholm announced new goals to lower the cost of clean energy and other climate change technologies, including reducing the cost of hydrogen and batteries of electric vehicles. DOE announced six initiatives to expand international cooperation.

- S. Environmental Protection Agency (EPA) opened public comment on its intent to consider reestablishment of California zero-emission vehicle (ZEV) mandate and GHG emissions standards under the state's Advanced Clean Car program.

- The vision presented by world leaders at the summit will have implications for the upcoming 26th UN Climate Change Conference of the Parties (COP26) in Glasgow, Scotland, on Oct. 31-Nov. 12, 2021. Resulting NDC from the COP26 will forecast how governments will support or hinder clean energy technology investment on a global scale.

- See Holland & Knight's Climate Week Report, May 2021

President Biden Unveils Fiscal Year 2022 Budget Request

- The White House on May 28, 2021, released President Joe Biden's $6 trillion proposed budget for federal spending in FY 2022. The president's budget proposal serves as a fiscal blueprint for the administration's policy priorities and signals to Congress what the White House hopes to accomplish over the coming years.

- Overall, the Biden Administration is eyeing more than $36 billion in spending to counter climate change, which the White House says would represent a $14 billion increase over FY 2021. President Biden seeks to ramp up spending on climate change across federal agencies, part of a government-wide approach to the issue that represents a dramatic shift from the Trump Administration. That includes asking Congress to infuse money into neglected government climate programs as well as initiatives to help counter the threat with clean energy technology, zero-emission vehicles and increased energy efficiency.

- As a whole, the president's budget request emphasizes a focus on deploying clean energy technology, in line with President Biden's goal to achieve net-zero emissions by 2050. Broadly, the budget calls for spending $157 billion over 10 years on electric cars and buses and $97 billion over 10 years on U.S. power infrastructure, including through investments in hydrogen and carbon capture and sequestration, as well as providing community solar and clean energy block grants.

- The budget proposed $46.2 billion for the U.S. Department of Energy (DOE), a $4.3 billion (10.4 percent) increase from the FY 2021 enacted level. The budget serves as an outline for marshaling the federal government's spending power to swiftly curtail greenhouse gas (GHG) emissions in order to meet his ambitious climate change goals. Half of the increase for DOE, roughly $2.3 billion, was appropriated as part of the government funding bill passed in December.

President's Budget Proposal Expands, Extends and Creates Tax Credits for Renewable Energy

- U.S. Department of the Treasury released the General Explanations of the Administration's Fiscal Year 2022 Revenue Proposals, which is colloquially referred to as the "Green Book." The Green Book proposes the expansion, extension and creation of a number of green energy tax credits.

- Electric Vehicles and Charging Infrastructure: The proposal

- extends the current $1,000 Section 30C credit for EV-charging stations installed at residential property for five years

- expands and extends the current 30C credit for EV-charging stations for commercial use by increasing the business credit cap to $200,000 per device, allowing businesses to claim the credit on a per-device basis, extending the credit for five years with a direct pay option

- creates a new tax credit for medium- and heavy-duty zero-emission vehicles based on the Section 30D tax credit, offering credits that range from $25,000 for a Class 3 vehicle to $120,000 for Class 7-8 vehicles and gradually phasing down through 2027 (proposal also includes a direct pay option), and

- creates a new tax credit for medium- and heavy-duty zero-emission vehicles based on the Section 30D tax credit, offering credits that range from $25,000 for a Class 3 vehicle to $120,000 for Class 7-8 vehicles and gradually phasing down through 2027 (proposal also includes a direct pay option)

- Sustainable Aviation Fuel: Creates a new tax credit in the amount of $1.50 per gallon for fuel that achieves at least a 50 percent reduction in emissions when compared with conventional jet fuel. The temporary credit becomes even more valuable if the sustainable fuel produced is cleaner when compared with conventional fuel.

- Expand Availability of Solar and Wind Tax Credits (ITCs and PTCs): Provides a full 100 percent production tax credit (PTC) for wind and certain other qualified facilities that begin construction after 2021 and before 2027, with a five-year phased-down (20 percent per year) PTC continuing to be available for projects commencing through 2030. It also extends the full 30 percent investment tax credit (ITC) for solar and geothermal electric energy property and other qualified facilities that begin construction after 2021 and before 2027, followed by a five-year phase out each year between 2027 and 2030. The proposal would also expand the ITC to certain stand-alone energy storage technology starting in 2022

- Expand and Enhance Carbon Oxide Sequestration Credit (Code Section 45Q): Extends the deadline for construction of qualified facilities from Jan. 1, 2026, to Jan. 1, 2031. The credit amount would be increased by an additional $35 per metric ton (to $85) for "hard-to-abate industrial carbon oxide capture sectors such as cement production, steelmaking, hydrogen production and petroleum refining." Direct air capture projects would be eligible for an extra $70 per metric ton credit (i.e., a total credit of $120)

- Qualifying Transmission Property: Creates a new 30 percent investment tax credit for certain qualifying electric transmission property (e.g., overhead, submarine and underground transmission facilities, as well as any ancillary facilities and equipment necessary for transmission facility operation) with a minimum voltage of 275 kilovolts (kVs) and a minimum transmission capacity of 500 megawatts (MWs) that is placed in service after 2021 and before 2032

- Electric Generation Tax Credit for Existing Nuclear Power Plants: Expands the electric generation tax credit (Code Section 45J) for existing nuclear power plants by providing up to $1 billion (annually) in credits for energy generated. The credits would be allocated to plants that would bid for the credit every two years. The credits would be targeted to economically at-risk facilities to prevent the early retirement of nuclear facilities and would continue through 2030

