Charting a Path Forward in 2026: Holland & Knight's Year-End Healthcare Antitrust Report

Highlights

- In 2025, there was heightened bipartisan scrutiny of healthcare consolidation at the state level, with a focus on the corporate practice of medicine and private equity investments.

- At the same time, the Federal Trade Commission implemented significant changes to Hart-Scott-Rodino Act filing requirements and broadened its enforcement spotlight from only private equity groups to all stakeholders in the healthcare industry.

- This Holland & Knight alert provides an overview of these actions and what they could mean for stakeholders moving into 2026.

As 2025 comes to a close, Holland & Knight antitrust and healthcare attorneys are analyzing how federal and state scrutiny of healthcare consolidation has reshaped the industry and providing intelligence on how to navigate 2026. The Federal Trade Commission (FTC) implemented significant changes to Hart-Scott-Rodino Act (HSR) filing requirements and broadened its enforcement spotlight from only private equity firms to all stakeholders in the healthcare industry. On the state level, 2025 saw heightened bipartisan scrutiny of healthcare consolidation, with a focus on the corporate practice of medicine (CPOM) and private equity investments.

However, not many new states joined the national patchwork of laws, and mostly states with existing laws were able to make incremental improvements. Stakeholders should remain up to date on the latest developments, factor in these new changes into deal processes and participate in the broader discussions about healthcare consolidation to excel in 2026 dealmaking. They should also pause and reflect on any organizational improvements needed to prepare for future healthcare antitrust oversight, expanded disclosure requirements and a renewed focus on the CPOM doctrine.

HSR Updates

As discussed in previous Holland & Knight alerts, the FTC in 2024 unanimously approved substantial amendments to the HSR antitrust rules (Final Rule) that increased filers' costs and burdens. The Final Rule significantly broadened the universe of information and documentation that must be reported, and the FTC estimated that HSR filings under the Final Rule will now take on average 68 to 121 hours to prepare (a stark increase from the previous average of 37 hours). HSR filings must also now include extensive narratives regarding the transaction, which give stakeholders the opportunity to discuss the effects of the transaction on cost, quality of and access to healthcare. Moreover, stakeholders must include information regarding transactions closed in the prior five-year period that exceed $10 million, meaning that the details and documentation for these smaller add-ons could now be scrutinized by federal and state authorities. The Final Rule became effective on Feb. 10, 2025, and a new form became available on the FTC's website.

Several business groups led by the U.S. Chamber of Commerce sued the FTC on Jan. 10, 2025, in the U.S. District Court for the Eastern District of Texas to challenge the HSR Final Rule, but they did not seek injunctive relief to stop it from taking effect. The lawsuit alleges that the FTC's Final Rule violates the Administrative Procedure Act by, in part, exceeding the FTC's statutory authority in promulgating a costly and burdensome rule. The case, Chamber of Commerce of the United States of America v. Federal Trade Commission, Case No. 6:25-cv-00009, is assigned to District Judge Jeremy D. Kernodle.

On March 8, 2025, the U.S. Chamber of Commerce filed an amended complaint further seeking injunctive relief to stop the FTC from enforcing the Final Rule or any requirement therein. In August 2025, the plaintiffs and FTC filed motions and cross-motions for summary judgment. The court held a hearing on the summary judgment motions on Dec. 15, 2025, and took the motions under advisement.

Holland & Knight's Antitrust Team is closely monitoring the Chamber of Commerce's lawsuit. (See Holland & Knight's previous alerts, "Annually Adjusted Hart-Scott-Rodino Thresholds and Filing Fees Take Effect Feb. 21, 2025," Jan. 23, 2025, and "A Year-End Report for Healthcare Antitrust and What to Expect Later in 2025," Jan. 23, 2025, along with the Holland & Knight Antitrust Blog post "Understanding Chamber of Commerce v. FTC and Its Implications for the HSR Act," Jan. 14, 2025.)

