SEC Enforcement 2025 Year in Review

In this third installment of Season's Readings, we button up our winter jackets and examine the transformative Year of Enforcement that was 2025. The past year has been one of significant transition at the SEC, with new leadership setting a different course from the previous administration's enforcement priorities.

The Barometer's Way Down: Enforcement by the Numbers

The 2025 calendar year began with a seismic shift in SEC leadership. Chair Gary Gensler stepped down in January. Following his departure, Commissioner Mark Uyeda served as Acting Chair, before Paul Atkins was sworn in as the new SEC Chair in April 2025. During his term as Acting Chair, Commissioner Uyeda made a number of public statements forecasting the agency's priorities for 2025, including a focus on fraud within the Division of Enforcement, protecting retail investors while also empowering their private company investments, increasing and encouraging initial public offering (IPO) activity and scaling public company disclosure requirements.

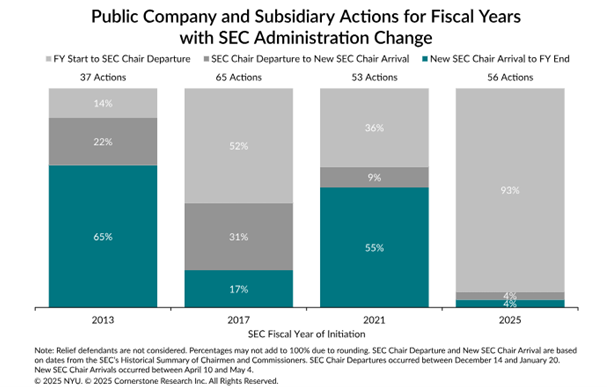

According to a report by Cornerstone Research, 93 percent (52 of 56) actions brought in fiscal year (FY) 2025 (ended Sept. 30) against public companies and subsidiaries were initiated under former Chair Gensler. See chart below. Since his departure in January 2025, enforcement activity has slowed significantly, with only four actions against public companies and subsidiaries initiated in FY 2025 under Acting Chair Uyeda and Chair Atkins – a record low. The slowdown coincided with notable changes in staffing, including the departure of approximately 15 percent of Enforcement staff.

Since the fiscal year closed on Sept. 30, the SEC has initiated 20 civil actions and 16 administrative proceedings, with few days remaining in the calendar year. Demonstrating the new administration's "back to basics" enforcement approach focused on prosecuting "lying, cheating, and stealing" that harms investors, these recent actions include charges against a couple for an alleged multimillion-dollar Ponzi-like scheme, a case against an investment adviser for allegedly making false statements to raise more than $169 million and charges against six purported private fund advisers for alleged material misrepresentations in their Form ADV filings.

Make It Snow?: Record-Low Settlements Imposed in Public Company and Subsidiary Actions

The financial impact of enforcement actions also changed considerably. Monetary settlements imposed by the SEC in public company and subsidiary actions in FY 2025 decreased by 45 percent, to $808 million – the lowest since FY 2012, according to Cornerstone Research. Even more striking was the record-low disgorgement and prejudgment interest total of $108 million, more than $300 million below the next-lowest total in FY 2012.

Despite these declines, cooperation remained highly valued, with the SEC identifying cooperation by 73 percent of public company and subsidiary defendants that settled in FY 2025, a figure higher than the FY 2016-2024 average of 65 percent. This suggests that while the current SEC may be bringing fewer cases, it continues to incentivize cooperation when cases are pursued. This makes sense in an environment with fewer full-time enforcement staff – cooperation enables the agency to carry out and complete investigations faster and redeploy its limited resources to other matters.

Winds of Change: Case Dismissals and Policy Shifts

In 2025, the SEC demonstrated a new willingness to dismiss ongoing enforcement actions that no longer align with current enforcement priorities – most notably in connection with a departure from its prior focus on cryptocurrency matters, but also in connection with:

- Dealer Registration Cases. In June 2025, the SEC dismissed three separate enforcement actions against three groups of defendants charged with failing to register as securities "dealers," under Section 15(a)(1) of the Securities Exchange Act of 1934, even though courts had already ruled in some instances that the SEC's allegations were sufficient to support the charges. In its announcement, the SEC stated dismissal was appropriate "in the exercise of its discretion and as a policy matter."

