Government Contracts Enforcement: DOJ Publishes Fiscal Year 2025 False Claims Act Statistics

Highlights

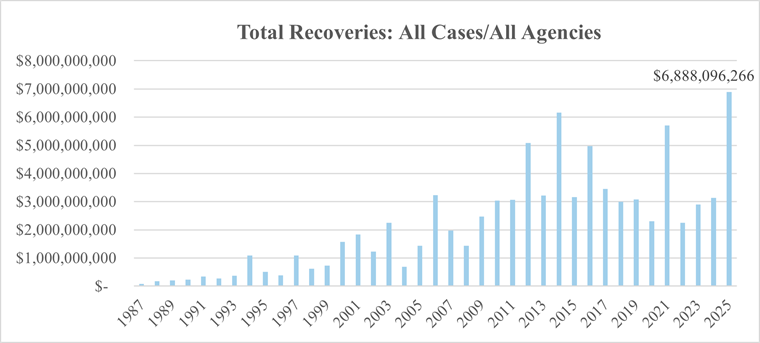

- The U.S. Department of Justice (DOJ) has published its statistics on False Claims Act (FCA) settlements and judgments for fiscal year (FY) 2025, revealing an unprecedented, record-breaking year for enforcement.

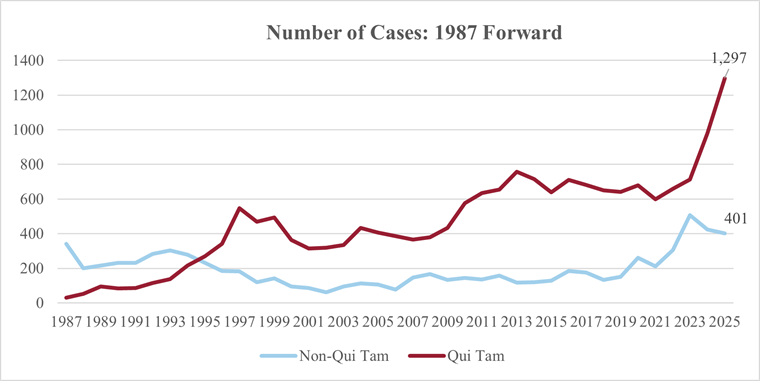

- According to DOJ, total recoveries surpassed $6.8 billion – the highest single-year amount in the history of the FCA – and whistleblower, or qui tam, actions also reached an all-time high, with 1,297 new suits filed and more than $5.3 billion recovered from these matters.

- This Holland & Knight alert gives context about the FCA, details topline FY 2025 statistics, reviews trends in enforcement action, provides practical implications for government contractors and offers an outlook for 2026 and beyond.

The U.S. Department of Justice (DOJ) has published its statistics on False Claims Act (FCA) settlements and judgments for fiscal year (FY) 2025, revealing an unprecedented, record-breaking year for enforcement. According to DOJ, total recoveries surpassed $6.8 billion – the highest single-year amount in the history of the FCA. Whistleblower, or qui tam, actions also reached an all-time high, with 1,297 new suits filed and more than $5.3 billion recovered from these matters. The U.S. federal government also opened 401 new investigations, including several aligning with announced enforcement priorities.

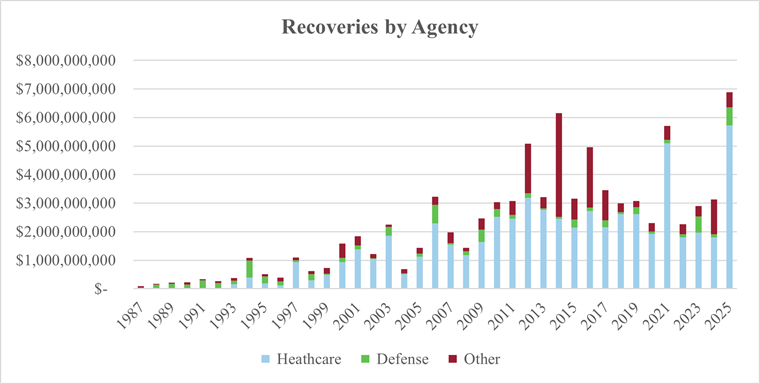

Though healthcare fraud remains a dominant source of recoveries, DOJ's report highlights significant enforcement actions in government procurement, with substantial settlements related to military contracts and, increasingly, noncompliance with cybersecurity requirements. Efforts to prosecute pandemic-related fraud continues to yield significant results, with more than 200 settlements and judgments exceeding $230 million. Additionally, a record-breaking settlement in a customs fraud case underscores the expanding scope of FCA enforcement, signaling heightened compliance risks for government contractors across all sectors.