Noncompete Agreements

With respect to noncompete agreements, 2025 saw the FTC abandon its final rule banning employer noncompete agreements. Specifically, on Sept. 5, 2025, the FTC ended its attempt to appeal decisions out of the U.S. District Courts for the Northern District of Texas and Middle District of Florida blocking the FTC from implementing its final rule (Ryan, LLC v. FTC (5th Cir.) and Properties of the Villages, Inc. v. FTC (11th Cir.)).

However, FTC Chairman Andrew Ferguson explained as part of the commission's vote to move forward that the FTC still intends to "move[] aggressively against unlawful noncompete agreements" under the Trump Administration.

For example, on Sept. 4, 2025 (the day before dismissing its appeals), the FTC filed an enforcement action and a consent order against an employer alleging that the employer's noncompete agreements imposed on almost all of the company's employees, regardless of skill level or job duties, constituted unfair methods of competition. That same day, the FTC issued a request for information (RFI) regarding employer noncompete agreements. This RFI was to better understand the scope, prevalence and effects of employer noncompete agreements, as well as gather information to inform possible future enforcement actions. Interested parties had until Nov. 3, 2025, to submit comments. Holland & Knight's Antitrust Team will closely monitor any developments arising from the RFI.

Additionally, on Sept. 10, 2025, Ferguson issued noncompete warning letters to select healthcare employers and staffing companies. The letters urged these entities to conduct comprehensive reviews of their employment agreements to ensure that they do not run afoul of the law.

Finally, on Jan. 27, 2026, the FTC will host a workshop titled "Moving Forward: Protecting Workers from Anticompetitive Noncompete Agreements," where the industry will learn more about the FTC's enforcement priorities.

Holland & Knight's Antitrust Team is available to assist healthcare employers and staffing companies in conducting comprehensive reviews of their employment agreements to ensure compliance with the law.

Shifting Priorities in Antitrust Enforcement

Under Ferguson, the Trump Administration's FTC priorities and enforcement strategies have shifted from the prior Biden Administration. The federal government's challenges (and resolutions) this year demonstrate that federal enforcers remain highly focused on competition in healthcare. However, in addition to a lessened emphasis on private equity, the current FTC and U.S. Department of Justice (DOJ) have been willing to clear mergers and acquisitions with acceptable divestiture remedies. This is a notable departure from the Biden Administration, which often refused to consider proposed divestitures. Additionally, the government has focused on challenging transactions where it perceives a risk of resulting high levels of market concentration. Some characterize this focus on market concentration as indicative of a return to a more traditional form of merger review than existed in the previous administration.

FTC's Suit Against a Private Equity Firm

In 2024, as discussed in Holland & Knight alerts, the U.S. District Court for the Southern District of Texas dismissed all claims against a private equity firm in the FTC's lawsuit challenging one of its portfolio company's so-called "roll-up" strategy to consolidate anesthesiology practices in Texas. On Jan. 17, 2025, the FTC announced a settlement resolving a potential separate administrative antitrust case, and FTC commissioners approved the final order 3-0 on May 20, 2025.

In response to this settlement, Lina Khan, FTC chair under the Biden Administration, reiterated an inherent suspicion of private equity, stating that the settlement was structured to "ensure that [PE] cannot evade" the requirements of the settlement, because "[l]ike other private equity firms, [PE] uses a complex maze of related entities and funds to carry out its business." In contrast with this philosophy, Ferguson (then an FTC commissioner) in his concurrence with the consent order took clear issue with Khan's "hint at antipathy toward private equity" and stated that nothing about the consent party's status as a private equity firm was relevant to the outcome, which was rather "routine law-enforcement matter embodying a traditional approach to competition law." Ferguson's concurrence demonstrates that while healthcare remains under antitrust scrutiny in the current administration, the involvement of private equity firms in healthcare should not draw additional scrutiny, and businesses can rely on traditional notions of antitrust enforcement and precedent to guide compliance.