- Declining to Revisit Settlements. Despite pivoting away from crypto enforcement and dismissing dealer registration cases and its Solar Winds case (as we discussed), the SEC has stopped short of revisiting prior concluded settlements. This stance has created friction, particularly regarding the "off-channel communications" sweep that resulted in numerous settlements throughout 2023 to 2025. Despite petitions from several firms to modify their pre-2025 off-channel communications settlements to match more favorable terms given to later-settling firms, the Atkins SEC has maintained that "a party's belief that subsequent parties negotiated better settlement terms" does not justify altering prior agreements.

Cloudless Skies: Back to Basics

The new administration has clearly signaled a recalibration of enforcement priorities, moving toward a "back to basics" approach focused on "genuine harm and bad acts" and traditional securities fraud theories – insider trading, accounting fraud, market manipulation and adviser fiduciary breaches – while pulling back from novel theories of liability and technical violations.1 Indeed, Chair Atkins has signaled (as Acting Chair Uyeda did in advance of Atkins' confirmation) a return to the SEC's "core mission" of protecting investors, facilitating capital formation and safeguarding fair, orderly and efficient markets.2 Harking back to his days as an SEC Commissioner during the George W. Bush Administration from 2002 to 2008, Chair Atkins seems eager to implement his previous objectives of "transparency, consistency, and the use of cost-benefit analysis at the agency."

This "back to basics" approach is evident in the types of case brought by the Commission in 2025, including actions targeting large-scale offering frauds, public company reporting and disclosure violations, and investment adviser fraud.

This shift is also reflected in several key procedural reforms. In October 2025, Chair Atkins announced significant changes to the Wells process, designed to avoid "gotcha game" tactics by SEC staff and promote procedural integrity, transparency and due process in enforcement proceedings. The reforms mandate that enforcement staff provide expanded access to investigative files (e.g., testimony transcripts and key documents), extend the minimum response time for Wells submissions from two to four weeks and encourage "early engagement" opportunities such as submitting white papers before a formal Wells notice is issued. The changes also guarantee access to senior enforcement leadership upon request and ensure all Wells submissions are now presented to the full Commission for review, regardless of any subsequent changes in staff recommendations. Chair Atkins characterized these changes as essential to promoting the SEC's interest in accuracy and ensuring the agency is "not overlooking or misconstruing important evidence or misunderstanding legal limitations on our authority."

Furthering the goal of transparency, Chair Atkins announced a policy change in September 2025 to permit simultaneous consideration of settlement offers and related waiver requests. This restores a prior agency practice and provides welcome relief to parties who previously faced uncertainty about whether they would receive waivers from collateral consequences triggered by settlements (often key to a decision to settle).

Coming in from the Cold: A New Approach to Crypto

Perhaps nowhere is the change in approach more evident than in cryptocurrency regulation. In February, the SEC dismissed its high-profile civil action against Coinbase – the first such dismissal amid the agency's comprehensive reassessment of crypto oversight. This was followed by the closure of several other investigations against major crypto platforms.

The new administration established a dedicated Crypto Task Force led by Commissioner Hester Peirce to develop a comprehensive regulatory framework for digital assets. To complement the work of the Crypto Task Force, the SEC also announced the creation of the Cyber and Emerging Technologies Unit (CETU) to replace the Crypto Assets and Cyber Unit, which trimmed the number of SEC staff (down to about 30 staff from 50) dedicated to crypto enforcement. In announcing the rebranded unit, the SEC emphasized that the unit will "allow the SEC to deploy enforcement resources judiciously." Chairman Atkins' November speech outlining "Project Crypto" signaled a move away from regulation by enforcement toward establishing clearer rules for when digital assets constitute securities and creating viable registration pathways for crypto firms.3

The Commission also launched a Cross-Border Task Force in September to combat foreign-based frauds targeting U.S. investors, with particular attention to "gatekeepers" such as auditors and underwriters that help foreign companies access U.S. capital markets.

