Supreme Court Stays CTA Injunction in Texas Top Cop Shop Case, but CTA Reporting Still on Hold

Highlights

- The U.S. Supreme Court on Jan. 23, 2025, stayed the injunction against the Corporate Transparency Act (CTA) that had been issued in the Texas Top Cop Shop case.

- The Supreme Court did not address the injunction against the CTA's Reporting Rule that was issued in a different case, Smith v. United States Department of the Treasury.

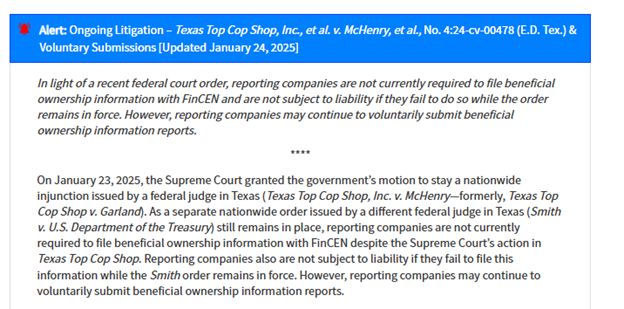

- The U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) has announced that reporting now still is not required because of the Smith case, notwithstanding the stay of the injunction in the Texas Top Cop Shop case.

In the Texas Top Cop Shop case, the U.S. District Court for the Eastern District of Texas on Dec. 3, 2024, issued an injunction that deferred all reporting requirements under the Corporate Transparency Act (CTA). (See Holland & Knight's previous alert, "Corporate Transparency Act Reporting," Dec. 4, 2024.) On Jan. 23, 2025, the U.S. Supreme Court granted a stay (i.e., lifted the injunction), pending the disposition of the appeal in the U.S. Court of Appeals for the Fifth Circuit and, if applicable, disposition of a further appeal to the Supreme Court.

Where Does the Reporting Rule Stand Now?

The future status of the CTA is unclear for several reasons.

First, though the injunction issued in the Texas Top Cop Shop case was enjoined by the Supreme Court, it did not address a similar, although more limited, injunction issued by the same federal district court in Smith v. United States Department of the Treasury, No. 24-cv-336 (E.D. Tex. Jan. 7, 2025). The Smith court issued an injunction prohibiting enforcement of the CTA limited only to the plaintiffs alongside a stay of the effective date of the Reporting Rule that applies nationwide. Accordingly, the reporting requirements under the CTA are still on hold by reason of the injunction in Smith. The government still could appeal the Smith ruling, and the Supreme Court did not address the Smith case in its Texas Top Cop Shop opinion.

Second, there is a series of actions in Congress, the executive branch and the courts focused on the repeal of the CTA.

- Congress. Recently, Sens. Rand Paul (R-Ky.) and Tommy Tuberville (R-Ala.) reintroduced the Repealing Big Brother Overreach Act, a bill that aims to repeal the CTA with a stated goal of protecting small-business owners. The bill so far has received support from about 21 Republican senators, but no Democrats have yet signed on. In the House, Rep. Warren Davidson (R-Ohio) reintroduced companion legislation, which has 66 Republican co-sponsors.

- Executive Branch. The Trump Administration has made clear its intention to eliminate regulatory burdens, which could include the CTA.

- Courts. In addition to the appeal of the Texas Top Cop Shop case in the Fifth Circuit, the U.S. Courts of Appeal for the Fourth, Ninth and Eleventh Circuits are also considering challenges to the CTA on various constitutional grounds.

What FinCEN Just Posted

The question now arises as to whether the Trump Administration will proceed to appeal the Smith case or not.

What Actions Should Reporting Companies Take Now?

Reporting currently is not required, although reporting companies may voluntarily report.

As Holland & Knight has observed previously, affected companies should continue to prepare to file under the CTA and closely monitor regulatory developments from FinCEN as well as the lower courts.

Holland & Knight continues to monitor executive, legislative and judicial developments affecting the CTA.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem, and it should not be substituted for legal advice, which relies on a specific factual analysis. Moreover, the laws of each jurisdiction are different and are constantly changing. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. If you have specific questions regarding a particular fact situation, we urge you to consult the authors of this publication, your Holland & Knight representative or other competent legal counsel.