(See Holland & Knight's previous alerts, "FTC Sues Private Equity Firm, Portfolio Company Over Anesthesiology Roll-Up Strategy," Sept. 26, 2023, "Private Equity Firm Welsh Carson Dismissed from FTC Antitrust Action," May 15, 2024, and "Recent Ruling Shows Healthcare Private Equity Firms a Path Through the New Antitrust Era," June 4, 2024.)

UnitedHealth and Amedisys

On Nov. 14, 2024, the DOJ's Antitrust Division filed a civil antitrust lawsuit to block UnitedHealth's proposed acquisition of Amedisys, a rival home health and hospital services provider. The DOJ alleged that UnitedHealth's acquisition of Amedisys, two of the largest home health and hospice providers in the U.S., would eliminate competition and harm patients. On Aug. 7, 2025, the DOJ filed a proposed settlement to resolve its challenge to UnitedHealth's acquisition of Amedisys. The settlement requires, among other things, UnitedHealth and Amedisys to divest 164 home health and hospice locations across 19 states, which the DOJ stated would preserve both price and wage competition. Additionally, Amedisys must pay a $1.1 million civil penalty for falsely certifying that it had provided full, correct and truthful responses to the government's HSR request for documents. The settlement was approved by the U.S. District Court for the District of Maryland on Dec. 10, 2025.

GTCR and Surmodics

In March of 2025, the FTC challenged the proposed transaction between GTCR, a private equity firm, and Surmodics, a medical technology company. GTCR already owned Biocoat, which specializes in supplying hydrophilic coatings for medical devices. Surmodics provides specialty hydrophilic coatings made for use with intravascular medical devices and supplies for in vitro tests. The FTC argued that Surmodics and Biocoat were the top two of four large hydrophilic coatings manufacturers and stood to control more than a 50 percent market share. The FTC challenged the deal in the U.S. District Court for the Northern District of Illinois, "litigating the fix."1 The FTC argued that the parties' proposed divestiture of only certain Biocoat assets, as opposed to full divestiture of the entire Biocoat entity, would not sufficiently preserve competition in the market. In November 2025, the court rejected the FTC's challenge, allowing the transaction to proceed with the proposed partial Biocoat divestitures. On Nov. 17, 2025, the FTC and certain state regulators stated that they did not intend to appeal the lower court's order.

Edwards and JenaValve

In August 2025, the FTC challenged a proposed transaction between Edwards and JenaValve. Edwards already owned JC Medical, a company that designs and develops transcatheter valve replacement devices that treat a heart condition called aortic regurgitation (TAVR-AR devices). As alleged by the FTC, JenaValve is the other leading company competing to bring TAVR-AR devices to market, and JC Medical and JenaValve are the only two companies with ongoing U.S. clinical trials for TAVR-AR devices. Edwards has so far rejected the FTC's call for divestiture of JC Medical. FTC commissioners ultimately voted 3-0 to issue an administrative complaint and authorize staff to seek a temporary restraining order and preliminary injunction and filed a complaint in the U.S. District Court for the District of Columbia to stop the transaction pending administrative proceedings. The parties participated in a preliminary injunction hearing at the end of November 2025.

Proposed Federal Statutes

There are two new proposed federal statutes: one that aims to tackle consolidation of medical providers and pharmacies by insurance companies, the Patients Over Profits Act, and one that aims to protect health systems from certain leaseback deals with real estate investment trusts (REIT), the Stop Medical Profiteering and Theft (MPT) Act. Consistent with similar legislation proposed in 2024, it is not anticipated that these legislative efforts will take hold in the U.S. Congress, but elements of these efforts could find their way into state legislative efforts in 2026.

