Private Equity

What our clients say:

-

"Holland & Knight knows our company and our business and offers tailored and practical solutions."

-

"I have not yet experienced a situation or complex matter which Holland & Knight was not able to advise on."

-

"They're extremely bright lawyers who understand complex and sophisticated matters and can offer practical solutions and advice."

Source: Chambers USA (2024 and 2025 guides)

Overview

Holland & Knight provides a premier platform for middle-market private equity transactions. Our attorneys combine a keen awareness of current market dynamics, the ability to think like entrepreneurs and consummate client focus to help drive the business goals and objectives of private equity firms, their portfolio companies and investors, family offices, independent sponsors and other financial investors across industries and transaction types.

We know that our clients look to seize every possible opportunity to maximize returns and growth. Our Private Equity Team understands the challenges that a market flush with cash presents, including significant competition for sourcing quality deals, contentious negotiations and tight deal deadlines.

Our commitment shows through benchmarking leagues tables – including those published by Bloomberg, LSEG, Mergermarket, PitchBook and The Deal – that rank us among the most active law firms in the U.S. for private equity transactions. Holland & Knight is also routinely honored for its role in several transactions that are recognized with "Deal of the Year" awards. These rankings and recognitions reflect our innovative approach, commitment to high-quality client service and dedication to establishing long-standing relationships.

We Get It

You're looking for value and results. And that includes your legal team.

We're your unlimited partners. We know where the pain points are in deals and the difference that having world-class counsel – and service – can make. That's why we put our full force behind every transaction, no matter its size.

You'll always get our "A-Team," with lead or hands-on partner involvement, in-depth legal knowledge, deep industry experience and middle-market rates.

Our value proposition – designed to meet your legal and business needs:

- Limited Partner Prospects. Connecting our contacts to capital.

- HK Deal Flow℠. Tapping long-standing relationships throughout the banking, financial and legal communities, our unique HK Deal Flow℠ program supplements deal-sourcing strategies, opens doors and generates leads before they hit the market. Since its inception in 2017, this proprietary program has successfully sourced more than 1,500 deals and facilitated over 2,000 introductions for program participants.

- Predictable, Affordable Pricing. Our rates are more reasonable than many other firms. We know the importance of cost certainty in your legal spend and can create alternative fee arrangements that work for everyone.

- Perspective: We Know Your Industry. Holland & Knight takes a collaborative, industry-focused approach, drawing on resources across the firm to help ensure that our clients have a deep understanding of the complex legal issues at hand. We stay on top of the relevant trends and identify opportunities to help your business move forward. Working in tandem, our attorneys develop creative, tax-efficient structures to help you acquire and finance companies across a broad range of sectors, including:

- consumer products and services

- energy and utilities

- financial services

- government contracts

- healthcare and life sciences

- technology

- transportation

- manufacturing and industrials

- Protection. Holland & Knight has one of the largest and most active representations and warranties insurance (RWI) practices in the U.S. In addition to advising on approximately 1,000 RWI underwriting matters each year, the firm's Representations and Warranties Insurance Team counsels transactional parties in connection with the purchase of approximately 200 insurance policies each year. This experience helps us to eliminate or greatly reduce escrows, holdbacks and other post-closing indemnification obligations. Our work for underwriters also gives us a 360-degree view of the private equity market and best practices – an advantage we pass along to you.

- Powerful Complementary Services. When you need additional related services, we have colleagues ready to help.

- Fund Formation: Our Private Investment Funds Team helps clients create domestic and international private investment funds.

- Dispute Resolution: One of the largest litigation teams in the U.S. is ready to protect your interests in court and through various forms of alternative dispute resolution, including arbitration.

- Proximity. With more than 200 private equity attorneys across offices in the U.S. and Latin America, we are well positioned to mobilize resources whenever and wherever our clients need us.