Background and Context

The FCA serves as the federal government's principal legal tool for redressing fraud involving government funds and property. The statute imposes significant liability, including treble damages and penalties, on entities and individuals who knowingly submit or cause the submission of false claims for payment to the U.S. A critical component of the FCA is its qui tam provision, which empowers private citizens (known as "relators") to file lawsuits on behalf of the government and receive a portion of any resulting recovery. The U.S. Congress substantially strengthened these whistleblower incentives in 1986, a move that has since contributed to total recoveries exceeding $85 billion.

The FY 2025 results are particularly notable, marking new records for total recoveries and the number of whistleblower suits filed. Recoveries obtained in this year are likely the product of cases initiated several years prior; FCA cases can take years to resolve, even absent trial.

Qui tam cases filed in 2025 are a staggering increase over years prior. The number of qui tam cases alone represents the total number of cases, qui tam and non-qui tam, brought in the prior year (approximately 1,400). This is notable in and of itself but particularly so when considering the current constitutional challenges to the qui tam provisions making their way through the courts. In a 2023 opinion, U.S. Supreme Court Justices Clarence Thomas, Brett Kavanaugh and Amy Coney Barrett indicated there were "substantial arguments that the qui tam device is inconsistent with Article II and that private relators may not represent the interests of the United States in litigation." The U.S. District Court for the Middle District of Florida subsequently held that the FCA's qui tam provisions were unconstitutional under Article II. The case is on appeal to the U.S. Court of Appeals for the Eleventh Circuit, with oral argument recently held.

The surge in activity highlights the DOJ's continued prioritization of FCA enforcement, with officials under the current administration emphasizing its role as one of the government's "most powerful weapons against fraud."

The FCA touches upon any program involving federal dollars, including healthcare spending, defense spending, civilian government contracts spending, grants and other entitlement programs, as well as DOJ's tracking recoveries involving the U.S. Department of Health and Human Services (HHS), U.S. Department of War (DOW) defense spending and other agency spending. Amounts reported in the latter two do not distinguish between contracts or grants.

Topline FY 2025 Statistics

The DOJ's data for the fiscal year ending September 30, 2025, demonstrates a significant escalation in FCA enforcement activity. The key metrics reported by the DOJ include:

- Total Recoveries. Settlements and judgments exceeded $6.8 billion, establishing a new single-year record. A significant portion of these recoveries relates to recoveries that are currently under appeal.

- Qui Tam A record 1,297 new whistleblower lawsuits were filed – a substantial increase over the previous record of 980 suits filed in FY 2024.

- New Government Investigations. DOJ self-initiated 401 new investigations during the fiscal year, which is on par with historical trend of increasing government FCA activity over the past few years.

- Qui Tam Recoveries. More than $5.3 billion was recovered in settlements and judgments from cases initiated by whistleblowers. This represents only 57 percent of total recoveries, lower than the typical share associated with intervened cases. This means relators are recovering with increased value, even absent DOJ intervention. Healthcare recoveries remain the driving factor in the results; though as discussed below, recoveries related to defense spending and other agencies are also high.

These figures illustrate the government's robust, two-pronged approach of pursuing its own investigations while actively intervening in high-value whistleblower cases. The reported recoveries primarily account for federal losses, although DOJ was also instrumental in securing additional recoveries for state Medicaid programs in many of these matters.

Procurement, Loan and Grant Fraud

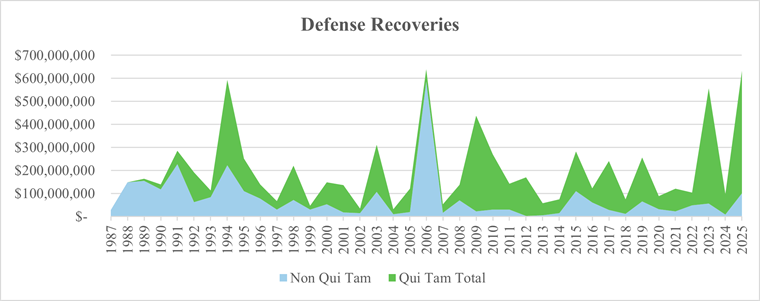

Defense matters represented a significant increase over the prior years, largely based on a single significant recovery related to government contract pricing requirements. Government-initiated recoveries rose sharply, representing the highest recovery in 10 years.