The Patients Over Profits Act (POP Act) was introduced by Reps. Val Hoyle (D-Ore.), Pat Ryan (D-N.Y.) and Pramila Jayapal (D-Wash.), and Sens. Jeff Merkley (D-Ore.) and Elizabeth Warren (D-Mass.). This new legislation is their response to concerns related to vertical integration in healthcare by insurance companies and their affiliates – in other words, corporations purchasing independently owned clinics across the country. The POP Act attempts to focus on care to patients, in lieu of shareholder wealth, and proposes to prohibit common ownership between insurers and Medicare Part B or Part C providers and the U.S. Department of Health and Human Services (HHS) secretary from contracting with any Medicare Advantage Organization that also owns a Medicare Part B or Part C provider.

The Stop Medical Profiteering and Theft Act (Stop MPT Act) was introduced by Sens. Edward Markey (D-Mass.), Bernie Sanders (I-Vt.) and Richard Blumenthal (D-Conn.). This new legislation is their response to concerns regarding certain REIT investments in hospitals and healthcare systems – particularly where REIT leases increase rent for health systems, decrease spending on patient care or drive health care providers out of business. The bill proposes to prohibit healthcare systems from entering a lease or sale agreement with an REIT that "could weaken the financial status of the health system or place public health at risk," allows HHS to review all lease agreements to determine any such issues and close tax loopholes for REITs related to rental income from healthcare properties.

The Holland & Knight Antitrust Team will keep a close eye on these proposed statutes and any developments or derivative statutes that arise impacting private equity in healthcare. (See Holland & Knight's previous alerts, "Q2 2025 Update on State Efforts to Regulate Healthcare Consolidation," April 2, 2025, and "A Year-End Report for Healthcare Antitrust and What to Expect Later in 2025," Jan. 23, 2025.)

State-Level Transaction Reporting

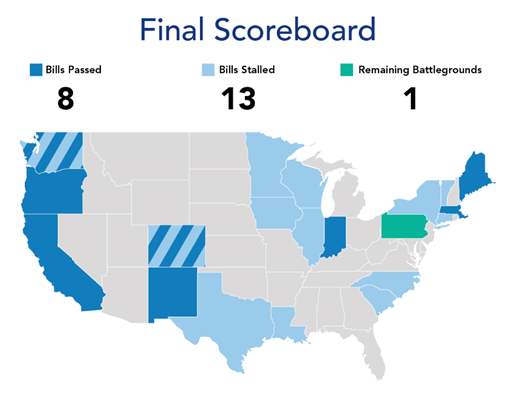

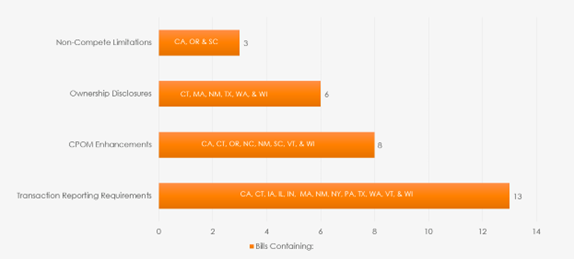

At the state level, transaction reporting laws saw an uptick in popularity across the country and became the focus of bipartisan legislative efforts. More than 20 states proposed over 30 new bills related to transaction reporting, ownership transparency, CPOM and restrictive covenant restrictions.

Seven states saw legislation successfully pass in 2025 – Colorado, Massachusetts, Maine, Oregon, New Mexico, California and Washington – compared to only one state last year, Indiana.2 Many other states saw their proposals fail, in some cases for the second year in a row.

State legislatures responded to a variety of local factors, resulting in unique frameworks within each jurisdiction, including constituency pressures, financial distress of healthcare entities, lack of awareness of healthcare consolidation and perceived rising patient costs linked to transactions. States also likely reacted to the FTC's shift in focus after the change in senior leadership. Below is a chart of how various state initiatives broke down. What is not covered in the chart is a moratorium on ownership in hospitals, which was successful only in Maine.