Do You Want to Build a Snowman?: New Faces, New Directions

2025 was defined by a sea change in SEC leadership, staffing and internal structure, all of which influenced its enforcement posture and policymaking. The agency's operations were also impacted by the 43-day federal government shutdown, throughout which nonessential staff were furloughed. Other agency changes included new directors for key divisions, a new Inspector General and a restructured approach to enforcement leadership. In Enforcement, the SEC appointed Judge Margaret Ryan as the new director of Enforcement. Judge Ryan, a long-standing judge for the U.S. Court of Appeals for the Armed Forces since her nomination by President George W. Bush in 2006, appears to have limited experience with the securities laws or securities industries. In announcing Judge Ryan's appointment, Chair Atkins emphasized that under her leadership, the Division will be "guided by Congress' original intent: enforcing the securities laws, particularly as they relate to fraud and manipulation."

One of the most significant structural reforms was de-delegation of authority for formal investigations. On March 10, 2025, the SEC issued a rule amendment rescinding the 2009 delegation of authority to the Enforcement Division Director to issue formal orders of investigation without the SEC's approval. This change will likely result in fewer investigations overall or more informal investigations through "voluntary" requests for information, potentially giving defense counsel increased flexibility to negotiate the scope of investigations and pursue early resolution.

Looking ahead to 2026, the SEC's Division of Examinations announced its priorities on Nov. 17, 2025, reinforcing the "back to basics" theme while also focusing on new technological risks. The priorities center on four key risk areas: Information Security and Operational Resiliency, Emerging Financial Technology, Regulation Systems Compliance and Integrity (SCI), and Anti-Money Laundering. Notably absent from the list is a specific focus on cryptocurrency, a significant departure from prior years.

A major new focus is on "emerging financial technology," particularly artificial intelligence (AI). Examiners will scrutinize firms' claims about their AI capabilities to combat "AI washing" and assess whether policies are in place to supervise its use in functions such as fraud prevention and trading. Cybersecurity also remains a top priority, with an emphasis on training and security controls to mitigate new risks related to AI and polymorphic malware attacks.

Other notable developments include:

- AI Washing Cases. Through the newly rebranded CETU, the SEC is actively investigating AI washing – companies making materially false or misleading statements about their AI capabilities. CETU is particularly focused on transparency – whether firms are accurately describing genuine machine-learning capabilities or simply rebranding rule-based automation under an "AI" label. Bringing its first AI washing enforcement action under the new administration in April 2025, the SEC charged Albert Saniger, founder and former CEO of Nate Inc., claiming he defrauded investors by making false and misleading statements about the company's purported AI capabilities.

- Insider Trading. Insider trading remains a cornerstone enforcement priority under Chair Atkins. According to Bloomberg Law, nearly 33 percent of actions in FY 2025 have focused on offering fraud or insider trading, up from 26 percent the previous year. The focus on these traditional securities violations aligns with the agency's renewed commitment to target intentional misconduct that directly harms investors, which SEC officials have repeatedly emphasized remains a bedrock priority regardless of other policy shifts.

- Approval of the TXSE. On Sept. 30, 2025, the SEC approved the Texas Stock Exchange (TXSE) as a national securities exchange, making it the first fully integrated national exchange headquartered in Texas. TXSE aims to provide an alternative to NYSE and NASDAQ with a competitive fee structure and will target mid- and large-cap issuers, with IPO capabilities expected to commence in late 2026.

Put a Bow on It: Wrapping Up 2025, Looking Toward 2026

This year of transition has set a new course for the SEC, marked by a pivot in enforcement philosophy, recalibration of priorities and renewed focus on the agency's foundational mission. Though enforcement actions have slowed, the agency's latest priorities signal a clear path forward, focused on traditional fraud, gatekeeper accountability and emerging technological risks

Notes

1 Chair Atkins, Keynote Address at the 25th Annual A.A. Sommer, Jr. Lecture on Corporate, Securities, and Financial Law (Oct. 7, 2025).

2 Chair Atkins, Opening Remarks at the SEC Town Hall (May 6, 2025).

3 Chair Atkins, The SEC's Approach to Digital Assets: Inside "Project Crypto" (Nov. 12, 2025).