The majority of recoveries (approximately 83 percent) relate to cases where the DOJ intervened. Adjusting for the large single settlement, 92 percent of the remaining recoveries relate to cases where DOJ intervened. This should not be surprising; allegations that defense spending places military systems or funding at risk will be a matter of high enforcement priority for DOJ.

In announcing the results, DOJ focused on alleged fraud involving government procurements, contracts and pandemic-era relief programs.

- Military Procurement Fraud: In the second-largest procurement fraud case in history, a major defense contractor agreed to pay $428 million to resolve allegations of providing false cost and pricing data and double-billing the government. Other significant recoveries included a $62 million settlement by another major defense contractor for alleged failure to disclose accurate pricing data for communications equipment and a $29.74 million settlement related to alleged defective pricing on military aircraft contracts. These recoveries fall on the tail of a 2023 FCA settlement for $377 million associated with alleged cost accounting violations. It is common for a single high-profile settlement to pave the way for related suits against other companies. DOJ also highlighted a $15.7 million settlement related to military parts that allegedly failed to meet testing requirements to be deemed military-grade.

- Cybersecurity Fraud: The DOJ's Civil Cyber-Fraud Initiative continued to gain momentum, with recoveries in this area exceeding $52 million across nine settlements in FY 2025 alone. A health benefits administrator and its parent paid $11.2 million to resolve claims of falsely certifying compliance with cybersecurity requirements, and a genomics company paid $9.8 million for allegedly selling systems with known vulnerabilities.

- Pandemic Fraud: The DOJ obtained more than 200 settlements and judgments totaling more than $230 million related to pandemic fraud in FY 2025. These cases involved false claims for Paycheck Protection Program (PPP) loans and fraudulent billing for healthcare services related to COVID-19. To date, total civil recoveries for pandemic-related fraud have exceeded $820 million.

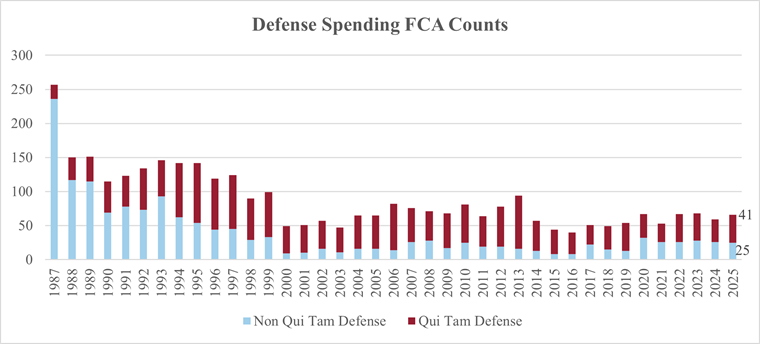

Defense cases are roughly the same as in years prior, representing only 3.8 percent of the 1,698 total cases in 2025. The current counts represent a significant departure from decades past, where defense FCA cases were more prevalent.

Though not clear, one cause of the drop could be related to increased compliance and oversight by contractors.

Tariff and Customs Avoidance

The DOJ directed resources to combat customs fraud, including misrepresenting the type, origin or nature of imported goods to evade tariffs and duties. This past year saw the largest-ever customs fraud resolution under the FCA: a $54.4 million settlement with a distributor of tungsten carbide products for improperly avoiding duties on goods from China. Several other tariff and customs avoidance cases have come out over the past several months, indicating a growing trend that impacts government contractors and commercial companies alike.

Qui Tam Activity and Relator Trends

The role of "relators" in uncovering fraud remains a cornerstone of FCA enforcement. In FY 2025, relators filed a record 1,297 qui tam lawsuits, shattering the previous record of 980 suits filed in FY 2024. These whistleblower-initiated cases were the basis for more than $5.3 billion in settlements and judgments during the fiscal year.

Under the FCA, relators who file successful lawsuits are entitled to receive a share of the government's recovery, typically ranging from 15 percent to 30 percent. This incentive structure continues to drive a high volume of new cases. The significant jump in filings from FY 2024 to FY 2025 indicates a growing awareness of the FCA among potential whistleblowers and an increasingly active relator bar.