Following are highlights of the legislative activities in certain key states:

- Massachusetts. On Jan. 8, 2025, Massachusetts became the first state to pass a transaction reporting bill, which expanded existing reporting obligations to increase transparency of healthcare entities and transactions, with specific aim at private equity investments. Holland & Knight attorneys discussed the impact of the new law in a live webinar with Massachusetts Health Policy Commission.3 More recently, Massachusetts held its 2025 Cost Trends Hearing and accepted pre-filed testimonies4 from private equity firms, pharmaceutical companies, REITs and management services organizations (MSO). Massachusetts, like many states in the wake of recent federal action, is studying rising costs and decreasing affordability and asked as part of the pre-filed testimony request that three private equity firms, one MSO and one REIT expand on how their organization is ensuring equitable and affordable access to high-quality healthcare. Significant private equity investors shared their belief that investments in the Massachusetts healthcare system increase technological innovation, reduce administrative workloads to boost efficiency and provide access to much-needed capital funds. The MSO affirmed its structure and management fully complied with and did not violate the CPOM. Similarly, the REIT asserted its practice was designed to provide stability and control to hospital operators and help reduce uncertainty of expenses.5

- California. As previously reported by Holland & Knight,6 Gov. Gavin Newsom signed two new bills into law, Assembly Bill (AB) 1415 and Senate Bill (SB) 351. AB 1415 significantly expands the role of the Office of Health Care Affordability (OHCA) to oversee healthcare transactions involving private equity groups, hedge funds and MSOs. The law imposes broader reporting requirements for MSOs and directs the OHCA to adopt future regulations and guidelines to eliminate duplicative reporting. The rulemaking process is underway, and the regulations are expected to become final in Spring 2026. SB 351 codifies California's CPOM doctrine, grants the attorney general (AG) enforcement power and further limits the viability of noncompetes. Though most stakeholders have already made adjustments to their written arrangements to comply with SB 351, ongoing attention to organizational processes will be needed to improve and ensure practice.

- Oregon. On June 9, 2025, Oregon passed SB 951 and its accompanying amendment, HB 3410A, after two years of legislative efforts. These bills impose significant restrictions on the relationships between physicians and MSOs and their supported practices by permitting only limited directed stock transfer agreements, restricting certain governance models for managed practices and prohibiting several industry-standard restrictive covenants. Importantly, the bill codifies CPOM with the restrictions regarding the support of payer contracting and billing and coding procedures being notable for platforms that use the standard MSO model. It is critical to note that these bills apply only to physician practices and those where physician assistants, nurse practitioners and physicians practice together. Accordingly, dental practices, nurse practitioners and other healthcare practices led by non-physicians are excluded.

With these changes, Oregon becomes one of the highest-risk states in the country for CPOM and likely an outlier for national platforms. The law requires existing platforms to make modifications by Jan. 1, 2029, and new platforms to make modifications by Jan. 1, 2026. Stakeholders have time to make modifications, but it will require an extensive review of all arrangements between an MSO, supported practice and supported physicians. The intensity of the law raises the question of whether Oregon will enact further amendments as they receive pushback from stakeholders who attempt to implement the changes required. Follow Holland & Knight's healthcare alerts to keep track of Oregon's response to the new law.

Meanwhile, the Oregon Health Authority (OHA) continues to review and approve healthcare transactions. As of the publication of this alert, OHA has reviewed more than 65 transactions. One notable update on the transaction process has been the inclusion of diligence reports in transaction submissions, making it the only process in the country to require such documents. This has not stopped transactions from occurring but makes the confidentiality procedures and scope of review questions paramount as stakeholders look to make transactions in 2026.