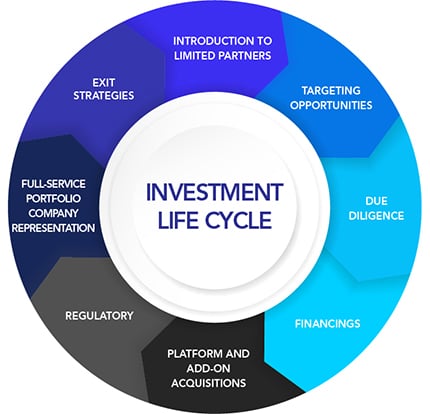

Start-to-Finish Advice

We'll collaborate with you to deliver effective, efficient strategies throughout the investment life cycle:

Our private equity attorneys can assist with:

- leveraged buyouts (LBOs)

- minority investments

- dividend recapitalizations

- transactions with multiple equity sponsors

- acquisitions from bankruptcy and other distressed investments

- negotiating restructurings and workouts

- joint ventures

- "going private" transactions

- carve-out or spin-off transactions

- special-purpose acquisition company deals (SPACs)

- private investment in public equity deals (PIPEs)

- employee stock ownership plans (ESOPs)

- debt and equity financings

Clients

Recent select matters include:

- Represented Polaris Alpha Holdings LLC, an affiliate of Arlington Capital Partners, in its sale to Parsons Corp., a digitally enabled solutions provider focused on the defense, security and infrastructure markets

- Represented Audax Private Equity and its portfolio company Fastener Distribution Holdings in the acquisition of Blue Sky Industries, a Monterey Park, Calif.-based distributor of C-class parts to aerospace and defense MRO and OEM customers

- Represented Bain Capital Credit and Carlyle Mezzanine Partners LP, in the sale of their investments in Shari's Restaurant Group Inc.

- Represented Blue Wolf Capital Fund III LP, through an affiliate, in its acquisition of 100 percent of New Zealand-based Tenon Holdings' shares in NACS USA Inc. (the holding company for Tenon's North American operating business); the North American holding company will operate under the new name Novo Building Products

- Represented Boyne Capital Management (BCM Fund I LP) in its acquisition of AmeriBest Holding Corp. and its subsidiary, AmeriBest Home Care Inc., a provider of home healthcare services

- Represented Brynwood Partners VII LP in the leveraged acquisitions of Cold Spring Brewing Co. and Carolina Beverage Group LLC

- Represented Carlyle Infrastructure Partners LP, the infrastructure fund of The Carlyle Group, in the sale of ITS ConGlobal to Australia-based AMP Capital's global infrastructure equity platform

- Represented Chart Capital Partners in its purchase of two counterintelligence and intelligence business units from Intelligent Decisions

- Represented Compass Diversified Holdings (NYSE: CODI) in the acquisition of Crosman Corp., the world's leading designer, manufacturer and marketer of air guns, archery products, optics and related accessories

- Represented DFW Capital Partners in connection with its acquisition of Superior Controls Inc., a New Hampshire-based provider of control systems integration and specialty engineering services to pharmaceutical, biotechnology, and food and beverage companies

- Represented Project Performance Company LLC, a portfolio company of FedCap Partners, in its equity sale to Data Systems Analysts Inc.; together they will provide mission-critical solutions to customers across the government IT market

- Represented Generation Partners in its acquisition of Westox Labs LLC, a toxicology lab providing services such as addiction treatment monitoring, medication monitoring, and drug and blood testing

- Represented Leading Ridge Capital Partners in the sale of its portfolio company, Rugby Architectural Building Products, to Hardwoods Distribution Inc. (TSX: HDI); Rugby is one of America's leading distributors of architectural wood products, decorative surfacing, doors and millwork to commercial and residential end users, with nearly $300 million in sales, 560 employees and 31 facilities across 35 states

- Represented Lincoln Road Global Management LLC, a Miami-based private equity firm, in connection with its investment in Pro-Tec Fire & Safety, a leading provider of fire extinguisher and safety services in the southeastern U.S.

- Represented Strategic Health Services LLC, d/b/a Palm Medical Centers, an MBF Healthcare Partners II LP portfolio company, in its acquisition of all of the assets of Jay Care Medical Center Inc., a primary care physician medical practice, and Parkview Medical Group LLC, an affiliated hospitalist group

- Represented Pine Tree Equity III LP, in its acquisition of Veracity Technology Solutions LLC, a provider of nondestructive testing and related services to the global power generation and aerospace industries

- Represented Prospect Capital Corp. (NASDAQ: PSEC) in the sale of its interests in Harbortouch Payments LLC to Searchlight Capital Partners; Harbortouch is a leading provider of integrated payment processing and point-of-sale systems to small and medium-sized merchant customers in the U.S.