Notably, FY 2025 saw relators achieve significant success in cases where the government declined to intervene. Two separate trials resulted in favorable verdicts for relators pursuing claims on behalf of the U.S., leading to judgments of $1.6 billion and $289 million. Though the recoveries are being challenged on appeal, these outcomes highlight the continued viability of non-intervened actions and underscore that a government decision not to join a case does not preclude significant damages.

Notable Enforcement Themes and DOJ Priorities

Beyond the sector-specific numbers, the FY 2025 results highlight several cross-cutting enforcement priorities for the DOJ. These themes offer insight into the department's strategic focus and likely future enforcement actions.

- Civil Cyber-Fraud Initiative: DOJ continued to prioritize holding contractors accountable for failing to meet cybersecurity requirements. Recoveries in this area have more than tripled in each of the past two years. This initiative treats cybersecurity obligations as material contract terms, and DOJ has shown it will aggressively pursue contractors who falsely certify compliance.

- Trade and Tariff Enforcement: Combating customs fraud has become a key focus, with DOJ launching a Trade Fraud Task Force to prevent the evasion of duties that deprive the government of revenue and undermine national security. This effort yielded the largest customs fraud settlement in FCA history this past year.

- Pandemic Fraud Accountability: DOJ remains committed to pursuing fraud related to COVID-19 relief programs. With more than $820 million in civil settlements and judgments recovered to date, DOJ continues to unwind complex schemes involving the PPP and pandemic-related healthcare billing. A practical trend is that many investigations, whether criminal or civil, involve a parallel check as to whether the company obtained a PPP loan and review as to the propriety of that award.

- Cooperation and Self-Disclosure Credit: The DOJ has reiterated its commitment to incentivizing and rewarding companies that voluntarily self-disclose misconduct, cooperate with investigations and implement effective remedial measures. Several FY 2025 settlements reflected credits for such cooperation, resulting in reduced penalties or damage multiples for the defendants. Given the resource strain at DOJ and agencies, the value of cooperation and early settlement is at a premium.

Practical Implications for Government Contractors

The record-breaking recoveries and shifting enforcement priorities of FY 2025 create several clear risk areas that all government contractors should proactively address. The data suggests that companies must heighten their vigilance in several key operational domains:

- Pricing and Cost Disclosures. Procurement fraud remains a significant source of liability, with major settlements involving defective pricing, false cost data and improper billing arrangements. Contractors must ensure their cost and pricing data submitted during negotiations and performance is accurate, current and complete.

- Cybersecurity Compliance. False certifications of compliance with cybersecurity standards are no longer a theoretical risk. Litigation risk is highest where companies make affirmative representations but cannot show disciplined governance around them. DOJ's Civil Cyber-Fraud Initiative is actively securing multimillion-dollar settlements, making it imperative that contractors not only implement required security controls, but also accurately represent their compliance posture to the government.

- Internal Reporting and Whistleblower Management. The historic number of qui tam filings underscores the risk posed by internal whistleblowers. This trend suggests contractors must foster a culture where employees feel comfortable reporting concerns internally, and internal investigation and remediation protocols must be robust, credible and effective.

- Supply Chain and Subcontractor Oversight. Prime contractors are increasingly being held accountable for their partners' misconduct. Cases demonstrated that liability can arise from a subcontractor's inflated charges or a partner's role in a kickback scheme. Diligent vetting and oversight of subcontractors and vendors is critical.

Conclusion and Outlook

The historic recoveries and unprecedented volume of whistleblower lawsuits in FY 2025 signal that aggressive FCA enforcement is not a temporary spike but the new baseline. The record number of new qui tam filings ensures a robust pipeline of cases for years to come. In the wake of large settlements in areas such as cybersecurity and procurement pricing, contractors should anticipate increased whistleblower activity targeting these sectors in 2026 and beyond. Additionally, contractors should expect the DOJ to maintain its intense focus on supply chain issues and matters of national security while continuing to unwind pandemic-related fraud and ramp up its pursuit of cybersecurity and customs violations.

The key takeaway is clear: Vigilant compliance is more critical than ever – there is always someone watching and ready to report.

Please note: Charts based on DOJ statistics.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem, and it should not be substituted for legal advice, which relies on a specific factual analysis. Moreover, the laws of each jurisdiction are different and are constantly changing. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. If you have specific questions regarding a particular fact situation, we urge you to consult the authors of this publication, your Holland & Knight representative or other competent legal counsel.