The challenge to OHA's transaction approval process ended in 2025. Earlier this year, the U.S. Court of Appeals for the Ninth Circuit published a memorandum7 and formal mandate8 on the ongoing litigation between the Oregon Association of Hospitals and Health Systems (OAHHS) and OHA, which sought to invalidate the transaction review program for being unconstitutionally vague. The OAHHS argued that the program was a violation of the Due Process Clause of the Fourteenth Amendment and unlawfully delegated legislative power to the OHA in violation of Oregon state nondelegation doctrine. In 2024, a judge issued an opinion siding with the OHA on the constitutional question but declined to comment on the state question. The OAHHS filed an appeal in the Ninth Circuit that same year. This year, the court found the OAHHS had no standing since no sufficient injury had been alleged and that the underlying statute, combined with OHA's accompanying administrative rules and regulatory guidance, was sufficient notice of the transaction law.

- Indiana. Earlier this year,9 Holland & Knight attorneys spoke with then-Indiana AG Scott Barnhart about the new law, HB 1666,10 and how it will affect the state's regulatory reporting requirements. The new law is designed to enhance ownership transparency of hospitals, certain providers and insurers, as well as grant the AG authority to investigate market concentration of healthcare entities. Though the original proposal would have allowed the AG to approve or deny certain transactions, this consent right was removed from the final legislation. Notably, many independent healthcare practices provided testimony to the legislature that likely contributed to the carve-out from the reporting requirements for such practices. Indiana is a great example of both bipartisan focus on healthcare consolidation and the effects of stakeholder engagement in the shaping of balanced legislation.

- Texas. Texas introduced three bills in 2025 aimed at studying healthcare transactions and consolidation more broadly in the market: HB 2747, SB 1595 and HB 4408. None passed; however, the introduction of these bills (along with the activity in Indiana) cemented the bipartisan focus on healthcare consolidation. The Texas Legislature does not meet until 2027, but there is potential for renewed legislative focus and stakeholder reengagement in 2026, as discussions around these issues continue.11

- New York. As previously reported by Holland & Knight,12 New York broke the mold this year by introducing a bill that would require acquiring entities of veterinary clinics to submit notice and supporting documentation to the state Department of Agriculture and Markets prior to closing certain transactions, which would then be shared with the charity, antitrust and healthcare bureaus of the AG's office. The bill would give the AG power to prohibit a veterinary clinic acquisition it deems to be against the public interest.

Separately, in early spring 2025, the New York State Department of Health (DOH) published FAQs to provide guidance on the state's Disclosure of Material Transactions law. Two months later, DOH released its electronic Material Transaction Notice Form, which replaced the previous email submission process for reportable "material transactions." The FAQs clarified, among other things, the scope of "health care entities" subject to the law, including dental practices, clinical laboratories and pharmacies. The new form requires a much broader disclosure of information about the parties to a material transaction, the details of which were reported by Holland & Knight.13 Efforts to expand upon the law's existing notice and disclosure obligations, including, if requested, a full cost and market impact review, did not get signed into law.14

- Rhode Island. Earlier this year, Rhode Island AG Peter Neronha announced that he would be advocating for certain healthcare related initiatives in an effort to provide relief to a failing healthcare system. Among these proposals was regulation to require premerger notification of certain material corporate transactions involving private equity firms. The proposal is similar to what is being introduced across the nation in different state legislatures but notable in the fact that the AG proposed regulations without a statute, effectively drawing a line in the sand for private equity groups.15

- Maine. In June 2025, Maine passed a law imposing a one-year moratorium on private equity ownership or operation of a hospital in the state.16 The law is less restrictive than the original proposal, which would have imposed a five-year moratorium. This is the first successful explicit ban on private equity to date, and investors should take note. Other states are likely keeping an eye on the success of the new law and whether it garners support among their own constituents. Similar efforts have not been successful in Minnesota and Connecticut.