- Qualifying Advanced Energy Manufacturing: Modifies and expands the credits available for qualifying advanced energy projects (Section 48C) to include: industrial facilities; recycling in addition to production; and expanded eligible technologies, including energy storage and components, electric grid modernization equipment, carbon oxide sequestration and energy conservation technologies. The proposal authorizes an additional $10 billion in tax credits (with $5 billion allocated to coal communities), with the three-year application window opening after Dec. 31, 2021

- Low-Carbon Hydrogen Tax Credit: Establishes a credit for low-carbon hydrogen produced from a qualified low-carbon hydrogen production facility during its first six years of service for an end use application in the energy, industrial, chemicals, or transportation sector. Low-carbon refers to hydrogen produced using zero-carbon emissions electricity (renewables or nuclear) and water as feedstock, or hydrogen produced using natural gas as a feedstock with all carbon emitted in the production process captured and sequestered. The credit would be $3 per kilogram (kg) of hydrogen between 2022 and 2024, and $2/kg between 2025 and 2027, subject to an annual inflation adjustment

- Electric Vehicles and Charging Infrastructure: The proposal

- Of particular interest for businesses, many of the provisions outlined above propose the novel policy of offering incentives on a fully refundable, "direct pay" basis, allowing individuals and businesses to elect to recoup the full value of the credits as a cash payment from the federal government. Considered a priority of the industry, this direct payment option significantly increases the benefit of the credits, a move expected to help drive increased business investment. Also of note, the proposals contained in the Green Book generally include statements that the Biden Administration plans to work with Congress on measures to "pair these credits with strong labor standards, benefitting employers that provide good-paying and good-quality jobs."

- These proposals will require legislative change. Since the start of the 117th Congress and before, congressional Democrats have similarly been developing proposed legislation to expand credits related to renewable energy and energy efficiency with similar priorities and objectives to the Green Book proposals. Most notable among these proposals are H.R. 848, the Growing Renewable Energy and Efficiency Now Act (GREEN Act), sponsored by House Ways and Means Committee senior member Rep. Mike Thompson (D-Calif.), and S. 1298, the Clean Energy for America Act, championed by Senate Finance Committee Chairman Ron Wyden (D-Ore.). While the bills tackle the tax code's incentives for green energy with philosophically different approaches, they both target many of the same tax credits discussed in the Green Book.

- Tax policy is an important tool for incentivizing renewable energy, and change to the tax code as proposed in the Green Book are certainly needed to meet President Joe Biden's ambitious goal to reach 100 percent clean energy and net-zero economy-wide carbon emissions no later than 2050.

Conclusion

For more information or questions on any of the clean energy initiatives and legislation discussed or in progress on Capitol Hill, contact the authors.

Notes

|

U.S. Department of Energy FY 2022 Federal Funding |

||||

|

|

FY 2021 Enacted |

FY 2022 President's Request |

FY 2022 House |

FY 2022 Senate |

|

Department of Energy (DOE) |

$39.625 billion |

$46.2 billion |

$45.1 billion |

|

|

Energy Efficiency and Renewable Energy (EERE) |

$2.86 billion |

$4.73 billion |

$3.768 billion |

|

|

EERE: Sustainable Transportation |

||||

|

Vehicle Technologies Office (VTO) |

$400 million |

$595 million |

$530 million |

|

|

Bioenergy Technologies Office (BETO) |

$255 million |

$340 million |

$303 million |

|

|

Hydrogen and Fuel Cell Technologies (HFTO) |

$150 million |

$197.5 million |

$195 million |

|

|

EERE: Energy Efficiency |

||||

|

Advanced Manufacturing Office (AMO) |

$396 million |

$550.5 million |

$500 million |

|

|

Building Technologies Office (BTO) |

$290 million |

$462 million |

$350 million |

|

|

Federal Energy Management Program (FEMP) |

$40 million |

$438 million |

$60 million |

|

|

EERE: Renewable Energy |

||||

|

Solar Energy Technologies Office (SETO) |

$280 million |

$386.6 million |

$350 million |

|

|

Wind Energy Technologies (WETO) |

$110 million |

$204 million |

$170 million |

|

|

Water Power Technologies Office (WPTO) |

$150 million |

$196 million |

$175 million |

|

|

Geothermal Technologies Office (GTO) |

$106 million |

$163 million |

$137 million |

|

|

Loan Programs Office |

||||

|

Title 17 Innovative Technology Loan Guarantee Program |

$29 million |

$179 million |

$29 million |

|

|

Advanced Technology Vehicles Manufacturing Loan Program (ATVM) |

$5 million |

$5 million |

$5 million |

|

|

Tribal Energy Loan Guarantee Program (TELGP) |

$2 million |

$2 million |

$2 million |

|

|

Other DOE Clean Energy Programs |

||||

|

Office of Technology Transitions (OTT) |

N/A |

$19.47 million |

$19.47 million |

|

|

Office of Clean Energy Demonstration (OCED) |

N/A |

$400 million |

$200 million |

|

|

Advanced Research Project Agency – Energy (ARPA-E) |

$427 million |

$500 million |

$600 million |

|

|

Office of Electricity |

$211.7 million |

$327 million |

$267 million |

|

|

Office of Fossil Energy and Carbon Management (FECM) |

$750 million |

$890 million |

$820 million |

|

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem, and it should not be substituted for legal advice, which relies on a specific factual analysis. Moreover, the laws of each jurisdiction are different and are constantly changing. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. If you have specific questions regarding a particular fact situation, we urge you to consult the authors of this publication, your Holland & Knight representative or other competent legal counsel.