Aircraft Leasing Insurance Change: Sub-Limited Hull War Confiscation Risk

As airline policies come up for renewal, insurers are imposing a sub-limit for confiscation-type risks (confiscation sub-limit) within the annual aggregate limit applicable to the Hull War coverage.

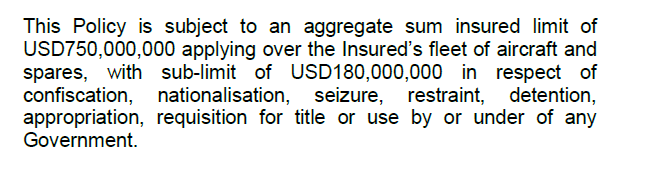

For example, an insurance certificate provided to the lessor under a lease agreement may provide the following in relation to the Hull War coverage:

Note that the confiscation sub-limit applies to confiscation, etc. by any government – not solely by the government of registration of an aircraft.

Leading brokers in the London market share that:

- Since the beginning of the Russia-Ukraine war and the mass non-return by Russian airlines of leased aircraft, Hull War policy aggregate limits and coverage for confiscation risks have been under intense scrutiny.

- The result is that Hull War confiscation risks are now being sub-limited, with different limits for different airlines depending on insurers' assessment of the risk.

- Insurers are also being restricted in the coverage that they can provide to airlines by their own reinsurance arrangements.

- At this time, insurers generally are not prepared to increase the confiscation sub-limit in consideration of an additional premium.

- Insurers are calculating the confiscation sub-limit applicable to an airline on a case-by-case basis.

- Similar confiscation sub-limits are being imposed on the Hull War coverage under lessor contingent insurance policies.

When this issue arises in relation to leased aircraft, the lessor may give consideration to the following:

- The lessor will need to be satisfied that the confiscation sub-limit is the maximum extent of coverage that is commercially available. The lessor's own insurance advisors may confirm this in any specific case.

- The lessor may approve the insurances without prejudice to the lessor's right to revisit the confiscation sub-limit if additional coverage becomes commercially available in the leading insurance markets.

- If the lease agreement contains a clause allowing the lessor to impose changes to the insurance requirements upon a future change in market practice, the lessor may reserve its rights to utilize this clause if additional confiscation coverage becomes commercially available in the leading insurance markets.

- For new lease agreements, depending on the airline and lessor's view of confiscation type risks, specific wording may be negotiated to ensure that the confiscation coverage is maintained to the maximum extent that it is commercially available in the future, with the parties revisiting the coverage upon each renewal during the lease term.

- Information undertakings may require the airline to notify the lessor of any claims notified or paid under the Hull War coverage so as to allow the lessor to monitor exhaustion of Hull War aggregate limits.

- As to the terms on which the lessor becomes an additional insured under the airline's insurances, AVN67B continues to be the prevailing endorsement. To the extent that it is proposed that AVN67B is replaced with AVN67C, it is noted that AVN67C excludes coverage for theft by the airline (whereas AVN67B does not).

- As part of its analysis, the lessor may wish to confirm if its own policy excludes coverage to the extent that the loss arises due to exhaustion of aggregate limits under the airline's policy.

- If there is heightened concern about confiscation risk, the lessor may investigate whether a political risks insurance policy (also called aircraft repossession insurance) is available on commercial terms. For an example of policy wording, see LSW147 Repossession of Leased Equipment Insuring Conditions.

If you have any questions, please contact the author or another member of Holland & Knight's Asset Finance Group.