More recently, the Commission to Evaluate Regulatory Review and Oversight of Health Care Transactions met17 to consider new legislative proposals, which included elements from nearly all of the proposed legislation across the country. Several proposals received favorable feedback from committee members and are likely to come forward in the 2026 legislative agenda:

- a proposal to require notification of the AG when a healthcare entity files with the FTC about a pending merger or acquisition

- a proposal to require certificate of need reviews to consider the impact on affordability and accessibility of healthcare for consumers

- a proposal to require notice of change of control or significant ownership stake by private equity, hedge fund or MSOs, along with a requirement to disclose the ultimate parent entity and investment fund, names of all entities and debt-to-equity ratios

- a proposal to consider an expanded review and approval process for healthcare transactions that, at minimum, include private equity firms but could also include MSOs and REITs

- a proposal to prohibit private equity groups and hedge funds from interfering with clinical judgments, staffing levels, medical records and custody over data; would also include limitations on individuals serving as directors or officers in any entity they managed (similar to Oregon's recent bill, as outlined above)

- a proposal to prohibit majority ownership by private equity firms, hedge funds and MSOs

- a proposal to introduce a cap on debt financing ratios

- a proposal to prohibit provider noncompete clauses and non-disparagement limits

Holland & Knight will continue to monitor the various proposals by the committee and legislative body.

The Road Ahead

As we approach the end of 2025, healthcare stakeholders are bracing for a wave of antitrust enforcement and legislative activity in 2026. The FTC is expected to focus on anti-competitive conduct in the healthcare industry and continue studying the effects of restrictive covenants. At the state level, Vermont, Colorado, Maine and other states will likely introduce new proposals. The recent successful passage of bills in Oregon and California is expected to spark renewed interest among other states in revisiting their CPOM doctrines. The proposed federal legislation targeting REITs and insurance company roll-ups of providers could expand the focus of state legislation.

This momentum signals a broader trend: State-level regulatory scrutiny will broaden, likely targeting REITs, MSOs, health systems, insurance companies, private equity groups and other healthcare investors. The underlying foundation for all flavors of oversight will be the examination of impacts on access, quality and cost of care. For stakeholders, this means navigating a more complex landscape where proactive planning and a robust compliance framework will be rewarded with risk mitigation and faster timelines for closing transactions.

Notes

1 When parties seeking to merge propose a divestiture or other remedy and, in case of a court challenge, argue whether that "fix" should sufficiently allay impacts to competition, rather than litigating about the deal as originally proposed.

2 "Healthcare Private Equity Transactions Under Scrutiny: Midyear Review," Holland & Knight alert, Aug. 1, 2024.

3 Healthcare Transactions in Massachusetts: What Investors Should Know," Holland & Knight webinar, May 21, 2025.

4 Massachusetts Health Policy Commission.

6 "California's Private Equity Bills Head to Gov. Newsom for Round 2: Are They Still Redundant?," Holland & Knight alert, Sept. 15, 2025 (updated Oct. 14, 2025).

7 U.S. Court of Appeals for the Ninth Circuit Memorandum.

9 "Healthcare Transactions in Indiana: What Investors Should Know," Holland & Knight webinar, June 12, 2025.

10 Indiana General Assembly House Bill 1666.

11 "Why Texas Should Slow Down On Healthcare Merger Bills," Holland & Knight report, May 21, 2025.

12 "New York State Department of Health Publishes Form of Material Transactions Notice," Holland & Knight Healthcare Blog, May 15, 2025.

13 Id.

14 Id.

15 "Proposed Transaction Notice Requirements May Impact Medical Groups in Rhode Island," Holland & Knight Healthcare Blog, Sept. 26, 2025.

16 Maine Bill Amendment LD985.

17 Maine Commission to Evaluate Regulatory Review and Oversight of Health Care Transactions.

Information contained in this alert is for the general education and knowledge of our readers. It is not designed to be, and should not be used as, the sole source of information when analyzing and resolving a legal problem, and it should not be substituted for legal advice, which relies on a specific factual analysis. Moreover, the laws of each jurisdiction are different and are constantly changing. This information is not intended to create, and receipt of it does not constitute, an attorney-client relationship. If you have specific questions regarding a particular fact situation, we urge you to consult the authors of this publication, your Holland & Knight representative or other competent legal counsel.